Interest rates 2019 – managing funding and PBGC variable-rate premiums in a volatile interest rate environment

In this article we review issues that record low interest rates present for defined benefit plan sponsors and strategies sponsors can adopt to deal with them. Our focus is primarily on reducing Pension Benefit Guaranty Corporation variable-rate premiums, with respect to which many sponsors will have options.

Current and projected interest rates

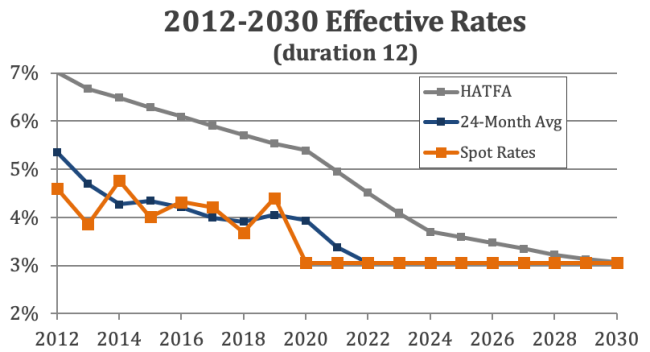

The following chart compares historical and projected HATFA, 24-month average, and spot rates for a typical pension plan, reflecting changes in market interest rates through August 27, 2019.

We note that rates are currently at (literally) historic lows. The utility of the projections in this chart very much depends on whether these conditions will persist.

HATFA, 24-month average and spot interest rates

To clarify the nomenclature:

HATFA rates are minimum funding interest rates determined under the Highway and Transportation Funding Act (HATFA), as amended by the Bipartisan Budget Act of 2015 (BBA). For 2019 and 2020, HATFA rates are based on 90% of the average of rates for a (trailing) 25-year period. They may generally be used for determining minimum funding, but not for determining variable-rate premiums.

HATFA rates are (as the chart indicates) significantly higher than 24-month average and spot rates in the near term. The “90%” multiplier phases down over the period 2021-2024 to 70%, accounting for much of the reduction in HATFA rates shown in the chart. The point at which the HATFA rates “cross” 24-month average and spot rates is where the HATFA 25-year average interest rate stabilization is projected to no longer apply.

24-month average rates are minimum funding interest rates determined under the Pension Protection Act (PPA). They are the average of rates for a (trailing) 24-month period. They are used for determining minimum funding and may (subject to certain limitations) be elected as an “alternative” method for determining variable-rate premiums. (We discuss that election in detail in our article Interest rates 2019 – measuring UVBs for variable-rate premiums.)

Spot rates are one-month average rates. They may (alternatively) be used for plan funding and are the default method for determining variable-rate premiums.

In each case, the index for calculating these rates is high quality corporate bonds.

What interest rate applies when?

Given this framework, the following rules generally apply:

Minimum funding: So long as they are higher than 24-month average and spot rates, HATFA rates will be used to determine ERISA minimum funding requirements.

PBGC variable-rate premiums: Prior year 24-month average or spot rates are used to determine UVBs. (See our prior article for details on the choice between 24-month average and spot rates).

De-risking: Lump sum payouts that are part of a de-risking strategy must generally be determined using spot rates, although sponsors may, e.g., set their plans’ lump sum rates for an entire year based on spot rates for a prior year “lookback month.” The 2019 lookback month for a calendar year plan may be December, November, October, September or August 2018. Many sponsors use a November lookback month. (See our article De-risking in 2019 for a more detailed discussion of de-risking, interest rates and lump sum payouts.)

The significance of PBGC variable-rate premiums as a driver of plan funding

As the chart indicates, HATFA interest rate relief is (given current interest rate levels) projected to be the interest rate used for minimum funding purposes through 2028. HATFA rates are only marginally affected by 2019 declines in interest rates. Thus, HATFA interest rate stabilization (25-year averaging), especially in the near term, considerably eases otherwise applicable ERISA minimum funding requirements.

In contrast, PBGC variable-rate premiums are determined based off of a liability/asset calculation (UVBs) that does reflect market interest rates. Thus, e.g., 2020 variable-rate premiums will, to some extent at least, reflect 2019 interest rate declines.

In this context, many plan sponsors’ funding policies – and the response to current declines in interest rates – are likely to be framed with a view to reducing so far as possible PBGC variable-rate premiums.

The easy way to think about variable-rate premiums is as (for 2019) a 4.3% tax on underfunding. More technically, the amount of variable-rate premiums a sponsor pays with respect to a DB plan for 2019 is 4.3% of the plan’s unfunded vested benefits (UVBs), subject to a $541 per participant headcount cap. UVBs are determined as the present value of (beginning of year 2019) plan liabilities (for vested participants) minus the (beginning of year 2019) fair market value of plan assets. The premium rate and headcount cap are both adjusted for wage inflation each year. As we discuss in more detail in our prior article, UVBs are determined based on either end-of-prior-year spot rates or (if the sponsor so elects and subject to certain limitations) a 24-month average.

