Annuity Purchase Update: January 2021 Interest Rates

The COVID-19 pandemic brought on numerous negative consequences, including a sharp market decline, reduced employee workforces, and decreased overall productivity. This caused plan sponsors to shift their priorities away from their pension plans and place annuity purchase transactions on hold during the second and third quarter of 2020.

Executive Summary

The COVID-19 pandemic brought on numerous negative consequences, including a sharp market decline, reduced employee workforces, and decreased overall productivity. This caused plan sponsors to shift their priorities away from their pension plans and place annuity purchase transactions on hold during the second and third quarter of 2020.

As the equity markets rebounded to all-time highs during the fourth quarter of 2020, sponsors were able to shift priorities back to their pension plans. Sponsors flocked to complete annuity purchases in the fourth quarter of 2020.

While several sponsors were able to complete purchases at favorable prices, insurance company participation was limited as a result of resource constraints from the influx of market activity. This further demonstrated the need to begin the annuity purchase process as early as possible to secure insurer availability.

December 2020 was a strong month for pension plans. Equity markets performed well and funding status improved. Annuity purchase prices increased slightly.

We completed several annuity purchases in 2020 at accounting balance sheet liability (GAAP PBO) prices. We continue to see aggressive low pricing from insurers relative to balance sheet liabilities.

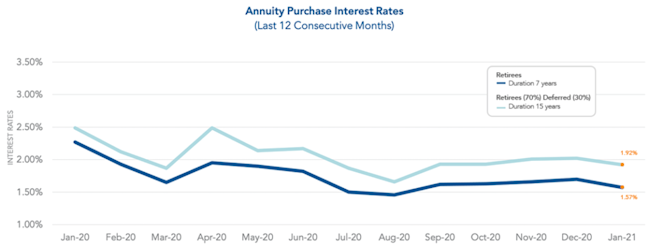

January 2021 Rates | ||

Duration: | 7 Years | 15 Years |

Range Rate: | 1.34% – 1.88% | 1.57% – 2.25% |

Average Rate: | 1.57% | 1.92% |

Average Rate Past Month Increase/Decrease: | - 0.13% | - 0.10% |

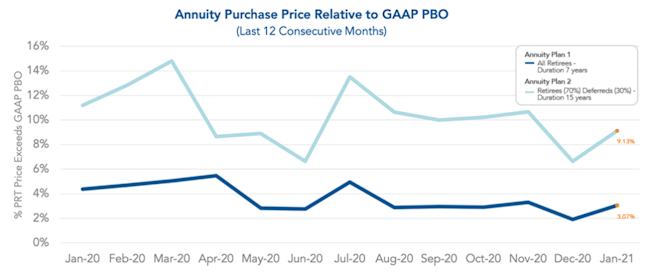

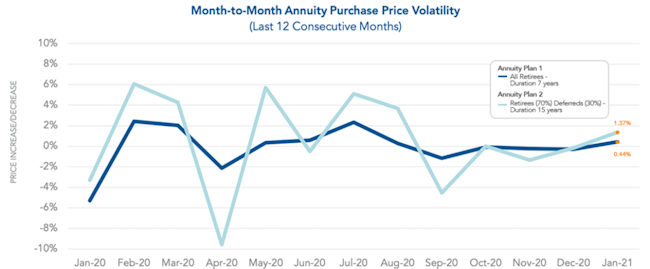

January 2021 Plan Tracker | ||

Plan: | Plan 1 | Plan 2 |

Annuity Purchase Price – Past Month: | +0.44% | +1.37% |

% Annuity Purchase Price Exceeds GAAP PBO: | 3.07% | 9.13% |

% Annuity Purchase Price Exceeds GAAP PBO – Past Month: | +1.14% | +2.48% |

Narrative

Pension plans experienced unprecedented volatility in 2020 due to the COVID-19 pandemic. Equity markets crashed at the end of the first quarter of 2020 and most plan sponsors put their annuity purchase transactions on hold. The second and third quarter had less annuity purchase activity than prior years. Equity markets rebounded however and eventually reached all-time highs in the fourth quarter. As the equity markets climbed there was a mad dash of plan sponsors trying to complete annuity purchases in the fourth quarter before year-end. These annuity purchase were primarily retiree carve-out transactions aiming to reduce PBGC premiums in 2021. Several plan sponsors were able to complete annuity purchases in the fourth quarter at favorable pricing levels. However, the mad dash of sponsors seeking annuity purchases caused many insurers to lack the requisite capacity for completing annuity purchases. Plan sponsors proceeded with their annuity purchase transactions but with less insurer participation. This means that there was less competition amongst insurers and ultimately the plan sponsor transacted at prices above optimal levels.

The 4th quarter of 2020 further instilled the importance of beginning the annuity purchase process as early as possible. The plan sponsors that started the process early in 2020 were able to secure maximal insurer participation and obtain optimal pricing for their transaction.

