2020 lessons learned – annuity settlements in the context of steeply declining interest rates

In this article we present some “lessons learned,” thus far, with regard to 2020 annuity settlements – transferring DB liabilities with respect to one or more participants to an annuity carrier. We say “thus far” because it is still practical for some sponsors to transfer DB liabilities to a carrier this year.

As we discussed in our last article, defined benefit plan valuation interest rates have declined nearly 200 basis points since late 2018. While interest rate stabilization has significantly mitigated the effect of this decline on plan funding, the declines have affected financial statements and Pension Benefit Guaranty Corporation premiums, presenting a number of challenges and opportunities for defined benefit plan sponsors.

In this article we present some “lessons learned,” thus far, with regard to 2020 annuity settlements – transferring DB liabilities with respect to one or more participants to an annuity carrier. We say “thus far” because it is still practical for some sponsors to transfer DB liabilities to a carrier this year.

Framework

Again, let’s begin with timing: annuities settled in 2020 will affect year-end 2020 financials, 2021 ERISA minimum funding, and 2021 PBGC premiums.

In a context of stable interest rates, the annuity settlement decision, for some time, has been driven by increases in PBGC premiums. Cost savings from reducing headcount has generally come from (1) lower PBGC headcount premiums (the 2021 headcount premium is $86/per participant), (2) lower variable-rate premiums (VRPs) for plans at the VRP headcount cap (the 2021 headcount cap is $582 per participant), and (3) reduced ongoing administrative costs.A feature that we noted in our prior article with respect to lump sum payouts – that because of interest rate declines the cost of lump sums in 2020 is (significantly) lower than the book (and “real”) value of the related plan liability – does not apply to annuity settlements. Indeed, annuity settlements are made at a premium over book value, reflecting the carrier’s margin.

A “backward looking” PBGC variable-rate premium valuation interest rate and its implications

Significant declines in interest rates over the past two years do, however, have an effect on item (2) in our list of cost savings – lower VRPs for plans at the VRP headcount cap. For plans using the alternative method for calculating unfunded vested benefits (UVBs), headcount reductions via annuity settlements may generate a “loss” – that is, an increase in VRPs.

That is because, for the VRP calculation, these plans use a “backward looking” 24-month average of market interest rates ending (for 2021) as early as August 2020. (Remember: annuity settlements in 2020 affect the 2021 VRP calculation.) In the context of steeply declining rates, the annuity is paid out at book + a carrier premium, but the UVBs “removed from the books” are valued using those “backward looking” interest rates that, in effect, undervalue the liability (vs. the market). Based on current market rates, we estimate that an annuity settlement (in this context) will increase the plan’s 2021 UVBs, and the increased VRP would be 4.6% of that amount. For instance, in our model, a $20 million annuity purchase in 2020 would increase the plan’s UVBs by $2.4 million and its VRP by $111,000.

Two example plans

As with our discussion of lump sum payouts, we’d like to illustrate this factor in the annuity settlement equation – backward looking PBGC UVB valuation interest rates vs. steeply declining market rates – by looking at two different plans.

Plan 1 – At the VRP headcount cap for 2021

$100 million in liabilities (at current GAAP/market interest rates)/$70 million in assets.

2,000 participants, including 1,000 retirees.

GAAP liability with respect to each participant = $50,000.

Purchase annuities for 400 retirees.

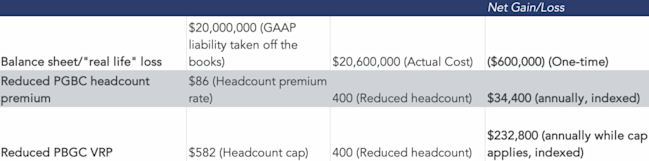

The following table presents the gains/(losses) from this reduction in participant headcount.

Table 1: Gains/(Losses) from headcount reduction for a plan at the VRP headcount cap

The balance sheet gain for lump sum payments turns into a balance sheet loss for annuity settlements – equal to around 3% of the liability settled – attributable to the annuity carrier’s margin-over-book. Gains from the reduction in PBGC headcount and VRP headcount cap premiums are simple arithmetic – the headcount/headcount cap rate times the number of participants taken off the books. And we note that while the balance sheet loss is “one-time,” the PBGC premium gain (that is, premium reduction) recurs annually.

Plan 2 – Not at the VRP headcount cap for 2021

$100 million in liabilities (at current GAAP/market interest rates)/$70 million in assets.

4,000 participants, including 2,000 retirees.

GAAP liability with respect to each participant = $25,000.

UVBs for purposes of the PBGC VRP valued using backward looking 24-month average (the “alternative method”).

Purchase annuities for 800 retirees.

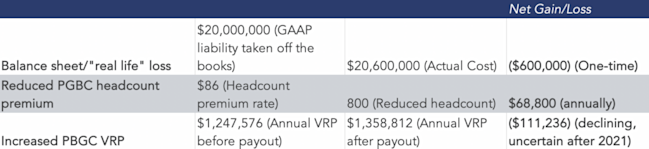

The following table presents the gains/(losses) from this reduction in participant headcount.

Table 2: Gains/(Losses) from headcount reduction for a plan not at the VRP headcount cap

For this plan, there is the same balance sheet loss, attributable to the annuity carrier’s margin-over-book.

The headcount reduction also – and somewhat counterintuitively – produces a loss on (that is, and increase in) VRPs. The latter loss results (as discussed above) from the mismatch between (1) the cost of the annuity settlement, valued at book/market + a carrier premium and (2) the value of the associated UVBs, valued based on 24-month average interest rates for the period ending August 2020. In a period of steeply declining interest rates, that 24-month average will significantly “undervalue” these liabilities (vs. the market). This effect only applies to plans that use the alternative method to value UVBs and are not at the VRP headcount cap.

Our assumption, in this example, that each participant’s benefits is valued at $25,000 distorts our analysis somewhat. For smaller benefits, headcount reductions may still produce gains.

Effect on ERISA minimum funding

Buying annuities (with plan assets) to settle liabilities will generally reduce a plan’s funded status for purposes of ERISA minimum funding requirements, because the participant’s benefit is being paid out “in full” (plus the carrier premium) whereas it had only been funded “in part.” The math here is complicated because of the effect of HATFA interest rate stabilization, but in our example, both plans went from 83% funded to 71% funded.

Sponsors will want to consider the effect of annuity settlements on minimum funding requirements – particularly payments that may take the plan below 80% funding (on a HATFA basis), triggering benefit restrictions.

Takeaways

All annuity settlements will increase “real life” plan underfunding and produce a one-time “loss” (an increase in plan underfunding) on the balance sheet. And as we said with respect to lump sums (where the 2020 impact is a “gain”), this is not “just” an accounting effect. It reflects real life. There is less money in the plan relative to total liabilities. This balance sheet loss is strictly the effect of the additional premium-over-book paid to the annuity carrier.

Annuity settlements will also reduce plan funding for ERISA minimum funding purposes.

For plans at the VRP headcount cap, the (one-time) balance sheet loss will be offset by a significant (annual) gain – in reduced PBGC premiums – from headcount reduction.

For plans not at the VRP headcount cap, who are using the alternative method to value UVBs, in many cases that math is not as favorable, and the headcount reduction may produce an increase in 2021 VRPs. For these plans, 2020 annuity settlements are most attractive (1) with respect to small benefits or (2) where there are corporate/capital structure reasons for doing a risk transfer.

For sponsors that see an advantage in annuity settlements, there is still time in 2020 to arrange one.

Whether sponsors will be in the same situation in 2021 will depend on what happens to interest rates over the next 12+ months.

* * *

We will continue to follow this issue.