DB endgames

A number of factors are resulting in improved defined benefit plan funding. And as plans approach “full funding,” some sponsors are considering plan termination as an option. In this article we briefly review: (1) the factors/moving parts affecting funded status; (2) (very generally) the effect of recent trends in those factors on plan funded status; (3) and the issues presented by different endgame strategies.

Factors driving plan funded status

There are three main drivers of funded status: (1) the present value of liabilities, primarily a function of interest rates, but also recently increased by a one-time decrease in mortality assumptions; (2) asset value, primarily a function of stock and bond market performance; and (3) contributions.

Interest rates

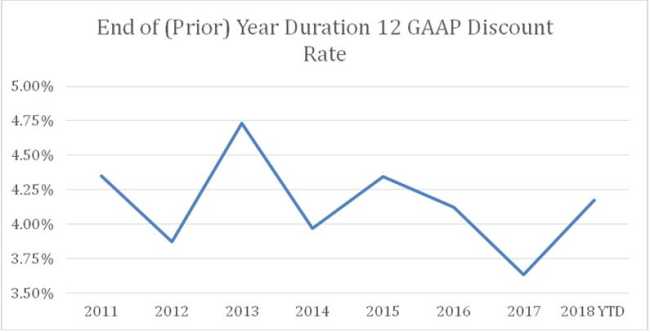

The main factor affecting liability values is interest rates. Here is a chart showing the end of (prior) year effective GAAP discount rate for a duration 12 plan for the period 2012 (as of December 2011) to date.

Current (June 2018) interest rates have, relative to the beginning of the year, gone up by more than a 50 basis points and are higher than year-end 2016. But they are lower than year-end 2015 and significantly lower than year-end 2013. Generally, over the last six-plus years, rates have fluctuated in a 150 basis points zone with a floor around 3.5% and a ceiling around 5%. And they are currently pretty much in the middle of that zone, at around 4.25%.

Mortality

Sponsors have also had to recognize reductions in mortality, which have increased liabilities, for financial statement purposes beginning as early as 2015 and for ERISA minimum funding purposes beginning 2018. The impact on plan liabilities of this change will vary from sponsor to sponsor, with an average net effect of between 3-5%.

Assets

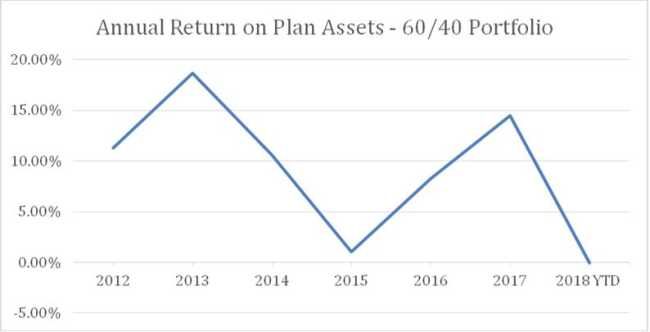

The plan asset story points more clearly in one direction – towards improved plan funding via asset returns. The following chart shows annual returns on a 60/40 portfolio for the period 2012 to date.

These numbers provide a simplistic picture of (generally very positive) plan asset returns. Many sponsors have adopted risk-mitigation plan investment strategies or have invested in alternatives, real estate, non-U.S. assets, etc., that will produce significantly different results.

Contributions

Amended Pension Protection Act (PPA) rules have permitted many sponsors to reduce or defer plan funding. Some sponsors have, however, for strategic reasons continued to fund (at times, aggressively) at levels above ERISA minimums.

The reduction in the corporate tax rate, from a maximum of 35% in 2017 to 21% in 2018, included in 2017 Tax Reform legislation (the Tax Cuts & Jobs Act of 2017), has encouraged many sponsors to consider accelerating funding for 2017. (We discuss these issues in our article DB funding and 2017 tax planning.) Thus, a recent study by professors at the University of Wisconsin School of Business found an implied 23.8% increase in contributions for 2017 over the average contribution for the 414 non-financial U.S. firms they studied. (The Effects of the Tax Cuts & Jobs Act of 2017 on Defined Benefit Pension Contributions, Fabio B. Gaertner, Daniel P. Lynch and Mary E. Vernon (May 2018).)

