2014 pension de-risking: deferred vested liability

In this article we discuss how increases in interest rates and increases in the Pension Benefit Guaranty Corporation’s (PBGC) flat-rate premium have made ‘de-risking’ more attractive in 2014. For purposes of this article, by de-risking we mean paying out a participant’s benefit as a lump sum and thereby eliminating the related liability, and our focus will be on plans’ ‘deferred vested’ liability, which is often the ‘low hanging fruit’ of de-risking.

Interest rates and de-risking

In June of 2012 we posted a long article on How low can you go? Interest rates and DB plans. Summarizing: over the long-, medium- and short-term interest rates have been declining, and those declines have put pressure on DB plan sponsors, significantly increasing both the cash and ‘earnings’ cost of funding their plans. Since then, however, interest rates have been going up.

For de-risking purposes, the key rates are those used to calculate lump sums. Generally, those rates are Pension Protection Act (PPA) ‘spot’ first, second, and third segment rates for a designated month. Many sponsors set the lump sum rate at the beginning of the year, based on prior year November interest rates (published in early December), so that participants and administrators will know what rate will be used to calculate their lump sum for the entire year. We now have those (November 2013) rates for 2014.

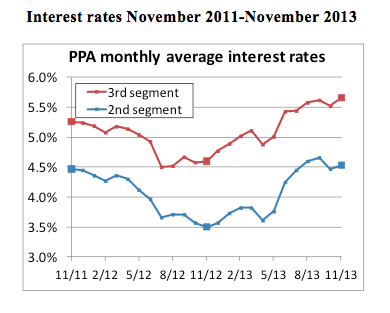

The following chart shows PPA spot second and third segment rates for the period between November 2011 and November 2013:

The segment rates for November 2011, 2012, and 2013 are summarized in the table below:

Lump sum rates (prior November) 2012-2014

First Segment | Second Segment | Third Segment | |

2012 (Nov 2011) | 1.99% | 4.47% | 5.26% |

2013 (Nov 2012) | 0.97% | 3.50% | 4.53% |

2014 (Nov 2013) | 1.19% | 4.53% | 5.66% |

Thus, lump sum valuation interest rates for plans in 2014 will be higher than in 2013 – more than 100 basis points higher for the second (years 6-20) and third (years 21+) segments.

PBGC flat-rate premium increase

Under the “Moving Ahead for Progress in the 21st Century Act” (MAP-21), the PBGC flat-rate premium is $42 per participant in 2013 and $49 in 2014. The Bipartisan Budget Act of 2013 (BBA 2013) will increase it further to $57 in 2015 and $64 in 2016 (and indexed to wage inflation thereafter.) Obviously, these increases, at the margin, make de-risking more attractive in 2014 – the higher flat-rate premium makes it more expensive to continue to maintain the plan benefit.

Evaluating the significance of these changes

To get a feel for how much these changes are ‘worth,’ let’s consider an example. Let’s compare how much it would cost to ‘de-risk’ a terminated vested participant in 2013 vs. 2014. In each case, we’ll assume the participant is 50 years old and is due a monthly life annuity benefit beginning at age 65 of $100 per month. We’ll compare the de-risking cost at 2013 interest rates/PBGC premiums vs. 2014 interest rates/PBGC premiums

Lump sum value of $100 monthly annuity beginning at age 65 to current 50-year old

Year | Lump Sum |

2013 | $7,759 |

2014 | $6143 |

The increase in rates this year translates to a decrease in the lump sum payout to a 50-year old of 21% in 2014.

If the benefit remains in the plan and is ultimately paid out as an annuity, annual PBGC premiums will also be payable. Under a de-risking strategy, these payments are eliminated, creating a source of savings to the plan. The table below compares the present value of future PBGC premiums for our sample employee based on 2013 law with those under BBA 2013 (both numbers assume 3% annual wage inflation):

Present value of related PBGC premium

Year | PV PBGC |

2013 | $1,473 |

2014 | $1,602 |

BBA 2013 increases the cost of the headcount premium in the above example by about 9%. The table below combines these numbers to calculate the ‘net cost’ of de-risking in 2013 versus 2014.

Net cost of de-risking (value of lump sum minus value of premium)

Year | Value of lump sum | Value of premium | Net cost of de-risking |

2013 | $7,759 | ($1,473) | $6,286 |

2014 | $6,143 | ($1,602) | $4,541 |

Thus, after decreases in interest rates and increases in the PBGC flat-rate premium, the net cost of de-risking this participant has gone down by 28% in 2014 versus 2013.

In general, the decrease in lump sum values from the first table will be a function of the participant’s age – for younger participants, the change in rates this year has a more substantial impact on lump sum values.

The relative impact of higher PBGC premiums, on the other hand, is related to the size of the benefit. For larger benefit amounts (e.g. $1,000 per month rather than $100) the savings are less significant. For small benefit amounts, such as the $100 used in this example, PBGC premiums, based on 2014 rules, will cost 26% of the value of the actual benefit received by the participant ($1,602 vs. $6,143), which seems like a strong case for de-risking all by itself. For larger benefit amounts (e.g. $1,000 per month rather than $100), the savings are less significant.

De-risking participants in pay status

The foregoing illustrates the reduction in the cost (2013 vs. 2014) of de-risking for a terminated vested participant. For participants in pay status, the analysis changes and the reduction in cost is likely to be less. In that regard we have the following observations:

Paying lump sums to participants in pay status is controversial (see our article Concerns over pension de-risking).

Regulatory approval (e.g., from the IRS) may be required.

There is evidence that current annuitants are much less likely to elect a lump sum benefit in lieu of annuity payments than deferred participants.

The incremental cost of purchasing an annuity rather than paying out a lump sum is less for current annuitants than for deferred vested participants.

Long-term rates have risen by more than short-term rates, decreasing the cost of de-risking deferred vested participants by more than current annuitants.

PBGC premiums comprise greater ‘overhead’ for deferred vested participants, since premiums are paid for more years while benefits are less valuable.

* * *

2014 will generally be a better year for de-risking than 2013, particularly for deferred vested liability. We anticipate significant activity by sponsors along these lines next year.

We will continue to follow this issue.