2013 Pension Funding: Timing and Opportunities

For calendar year defined benefit plans, the period January-April is critical: key calculations, e.g., the value of plan assets and liabilities, are made; and key trigger dates apply, e.g., the benefit restriction ‘haircut’ on April 1 and the first quarterly payment on April 15. The amount and timing of contributions can have a significant effect on how much PBGC premiums are owed, whether benefit restrictions apply and, indeed, on how much must be contributed to the plan for the year. In this article we review how current rules on the amount and timing of contributions work and how to best use them to achieve firm objectives.

This article is technical in places and is generally provided for sponsor officials who manage DB plan funding.

Scope

Let’s begin by defining the scope of the discussion. We will assume for all purposes we are dealing with a calendar year plan; so we will not be discussing fiscal year plan year timing issues. And we will assume we are dealing with a frozen plan, so we won’t be considering, for example, the calculation of normal cost, although similar results hold in such cases. Finally, we’re going to use, as an example, contribution timing for the 2013 year.

Two funding regimes

There are actually two funding regimes applicable under ERISA (as amended by the Pension Protection Act (PPA)). The first, ‘regime one,’ is a set of rules that requires the amortization of asset-liability shortfalls over seven years. The second, ‘regime two,’ is a set of rules — benefit restrictions, at-risk rules and a limitation on funding of executive compensation – that, in effect, punishes a sponsor for allowing a plan to drop below specific funding thresholds – generally 60% or 80%.

The second funding regime forces sponsors of plans who wish to avoid the application of, for instance, restrictions on lump sum payments, to fund shortfalls currently, and not over seven years, at least up to the 80% threshold. As a general matter (and with some exceptions), a sponsor does not have to conform to regime two funding requirements, so long as it is willing to put up with the restrictions that apply if, for example, funding falls below 80%.

Calculating the FTAP and AFTAP

Under both regime one and regime two, contributions for any year are generally a function of the plan’s assets-to-liabilities funding ratio. For regime one funding purposes and some regime two calculations, that ratio is generally called the funding target attainment percentage (FTAP). For purposes of regime two benefit restrictions rules, it’s the adjusted funding target attainment percentage (AFTAP). Depending on the purpose, (a) ‘credit balances’ may or may not be subtracted from assets, (b) ‘at-risk’ assumptions may or may not be reflected, and (c) recent annuity purchases may or may not be included in assets and liabilities.

Generally, both regime one and regime two funding ratios are calculated based on asset and liability values as of the beginning of the year. So the FTAP and AFTAP for 2013 calendar year plans are determined as of January 1, 2013.Thus, if you want to affect, for instance, the 2013 AFTAP, you must make a contribution ‘for’ 2012. We will discuss in more detail below how/when that may be done.

Regime one timing

Generally under ERISA, the sponsor must make a contribution each year adequate to pay off the shortfall – the gap between assets and liabilities – over seven years. In this article, we will assume the shortfall payment equals one-sixth of the shortfall (for plans that have been making shortfall contributions in prior years, the 2013 shortfall payment may be greater.)

So, under regime one, you calculate your FTAP (beginning-of-year asset-liability shortfall) and (more or less) contribute roughly one-sixth of that to the plan. When must that contribution be made?

No quarterly contribution obligation

Generally, if there is no quarterly contribution obligation, contributions for the current year (assuming applicable extensions) must be made on or before September 15 of the following year. So, ‘for’ 2012, the contribution may be made on or before September 15, 2013.

Quarterly contribution rules – generally

Plans that have a funding shortfall for the prior year are required to make quarterly contributions for the current year. As we said above, funding shortfalls are determined as of the beginning of the year (here, the beginning of the prior year). Thus, the requirement to make a quarterly contribution in 2013 is based on January 1, 2012 assets and liabilities.

To connect the last dot: the latest a sponsor may affect this amount — the amount of the prior year shortfall — is September 15 of the prior year. So, a sponsor that wished to avoid quarterly contributions for 2013 had until September 2012 to make a contribution to eliminate the applicable prior year shortfall, which would eliminate the need to make quarterly contributions in 2013.

Quarterly contributions must be made on April 15, July 15, October 15 of the current year and January 15 of the following year.

The amount of each quarterly contribution is equal to 25% of the lesser of (1) 90% of the minimum required contribution for the current plan year and (2) 100% of the minimum required contribution for the preceding plan year.

