Minimum funding 2024 – interest rate relief is over (for now)

For more than a decade, “interest rate relief” has cushioned the effect of declining interest rates on defined benefit plan liability valuations, by providing a floor on rates equal to the average of rates over the prior 25 years. Recent increases in interest rates have, however, brought them in line with the 25-year average, rendering relief inapplicable. Indeed, if rates continue to rise, 25-year average funding “relief” may in some cases actually limit a DB plan’s ability to recognize that increase.

For more than a decade, “interest rate relief” under the Moving Ahead for Progress in the 21st Century Act (MAP-21) (2012), the Highway and Transportation Funding Act of 2014 (HATFA), and the American Rescue Plan Act of 2021 (ARPA) has cushioned the effect of declining interest rates on defined benefit plan liability valuations, by (oversimplifying somewhat) providing a floor on rates equal to the average of rates over the prior 25 years. Recent increases in interest rates have, however, brought them in line with the 25-year average, rendering relief inapplicable. Indeed, if rates continue to rise, as we’ll explain, 25-year average funding “relief” may in some cases actually limit a DB plan’s ability to recognize that increase.

As we discuss below, for some sponsors of underfunded plans, these developments, together with asset performance, will result in increased minimum funding requirements/cash flow demands for their DB plans.

In what follows we discuss the current interest rates and the rules applicable to DB liability valuation and their effect on underfunded plans subject to ERISA minimum funding requirements.

Current rates

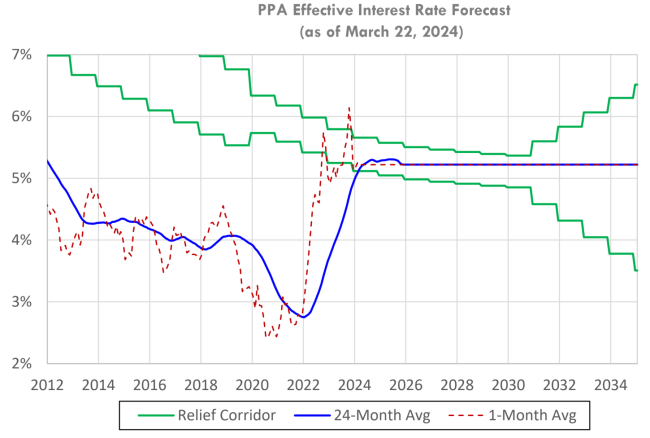

Below is a chart showing current funding rates, assuming no change in future interest rates.

The (25-year average) interest rate relief is actually a corridor: Under current rules (see our article on ARPA) the segment rates used to value plan liabilities for 2024 may (as indicated on the chart) be no lower than 95% of the (trailing) 25-year average and no higher than 105% of the 25-year average.

Thus, while, since 2012, interest rate “stabilization” has functioned as a floor on valuation interest rates, the MAP-21/HATFA/ARPA 25-year limit also imposes a ceiling on rates – as noted, currently 105% of the 25-year average. Current 24-month average and 1-month average (spot) rates are within the “corridor”: they are, in effect, over the floor (95% of the 25-year average) and under the ceiling (105% or the 25-year average). In that situation, there literally is no funding relief, and underfunded plans must value liabilities based on (more or less) market rates, for 2023 and 2024.

(Note that 1-month rates briefly exceeded the relief ceiling in late 2023, but this has no impact on funding requirements for most plans.)

A (future) decline in rates could bring funding relief back into play, although the floor is on a declining trajectory, gradually until 2030 and rapidly thereafter. Interestingly (and problematically) a modest rise in rates over the next few years could (because of the 105% ceiling) force plans to use a liability valuation rate that is lower than market rates – unless Congress changes that rule.

Interest rates and asset values

At first blush, one might assume that this situation – where market rates and “stabilization” rates are more or less the same – is not a problem: a high valuation rate (25-year average or market) is a high valuation rate.

