Annuity Purchase Update: February 2021 Interest Rates

De-risking defined benefit pension plans through the purchase of annuities has been executed by companies of all sizes as a way to manage their liabilities and expenses. In 2020, $26.5B of annuities were purchased by plan sponsors. Many frozen plans implement this strategy to move them a step closer to their ultimate end game.

Executive Summary

De-risking defined benefit pension plans through the purchase of annuities has been executed by companies of all sizes as a way to manage their liabilities and expenses. In 2020, $26.5B of annuities were purchased by plan sponsors. Many frozen plans implement this strategy to move them a step closer to their ultimate end game.*

February Highlights

+ Plan funding status improved

Assets increased

Interest rates increased

+ Annuity purchase cost increased

Annuity purchase interest rates increased

Annuity purchase activity decreased (the first quarter tends to have the lowest level of annuity purchase activity for the year, which also produces. the greatest insurance company participation)

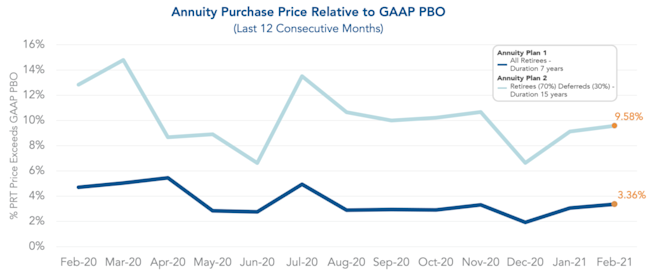

Annuity purchase cost is 98% – 103% of the pension accounting value (GAAP PBO)

+ Now is the time to analyze annuity purchase cost versus PBGC savings

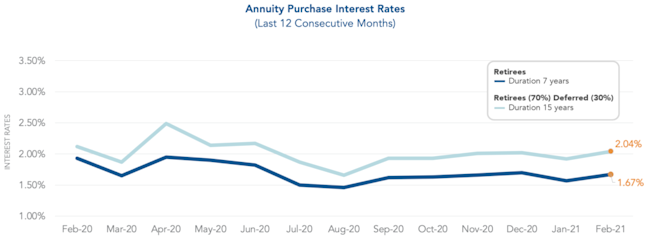

January 2021 Rates | ||

Duration: | 7 Years | 15 Years |

Range Rate: | 1.45% – 2.02% | 1.67% – 2.35% |

Average Rate: | 1.67% | 2.04% |

Average Rate Past Month Increase/Decrease: | 0.10% | 0.12% |

Average Rate During 2020: | 1.74% | 2.05% |

Average Rate YTD Increase/Decrease: | 0.10% | 0.12% |

February 2021 Plan Tracker | ||

Plan: | Plan 1 | Plan 2 |

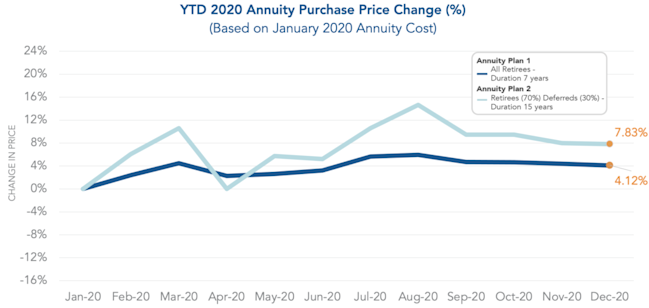

Annuity Purchase Price – YTD: | - 0.72% | - 1.98% % |

Annuity Purchase Price – Past Month: | - 0.72% | - 1.98% |

% Annuity Purchase Price Exceeds GAAP PBO: | 3.36% | 9.58% |

% Annuity Purchase Price Exceeds GAAP PBO – Past Month: | +0.29% | +0.45% |

Narrative

2021 marks a new year for plan sponsors. There are currently several happenings in the world that impact the marketplace. At the forefront are the persisting pandemic, rollout of vaccines, and new Biden-led administration. While we cannot predict how these major events will impact the marketplace, we can confidently state that the outlook for plan sponsors is trending positively. Equity markets are strong and interest rates are rising. This will generally lead to improved plan funding statuses and decreasing annuity purchase prices.

New regulations in 2021 may substantially increase funding relief for plan sponsors. It is important to note that this relief does not extend to PBGC premiums. If plan sponsors contribute the minimum required contribution amounts to their plans, their PBGC premiums will increase.

The 4th quarter of 2020 further instilled the importance of beginning the annuity purchase process as early as possible. The plan sponsors that started the process early in 2020 were able to secure maximal insurer participation and obtain optimal pricing for their transaction.

As mentioned in the January 2021 Pension Finance Update, pension plan funding statuses improved in January. The average duration 7 annuity purchase interest rates increased 10 basis points and average duration 15 rates increased 12 basis point since last month as seen in the below graph titled Annuity Purchase Interest Rates.