Approaching full funding, for GAAP

Bottom line: Interest rates continue to fluctuate in a relatively narrow range, between 3.5-5%. It remains to be seen whether, e.g., because of Federal Reserve policy, they break out of that range over the next 1-2 years. Asset returns have been generally positive. Taking into account derisking and risk transfer activity and contribution policy, many plans are in or at least approaching funding in the 90-110% range, for financial statement reporting (GAAP).

What next?

Many sponsors – especially sponsors of frozen DB plans – have been operating against an implicit (or in some cases explicit) plan of terminating their DB plan once it reaches full funding. That is the “glide path” around which their contribution, investment and liability hedging strategies have been structured.

The cost of plan termination is, however, generally significantly greater than a plan’s GAAP liability.

Annuity purchase

Under ERISA/Tax Code qualified joint and survivor rules, the default benefit under a defined benefit plan must generally be a qualified joint and survivor annuity (or single life annuity if the participant is unmarried). Thus, in connection with a plan termination, sponsors will generally have to offer an annuity to all participants (except where the present value of the accrued benefit is $5,000 or less).

For a number of reasons, the cost of settling a benefit as an annuity is more than its “book value” under GAAP rules: Insurance companies have regulatory (and business) overhead, profit margin, and generally use more conservative valuation and risk assumptions than an ongoing plan would. DOL rules require that in settling liabilities sponsors buy the “safest available annuity,” a market limitation that necessarily increases costs.

In contrast, lump sums generally can be paid out at (something approximating) GAAP book value. As noted, where the benefit is valued at more than $5,000, the participant must affirmatively elect (subject to spousal consent rules) the lump sum. These employee lump sum elections (obviously) can have a significant effect on the cost of a plan termination, generally reducing the cost of liability settlement vs. an annuity.

We also note that plan termination is not a simple process. Especially with respect to a large plan, it involves gathering a large amount of data. A variety of calculations – e.g., under alternative benefit options and different formulas – must be made. The necessary elections must be communicated to and then gathered from participants. And a substantial filing must be made with the Pension Benefit Guaranty Corporation. All of which further adds to cost.

We estimate that (all of) these requirements add between 15%-35% for non-retirees and 5%-10% for retirees to the cost of terminating a plan.

The risks of not terminating

The most obvious alternative to plan termination is for the sponsor to continue what they have been doing: operate and fund the plan while adopting those strategies they deem appropriate to reduce the size and volatility of plan costs. In that regard we would note the following:

Ongoing accruals (if any) may be discontinued (a plan freeze) without terminating the plan.

The cost of ongoing funding should (theoretically) be less than the cost of plan termination, because the sponsor does not have to pay the annuitization costs discussed above.

Interest rate and market risk, that would otherwise be settled through annuitization if the plan were terminated, would remain on the sponsor’s books. Sponsors have, however, developed a variety of strategies (generally going under the name “liability driven investments” (LDI)) to deal with these risks, including both asset-liability matching and LDI overlay strategies.

The sponsor will have to continue to pay PBGC premiums, which can be substantial. Although, as the plan becomes better funded, PBGC variable-rate premiums will generally go down.

The sponsor must continue to pay ongoing plan administrative costs.

Some of these costs can be mitigated by derisking, e.g., by offering lump sums to deferred vested participants.

* * *

Positive asset returns and increases in interest rates, if they continue, are likely to improve plan funding. What to do next, as a firm’s DB plan approaches or achieves full funding, will be an ongoing issue for many plan sponsors.

The math here and the strategic issues, e.g., the size of the plan relative to the sponsor’s market capitalization and its significance to company valuation, will differ from company to company. But before pulling the termination trigger, many sponsors will at least want consider the relative costs of plan termination vs. plan continuance.

We will continue to follow these issues.