Annuity Purchase Update: July 2019 Interest Rates

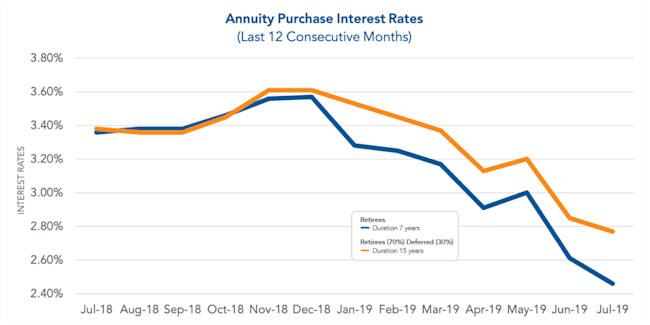

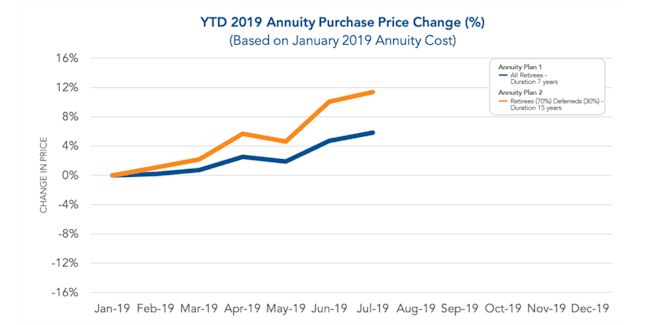

The first quarter of 2019 shows a noticeable drop in annuity purchase interest rates. The second quarter has continued the trend as rates fell again in July. Our experiences during 2019 have been that insurers are pricing annuity purchases aggressively. Annuity purchase prices have not risen as much as expected based on this year's drop in interest rates. We do not know how long this favorable, aggressive pricing from insurers will last.

July 2019 | |||||

Duration: | 7 Years | 15 Years | 7 Years | 15 Years | |

Range Rate: | 2.28% – 2.65% | 2.59% – 2.95% | Average Rate: | 2.46% | 2.77% |

The first quarter of 2019 shows a noticeable drop in annuity purchase interest rates. The second quarter has continued the trend as rates fell again in July. Our experiences during 2019 have been that insurers are pricing annuity purchases aggressively. Annuity purchase prices have not risen as much as expected based on this year’s drop in interest rates. We do not know how long this favorable, aggressive pricing from insurers will last.

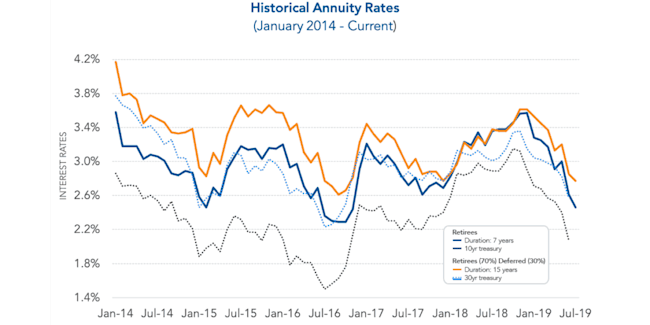

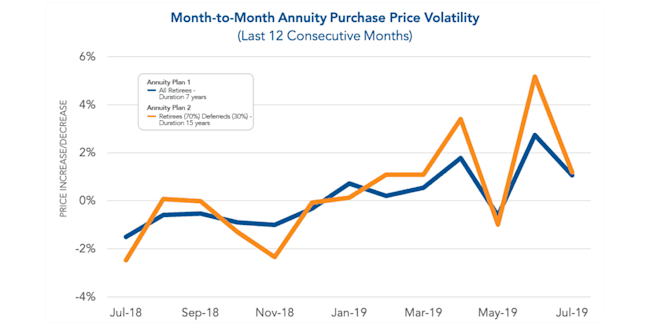

Annuity purchase interest rates can be volatile. Although 2018 experienced an upward trend in annuity purchase interest rates, history demonstrates these rates fluctuate over time with varying degrees of peaks and valleys. Sponsors can reduce the impact of this volatility on their balance sheet through Pension Risk Transfer strategies.

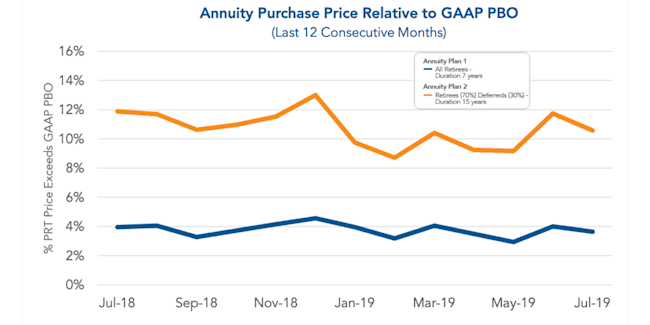

During 2018, the spread of annuity purchase prices above the GAAP projected benefit obligation (PBO) remained fairly stable, at around 4% for Annuity Plan 1 and 12% for Annuity Plan 2. From December 2018 to July 2019, as annuity purchase interest rates and yield curve interest rates changed rapidly, the spread fluctuated slightly up and down for both plans. Narrowing of the spread may represent an opportunity to complete an annuity purchase at a relatively cheaper price than when the spread is larger. Note that the below PBO calculations exclude future overhead costs that plan sponsors would pay to retain participants in the plan — examples of these overhead costs are administrative expenses and PBGC premiums. Future overhead costs would narrow the spread, though the extent to which the overhead costs narrow the spread is plan specific.

Significant cost volatility has persisted month-to-month this past year. The consistent short-term volatility of annuity pricing makes timing an early entrance to the insurance market a crucial part of the planning stage. By connecting with an annuity search firm early, sponsors can take advantage of favorable fluctuations in a volatile market.

Have a pension risk transfer need but not sure where to start? See our article, What to look for in an Annuity Search Firm.

*October Three collects annuity purchase rates for Duration 7 years and Duration 15 years from several insurers on a monthly basis. We have constructed 2 hypothetical annuity plans. Annuity Plan 1 contains retirees only and has a liability duration of 7 years. Annuity Plan 2 contains 70% retirees and 30% deferreds and has a liability duration of 15 years. Using the collected annuity purchase rates and 2 hypothetical annuity plans, we have produced the following graphs representative of actual 2018 Pension Risk Transfer market activity and the corresponding impact on pension plans.