Reducing variable-rate premiums

The strategies a sponsor may use to reduce variable-rate premiums differ depending on what sort of plan you have and (critically) on the plan’s funded status.

1. Plans that are fully funded on a non-HATFA basis. Sponsors of plans that are fully funded without regard to HATFA interest rate stabilization generally will not owe any PBGC variable-rate premium. 2019 interest rate declines will, however, if they persist, affect this “non-HATFA” calculation, and some sponsors who were in category 1 for 2019 may drop down to, e.g., category 2 for 2020. This calculation will, in addition to interest rate declines, be affected by (among other things) asset performance and contributions.

2. Plans that are fully funded on a HATFA basis but not on a non-HATFA basis. Sponsors of plans that are only fully funded if you apply the HATFA interest rate stabilization rules generally will owe PBGC variable-rate premiums. Sponsors of these plans may want to consider the borrow-and-fund strategy discussed in detail in our articles DB funding: pay now or pay later (2019) and Should I borrow money to fund up my pension plan? (2012).

3. Plans that are not fully funded but are at least 80% funded on a HATFA basis. Sponsors of these plans generally can reduce PBGC variable-rate premiums by accelerating 2019 quarterly contributions, treating those accelerated contributions as for 2018. Under this strategy, the sponsor, in effect, takes the amount of contributions required to be made for 2019 and contributes it for 2018. Doing that accomplishes two things: (1) it creates a credit balance that can be used to satisfy 2019 contribution obligations; and (2) it reduces the plan’s UVBs and thus the 2019 PBGC variable-rate premium obligation.

Indeed, a sponsor may want to consider this strategy with respect to any contributions it intends to make in the relatively near future.

If interest rates remain at current levels, funding requirements are in the long run likely to go up for many plan sponsors. That possibility may provide an additional incentive for accelerating funding using this strategy.

We discuss this strategy in detail in our articles DB funding: pay now or pay later (2019) and Reducing PBGC variable-rate premiums: timing contributions (2015). Please note: the deadline for any such contribution is September 13, 2019, for calendar year plans.

4. Plans that are not 80% funded on a HATFA basis. The acceleration strategy described in category 3 is generally not available to these plans. That is because that strategy depends on using a credit balance to satisfy 2019 funding obligations, and a plan must be at least 80% funded in 2018 to do that. Plans in this group (as well as some plans in the previous group) are, however, often subject to the variable-rate premium cap, and sponsors of these plans may want to review our article De-risking in 2019, explaining how plans subject to the headcount cap can reduce variable-rate premiums by settling liabilities via lump sum windows and/or annuity purchases.

We note that, for a sponsor using a 2018 lookback month to value lump sums, paying out lump sums in 2019 may be particularly attractive. Current interest rates are 100-120 basis points lower than the 2018 rates many sponsors use to value 2019 lump sums, and 2020 lump sum payouts are likely to be significantly more expensive than 2019 payouts.

These headcount cap reductions can be very valuable. The combined premium (per participant premium + variable rate premium headcount cap) for a single participant is likely to be around $640 in 2020, increasing per year thereafter. Given the drop in rates this year, some plans may find their premiums limited by the cap for many years into the future, increasing the reward for reducing headcounts now. More details on the application of the headcount cap are discussed in our earlier article.

General observations

Some of these categories/strategies overlap – For instance, any plan subject to the headcount cap, including one that is at least 80% funded on a HATFA basis, will want to consider reducing headcounts by settling liabilities.

Importance of the spot vs. 24-month average election – Sponsors will want to keep in mind that the analysis here depends in many cases on the amount of the plan’s UVBs. As discussed in our prior article, for 2019, the amount of a plan’s UVBs may (significantly) depend on the spot rate vs. 24-month average election.

Other advantages of additional 2018 contributions

As noted, for some sponsors (e.g., those in category 3), an additional contribution for 2018 (for calendar year plans, due by September 13, 2019) may reduce 2019 variable rate premiums. This contribution will also improve the plan’s funded ratio (generally, for all purposes), which may (depending on the plan):

Eliminate 2020 quarterly contribution requirements.

Avoid restrictions on the payment of lump sum benefits.

Ensure credit balances are available to meet funding requirements due beginning April 15, 2020.

Avoid a PBGC 4010 filing due April 15, 2020.

Our next article will discuss the impact of record low interest rates on funding more generally.

* * *

There are actions that many sponsors can take to reduce the impact of recent interest rate declines on DB plan finance – critically, executing strategies that will minimize PBGC variable-rate premiums. Obviously, there are a number of moving parts to consider with respect to these strategies, and sponsors and their consultants will want to be familiar with critical issues including long-run contribution strategy, plan demographics, the plan’s current financial position, investment results, the impact of the variable premium cap, ongoing de-risking activity, and financial statement impact.

We will continue to follow this issue.