To the extent the four quarterly contributions add up to less than the required contribution for the plan year, an additional required contribution is due (assuming applicable extensions) not later than September 15 of the following year.

Thus, for 2013, quarterly contributions would be due April 15, July 15 and October 15 of 2013 and January 15, 2014; and any final ‘true-up’ contribution would be due September 15, 2014.

Regime two timing

Now let’s turn to ‘regime two’ and the issue of benefit restrictions and other underfunding ‘penalties’.

Let’s begin with the fact that timing is more important for regime two funding because, generally, any shortfall (relative to the regime two threshold, for example, 80%) must be made up in the current year. For most plans, the most significant regime two ‘incentive’ is the PPA benefit restriction rules, so let’s review briefly how the timing of the application of those rules works.

Generally, benefit restrictions in the current year are based on the plan’s current year AFTAP. As discussed above, that is a beginning-of-year value. So, for 2013, the AFTAP equals assets divided by liabilities as of January 1, 2013.

The benefit restrictions work like an on-off switch. Generally, while the AFTAP is below one of the key thresholds (e.g., 80%), the restriction applies. Once the plan gets above the threshold, the restriction lifts. And, depending on the flow (and timing) of contributions to the plan and the actuary’s certification, the AFTAP can change during the year — so the switch can go on and then off during the year.

The switch is ‘fixed’ (unchangeable) for the year once an actuarial certification of the plan’s AFTAP is made. Generally, AFTAP values must be certified by an actuary no later than October 1 of the current year (e.g., for 2013, October 1, 2013). Until the actuarial certification is made, certain presumptions apply, as follows:

1. For January-March of the current year (e.g., January-March, 2013), the AFTAP is presumed to be the same as it was in the prior year. So, if the 2012 AFTAP, based on assets and liabilities as of January 1, 2012, was 85%, the plan’s AFTAP for the period January-March, 2013 would be presumed to be 85%.

2. As of April 1 of the current year (e.g., April 1, 2013), the prior year presumed AFTAP gets a 10% haircut. So, if the 2012 AFTAP is 85%, then the plan’s AFTAP presumed to be 75% as of April 1, 2013, triggering, e.g., restrictions on lump sum payments.

3. By October 1 of the current year (e.g., October 1, 2013), the plan’s actuary must certify what the plan’s AFTAP actually is (or else the AFTAP for the year is deemed to be less than 60%.) Again, the AFTAP is based on beginning-of-year values, e.g., assets and liabilities as of January 1, 2013.

For all of these purposes, contributions made for the prior year (e.g., for 2012) by September 15 of the current year (e.g., September 15, 2013) are included in those beginning-of-year values. So, for instance, a contribution ‘for’ 2012 that is made by September 15, 2013 counts as part of the January 1, 2013 assets, improving the 2013 AFTAP. However, the actuary certifying the plan’s AFTAP may not take into account contributions that have not actually been made. So, a contribution made on September 15, 2013 may not count as part of the January 1, 2013 assets, affecting the 2013 AFTAP, with respect to an actuarial certification made before that date.

Example

This is all pretty complicated, so let’s work through an example. Let’s assume that as of the beginning of 2012, a plan’s assets are $85 million and its funding target is $100 million, so its 2012 AFTAP is 85%. The actuary certifies that AFTAP by October 1, 2012.

Those are beginning-of-2012 values. But let’s assume that, because of asset losses during 2012, the 2013 funding ratio (AFTAP) is 70%.

For the period January-March 2013, the plan’s AFTAP is presumed to be 85% and no restrictions apply.

As of April 1, 2013 the ‘10% haircut’ applies, the plan’s AFTAP is presumed to be 75% and certain restrictions (e.g., restrictions on the payment of lump sums) apply; the switch flips on.

As of September 15, 2013, the sponsor makes a contribution for 2012 sufficient to increase the beginning-of-2013 funding ratio to 80%. September 15, 2013 is the latest date that such a contribution may be made.

On October 1, 2013, the actuary certifies that the plan’s beginning-of-2013 AFTAP is 80%, and the restrictions lift; the switch flips off.

Regime one + regime two

Regime two contributions — in our example, the contribution the sponsor made as of September 15, 2013 for 2012 — are, of course, made in addition to regime one contributions, and the interaction of the two is a little complicated and not particularly intuitive.

