Advantages to a Market Return Cash Balance Plan Design

professional service firms have significantly increased their adoption of Market Return Cash Balance plans over the past twelve years. In addition to the conversion of existing Fixed Rate plans, virtually every new Cash Balance Plan is incorporating the Market Return design right from the start.

As discussed in our Cash Balance (CB) Survey on “Cash Balance Plans – 2018 Survey and Trends”, professional service firms have significantly increased their adoption of Market Return Cash Balance plans over the past twelve years. In addition to the conversion of existing Fixed Rate plans, virtually every new Cash Balance Plan is incorporating the Market Return design right from the start. Reasons behind this phenomenon include:

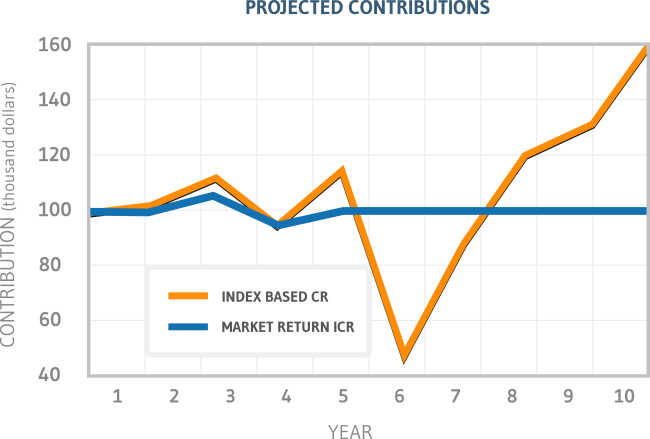

Contribution Stability

Because actual performance on underlying plan assets (positive or negative) is credited to participant accounts, Market Return plans rarely need to “true up” or adjust contributions at year’s end to reflect the mismatch of asset return and an internal crediting rate. In contrast, Fixed Rate design often requires an annual adjustment as returns fail to match the plan’s stipulated rate.

Reduced Exposure to Unfunded Benefits

With Market Return plans, participant accounts (plan benefits) move directly in concert with plan assets. Therefore, it tends to remain 100% funded at all times. Fixed Rate designs are only aligned at year’s end, so the plan can be underfunded throughout the year and can require substantial unexpected contribution during years when investment performance is sub-par, especially for those with large account balances.

Increased Stability as Plan Matures

Unlike every other type of Defined Benefit Plan (Traditional or Cash Balance), Market Return plans enjoy greater stability in both contributions and funded status as plans mature. Conversely, Fixed Rate plans become increasingly volatile over time.

Investment Policy not Driven by Desire to “Hit the Bogie”

Without the perceived need to target a pre-determined rate of return, Market Return plan sponsors are free to develop an asset allocation that fits their desired risk tolerance and make appropriate adjustments over time.

Ability for Participants to Capture “Upside” Potential

With the investment focus taken away from achieving the low interest rate “Bogie,” long-term investment performance is typically better with a Market Return design, which means a faster-accruing participant benefit.

Similarity to 401(k) Plan Experience

Participants like being able to monitor their 401(k) account balances throughout the year. Cash Balance Plans are no different, especially when valued daily.

With all of these advantages, is there any reason not to consider a Market Return design for your Cash Balance Plan?