Throughout all of 2020 we saw annuity pricing for retirees at or very near GAAP PBO levels. We continue to see aggressive pricing from insurers, whether the markets are declining like the first quarter of 2020 or soaring like the fourth quarter.

As mentioned in the December 2020 Pension Finance Update, December was a strong month for plan sponsors. The average duration 7 annuity purchase interest rates decreased 13 basis points and average duration 15 rates decreased 10 basis point since last month as seen in the below graph titled Annuity Purchase Interest Rates.

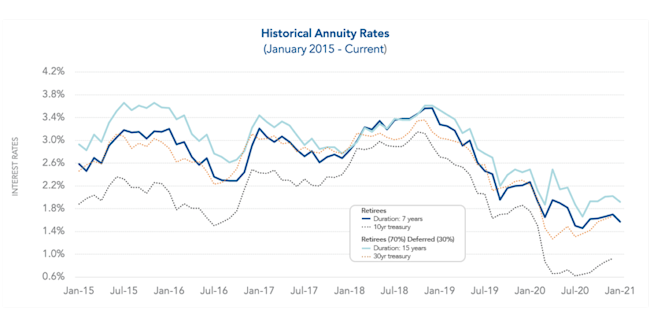

History demonstrates annuity purchase interest rates fluctuate over time with varying degrees of peaks and valleys. We observed an upward trend in both duration 7 and duration 15 annuity purchase rates at the end of 2019. Then in 2020, the COVID-19 pandemic spurred a crash in annuity purchase rates during the first quarter of 2020, an especially volatile second quarter, and an eventual rebound in the third and fourth quarter of 2020. Plan sponsors should consider getting their data in order for a Pension Risk Transfer. Implementing a Pension Risk Transfer strategy can help a plan sponsor fulfill organizational goals, including reducing volatility in financial disclosures due to volatile interest rates.

The spread of annuity purchase prices above the GAAP projected benefit obligation (PBO) remained fairly stable during 2019. This spread was around 3% for Annuity Plan 1 and 11% for Annuity Plan 2. In 2020, the spread has demonstrated more volatility due to the COVID-19 pandemic. As of January 2021, the spread for Annuity Plan 1 is 3.07% and the spread for Annuity Plan 2 is 9.13% as seen in the below graph. Relative to GAAP, an increase in annuity purchase rates generally lowers annuity purchase prices. Keep in mind that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs. Future overhead costs would narrow the spread, though the extent is plan specific.

This past year significant month-to-month cost volatility has persisted. In the past month the annuity purchase price for Annuity Plan 1 increased 0.44% and Annuity Plan 2 increased 1.37% as seen in the below graph. Timing an early entrance to the insurance market is a crucial part of the planning stage because of the consistent short-term volatility of annuity pricing. Sponsors can take advantage of favorable fluctuations in a volatile market by connecting with an annuity search firm early.

Additional Risk Mitigation Strategies to Consider

During these volatile times, one strategy plan sponsors have utilized is borrowing to fund their pension plan. The recent activities in the markets will negatively effect the funding status of plans and therefore may increase your plan’s PBGC Variable Rate Premium. In 2021, the PBGC Flat-Rate Premium will increase to $86 per participant, the Variable-Rate Premium will increase to 4.6% of unfunded vested benefits, and the Variable-Rate Premium Cap will increase to $582 per participant. As part of managing a pension plan, sponsors should consider a borrow-to-fund solution for de-risking their plan. By borrowing to fund, plan sponsors can exchange volatile pension liabilities in return for a fixed low interest rate loan. The benefits this funding can have include reducing PBGC premiums and accelerating tax deductions, as well as allowing plan sponsors to focus more on their core business. Additional detail regarding the potential merits of a borrow-to-fund strategy can be found in this article.

Looking Ahead

Looking ahead to future plan years, per the December Pension Finance Update, PPA funding relief will gradually sunset and this will generally lead to increased contributions from plan sponsors. Plan sponsors may wish to use these contributions to reduce the plan’s overall liability through use of a Pension Risk Transfer.

In 2021, the PBGC Flat-Rate Premium, Variable-Rate Premium, and Variable-Rate Premium Cap have each increased. Per the 2020 PBGC Premium Burden Report, PBGC premiums remain a major threat to even the most carefully managed pension plans. Continued attention to premiums should be a central part of viable pension management for the foreseeable future. Through use of a Pension Risk Transfer, plan sponsors can eliminate or significantly reduce future PBGC premiums.

The Society of Actuaries published a new Mortality Improvement Scale MP-2020 which generally reduces defined benefit plan liability valuations marginally.

Have a pension risk transfer need but not sure where to start? See our article, What to Look for in an Annuity Search Firm.