As we see it, a sponsor that has a benefit restrictions regime two funding problem in the current year generally must make a contribution “for” the prior year to fix it. That regime two contribution will also have a minor effect on the regime one contributions for the current year. For example, the September 15, 2013 regime two contribution described above (made for 2012) affects 2013 beginning-of-year assets, the numerator of the 2013 FTAP and, connecting all those dots, the regime one contribution for 2013.

Let’s now turn to an illustration of the foregoing principles.

Example – “ordinary” timing of regime one funding

Let’s begin with an illustration of a straightforward approach to the timing of funding, focusing for the moment just on regime one.

Let’s assume our plan has $76 million in assets and $100 million in liabilities as of January 1, 2013. So the plan has a shortfall for 2013 of $24 million.

Our funding rule of thumb is that year one funding equals about one-sixth of the shortfall. So, under these assumptions, this plan will have a 2013 regime one contribution requirement of $4 million ($24 million divided by six).

If the quarterly contribution rules do not apply, that $4 million may be contributed as late as September 15, 2014. (To keep things simple we are ignoring interest charges here and elsewhere in this article.)

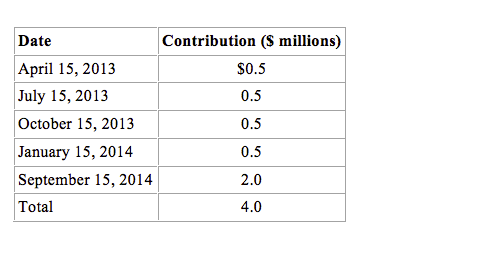

But, let’s assume the quarterly contribution rules do apply. Thus the sponsor must contribute the lesser of 100% of the 2012 required contribution, or 90% of the 2013 required contribution, in four payments, due on April 15, July 15 and October 15, 2013 and January 15, 2014. Let’s assume that the 2012 minimum contribution was $2 million, so the lesser quarterly contribution is one-fourth of 100 percent of $2 million. Under these assumptions, the sponsor will have to make contributions as follows:

The September 15, 2014 contribution of $2 million is the ‘true-up’ of the $4 million required contribution minus the $2 million in quarterly payments.

Regime two timing

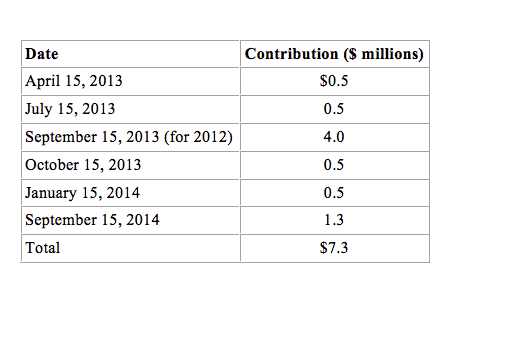

That’s the simple version under regime one. Now let’s assume that the sponsor wants to conform to regime two funding requirements and thus wants to increase the plan’s 2013 AFTAP to 80 percent. To do that the sponsor must make a contribution by September 15, 2013, for 2012, of $4 million ($76 million plus $4 million equals $80 million; $80 million divided by $100 million equals 80 percent).

That contribution will change the 2013 FTAP for regime one funding purposes. There’s another $4 million in the numerator; the numerator is now $80 million, and the 2013 shortfall is only $20 million ($80 million in assets versus a $100 million funding target). One-sixth of $20 million is $3.33 million. So, with those numbers in mind, here, again, is a straightforward approach to the timing of funding:

To be clear about what’s going on here: the sponsor is still making the same quarterly contributions, based on one-fourth of 100% of its 2012 contribution of $2 million. It’s also contributing, on top of those amounts, another $4 million, to improve plan’s 2013 AFTAP (based on beginning-of-2013 values) to 80%. That additional 2012 contribution reduces the 2013 contribution from $4 million to $3.3 million.

By September 15, 2014, the sponsor has to contribute whatever balance of the 2013 contribution hasn’t been covered by quarterlies. When it was only conforming to regime one, that balance was $2 million ($4 million owed minus $2 million in quarterlies). When it puts in $4 million, for 2012, to conform to regime two requirements, the balance goes down to $1.3 million ($3.3 million owed minus $2 million in quarterlies).