Low rates, however, may be associated with higher asset values. This is easiest to see with bonds – when rates go down bond values go up. A similar phenomenon applies (less precisely) to stocks – when rates go down, P/E (price/earnings) ratios go up.

While market rates were declining, underfunded plans were able to use high rates for valuation, while the declines in market rates (in many cases) increased the fair market value of the assets they held. Thus, for purposes of ERISA minimum funding, plans reaped the “reward” of low rates on the asset side of their balance sheet without having to face the consequences (higher liability values) of low rates on the liability side of their balance sheet.

It is also true that increases in interest rates may be associated with declines in asset values. Thus, when market rates went up sharply in 2022, asset values went down significantly (stocks went down nearly 20%).

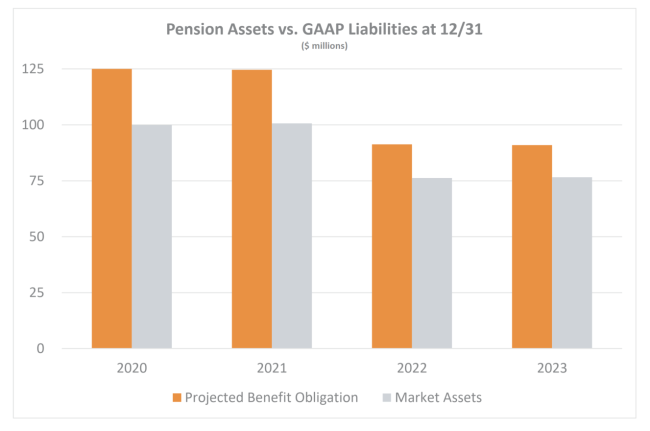

On DB plan sponsor’s financial statements (their balance sheets) these losses were more than offset by reductions in liabilities resulting from higher market interest rates. Thus, for purposes of financial disclosure, most plans’ funding position has improved markedly since rates bottomed out at the end of 2020, despite lower asset values. Below is an illustration of the experience of a typical $100 million plan that was 75% funded at 12/31/2020, increasing to 84% funded at 12/31/2023:

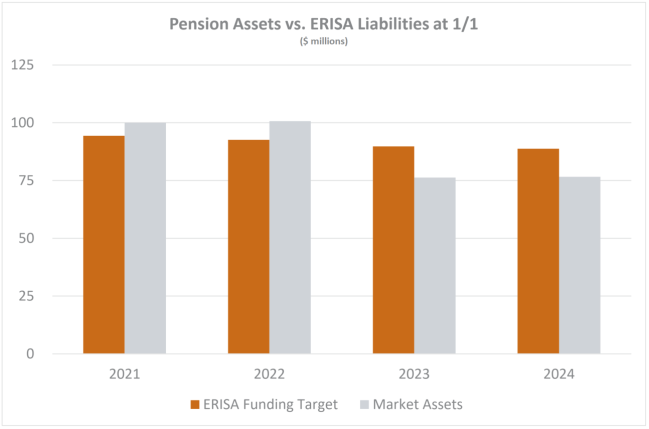

However, for minimum funding, where interest rate stabilization was in place, valuation rates didn’t go up. All that happened was, as described above, funding relief went away. The chart below illustrates the ERISA funding target liability compared to plan assets for the same plan used above:

On this measure, the plan was overfunded in 2021 and 2022 but underfunded in 2023 and 2024, as the funding stabilization rates have converged on market rates. (Note that plans can cushion the 2023 and, to a lesser extent 2024, impact on funding requirements if they are “smoothing” 2022 asset losses.)

For such plans, funding relief made navigating ERISA minimum funding rules straightforward: FTAP/AFTAP “hurdles” were easy to surmount and required contributions were modest to non-existent. Looking ahead, lots of plans will see higher required contributions, and proactive management of quarterly contribution requirements and credit balances will be important to managing plan costs.

The only consolation: by definition, interest rate “relief” – the “non-recognition” of market rates for ERISA minimum funding – could not go on forever. At some point, the actual value of the promised DB benefit would have to be paid.

* * *

We will continue to follow these issues.