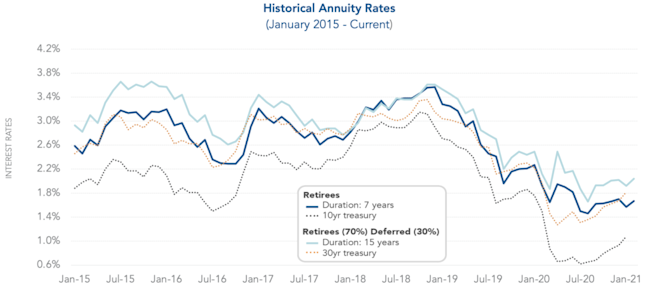

Annuity purchase interest rates fluctuate over time with varying degrees of peaks and valleys. This is evident in our graph below titled “Historical Annuity Rates”. We are currently experiencing an upward trend in interest rates. Plan sponsors should consider getting their data in order for a Pension Risk Transfer.

Implementing a Pension Risk Transfer strategy can help a plan sponsor fulfill organizational goals, including reducing volatility in financial disclosures due to volatile interest rates.

The spread of annuity purchase prices above the GAAP projected benefit obligation (PBO) is in line with historical averages. We refer to GAAP PBO and accounting book value interchangeably. In February 2021, the spread for Annuity Plan 1 is 3.36% and the spread for Annuity Plan 2 is 9.58% as seen in the below graph. An increase in annuity purchase rates generally lowers annuity purchase prices relative to accounting book value. Keep in mind that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs. Future overhead costs would narrow the spread, though the extent is plan specific.

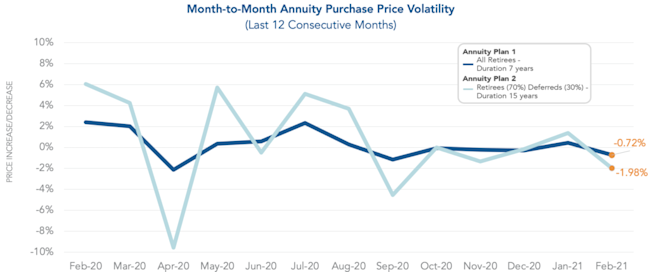

This past year significant month-to-month cost volatility has persisted. In the past month the annuity purchase price for Annuity Plan 1 decreased 0.72% and Annuity Plan 2 decreased 1.98% as seen in the below graph. Timing an early entrance to the insurance market is a crucial part of the planning stage because of the consistent short-term volatility of annuity pricing. Sponsors can take advantage of favorable fluctuations in a volatile market by connecting with an annuity search firm early.

Additional Risk Mitigation Strategies to Consider

During these volatile times, one strategy plan sponsors have utilized is borrowing to fund their pension plan. The recent activities in the markets will negatively effect the funding status of plans and therefore may increase your plan’s PBGC Variable Rate Premium. In 2021, the PBGC Flat-Rate Premium will increase to $86 per participant, the Variable-Rate Premium will increase to 4.6% of unfunded vested benefits, and the Variable-Rate Premium Cap will increase to $582 per participant. As part of managing a pension plan, sponsors should consider a borrow-to-fund solution for de-risking their plan.

By borrowing to fund, plan sponsors can exchange volatile pension liabilities in return for a fixed low interest rate loan. The benefits this funding can have include reducing PBGC premiums and accelerating tax deductions, as well as allowing plan sponsors to focus more on their core business. Additional detail regarding the potential merits of a borrow-to-fund strategy can be found here.

Looking Ahead

Looking ahead to future plan years, per the January Pension Finance Update, PPA funding relief will gradually sunset and this will generally lead to increased contributions from plan sponsors. Plan sponsors may wish to use these contributions to reduce the plan’s overall liability through use of a Pension Risk Transfer.

In 2021, the PBGC Flat-Rate Premium, Variable-Rate Premium, and Variable-Rate Premium Cap have each increased. Per the 2020 PBGC Premium Burden Report, PBGC premiums remain a major threat to even the most carefully managed pension plans. Continued attention to premiums should be a central part of viable pension management for the foreseeable future. Through use of a Pension Risk Transfer, plan sponsors can eliminate or significantly reduce future PBGC premiums.

The Society of Actuaries published a new Mortality Improvement Scale MP-2020 which generally reduces defined benefit plan liability valuations marginally.

Have a pension risk transfer need but not sure where to start? See our article, What to Look in an Annuity Search Firm.

*October Three advises plan sponsors through every step of the Pension Risk Transfer (PRT) process. Through long established relationships with insurers in the PRT marketplace, October Three collects annuity purchase rates for Duration 7 years and Duration 15 years on a monthly basis. We have constructed 2 hypothetical annuity plans which have been valued using the latest mortality tables and mortality improvement scales. Annuity Plan 1 contains retirees only and has a liability duration of 7 years. Annuity Plan 2 contains 70% retirees and 30% deferreds and has a liability duration of 15 years. Using the collected annuity purchase rates and 2 hypothetical annuity plans, we have produced the following graphs representative of actual PRT market activity and the corresponding impact on pension plans.