Accelerating contributions

We’d now like to describe an accelerated contribution schedule that provides one clear benefit — reduced PBGC premiums. In this regard, it’s worth noting that MAP-21 interest rate stabilization legislation changed (effectively increased) the valuation interest rate for funding purposes but did not change the rate used to determine the amount in PBGC variable premiums that is owed. Thus, under MAP-21, a plan may be, e.g., 100% funded for funding purposes but still owe variable PBGC premium.

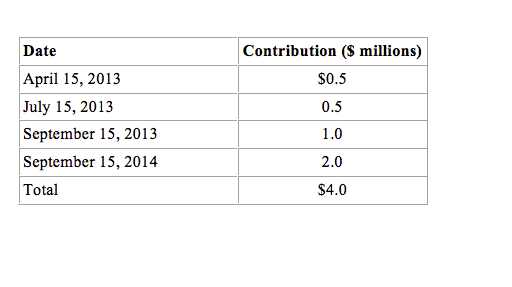

Let’s go back to our simple regime one table, but let’s accelerate the October and January payments to September 15, 2013 and consider the contributions made by September 15, 2013 as being for 2012.

The rationale here is simple: plans that owe PBGC variable premiums have an incentive to characterize all ‘grace period’ contributions, i.e. contributions between January 1 and September 15 2013, as being for the prior (2012) plan year to the extent possible. Why? Because such contributions are then included in the plan’s 2013 asset value, directly reducing the 2013 variable premium by $9 for every $1,000 in contributions.

A couple caveats are in order. First, we are assuming here that the required contribution for 2012 ($2 million) has already been made by April 15, 2013. If not, the 2012 ‘true-up’ contribution will need to be accelerated to April 15 to take advantage of this strategy.

Secondly, the strategy makes use of the ‘credit balance’ rules. In order to use a credit balance in 2013, a plan must have been at least 80% funded in 2012. And since 2012 results are based on (higher) MAP-21 interest rates, many sponsors will be able to clear this hurdle.

Now for the mechanics. On April 15, the sponsor contributes $0.5 million for 2012, creating a credit balance. Next, the sponsor elects to apply this newly-created credit balance to meet the April 15 quarterly contribution requirement. The same process is repeated on July 15. Then, on September 15, the deadline for making a contribution for 2012, the sponsor contribute $1 million, creating sufficient credit balance to satisfy the October 15 and January 15 quarterly requirements.

When the dust settles, the sponsor has made basically the same $4 million in contributions as under the straightforward application of the funding rules shown in the first table. However, since $2 million of these contributions were made for 2012, the plan reduces its 2013 PBGC premium by $18,000 with very little effort.

In real life, that is a bottom-line benefit to the enterprise. PBGC premiums aren’t like contributions — which, if more than the minimum will still reduce the sponsor’s obligation. They are a fee – once you pay them, you can’t get them back. (We discuss the relative utility of either paying PBGC variable premium or borrowing and funding (and avoiding or reducing the premium) in our article Should I borrow money to fund up my pension plan?)

Not all companies will want to employ this strategy. It will be of limited value to companies who can’t afford any acceleration of pension funding. But for those with ready access to capital, it is, at the margin at least, money-saving.

Finally, contributions that are made for 2012, if made before April 30th, can be reflected as a reduction in the plan’s unfunded liability shown on the PPA funding notice.

The opportunity to reduce PBGC premiums relatively painlessly exists for many plan sponsors. As we mentioned above, MAP-21 interest relief applies to plan funding calculations but not to PBGC premium calculations. So, sponsors focused on MAP-21 liabilities may be surprised at the size of PBGC premiums owed in October.

Second, PBGC premiums are going up, from 0.9% of unfunded liability in 2013 to 1.3% in 2014 and 1.8% in 2015. So, the $18,000 savings jumps to $26,000 and then $36,000 over the next two years.

Third, pension underfunding is, in effect, ‘borrowing’ from the pension plan. A penalty of 0.9% (in two years, 1.8%) for ‘borrowing’ from the plan for as little as one month (e.g. making an October 15 quarterly contribution rather than accelerating the contribution to September 15) looks like a stiff penalty, particularly in today’s ultra-low interest rate environment.

Fourth, the ability to execute this strategy requires some advance planning. For example, sponsors that want to do this for 2014 must ensure they are at least 80% funded in 2013, and they only have until this September 15 to ensure this outcome.