De-risking in 2019

In this article we discuss how changes in interest rates, Pension Benefit Guaranty Corporation premiums and mortality assumptions may affect sponsor decisions to de-risk (or not de-risk) defined benefit plan liabilities in 2019. For purposes of this article, by de-risking we mean paying out a participant’s benefit as a lump sum and thereby eliminating the related liability.

In this article we discuss how changes in interest rates, Pension Benefit Guaranty Corporation premiums and mortality assumptions may affect sponsor decisions to de-risk (or not de-risk) defined benefit plan liabilities in 2019. For purposes of this article, by de-risking we mean paying out a participant’s benefit as a lump sum and thereby eliminating the related liability.

We begin with a brief summary of our conclusions, followed by a more detailed analysis.

Summary

We illustrate our analysis of the effect of interest rates and PBGC premiums on the de-risking decision by using a (relatively simple) example: the cost-of-benefit and de-risking gain with respect to a terminated vested 50-year-old individual who is scheduled to receive an annual life annuity of $1,000 beginning at age 65.

We note that IRS recently published Notice 2019-18, which states that it “will not assert that a plan amendment providing for a retiree lump-sum window program causes the plan to violate [the RMD rules].” The analysis provided below would generally apply to lump sum payments to retirees as well.

For our example participant, increases in interest rates (November 2017 vs. November 2018) have reduced the 2019 base cost of paying this participant a lump sum benefit, vs. 2018, by around $1,200. On our assumptions, if a 50-year-old individual with a $1,000 benefit had been paid out in 2018, the cost would have been $7,867; in 2019 the cost would be $6,671.

Most of the savings from de-risking this participant come from reduced PBGC premiums – an (assumed) present value of $1,885 in PBGC flat-rate premiums and $2,578 in PBGC variable-rate premiums (only available to plans subject to the variable-rate premium cap).

In addition, for 2019 lump sum calculations there was an increase in the applicable mortality assumption, which will result in a decrease in lump sum costs. For our example participant that savings would further reduce the cost of paying out the participant in 2019 vs. 2018 by around $30.

The de-risking calculation is, of course, relative and dependent on the sponsor’s view of, e.g., future interest rate trends and the cost/savings of paying a participant all benefits this year vs. paying them next year vs. simply paying them when due (e.g., beginning at age 65). In this regard we note that market interest rates (as of February 2019) are down around 40 basis points relative to November 2018. All in all, 2019 looks like a relatively good year (certainly relative to 2018) to de-risk.

What follows is a detailed discussion of these conclusions.

Interest rates

De-risking involves paying out the present value of a participant’s benefit as a lump sum. The interest rates used to calculate that present value are the Pension Protection Act (PPA) “spot” first, second and third segment rates for a designated month. Many sponsors set the lump sum rate at the beginning of the calendar year, based on the spot rates in a prior year “lookback” month, so that participants will know what rate will be used to calculate their lump sum for the entire year. A plurality of plans use a November lookback month, which we use in our example. Under such an approach, for 2019 the lump sum rates would be the November 2018 PPA spot rates.

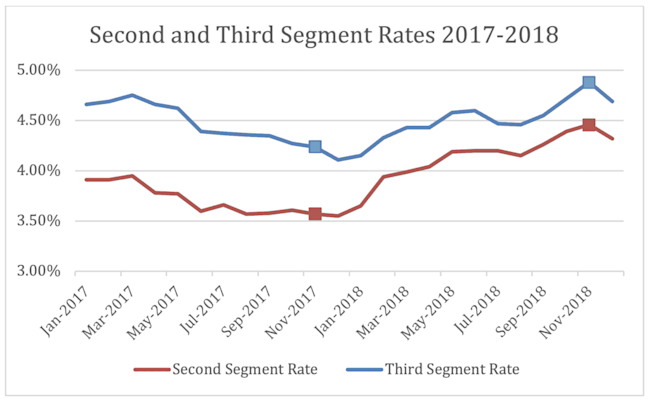

The following chart shows PPA spot second and third segment rates for the period 2017-2018 (with November rates highlighted).

PPA monthly average interest rates

As this data indicates, November 2018 interest rates were up significantly vs. November 2017 rates. (We note that the increase in 2018 rates was significant across all lookback months; the November 2017-November 2018 increase was, however, the greatest.)

As noted, based on these rates, the cost of de-risking our example participant decreased from $7,867 in 2018 to $6,671 in 2019.

(For purposes of this calculation, rather than doing a strict Tax Code 417(e) calculation, we simply assume the participant has a 21-year life expectancy at age 65.)

PBGC premiums

Reducing participant headcount, e.g., by paying out lump sums to terminated vested participants, reduces the PBGC flat-rate premium and may, depending on plan funding and demographics, reduce the variable-rate premium. Premiums for the current year are based on headcount for the prior year. So de-risking in 2019 will reduce premiums beginning in 2020.

PBGC flat-rate premiums

We are estimating the 2020 PBGC flat-rate premium to be $82 (the 2019 rate of $80 adjusted for one year of wage inflation).

For purposes of our analysis we assume no inflation-related increases in PBGC premiums. We use a discount rate of 2.5%, which generally assumes low or no inflation.

Discounting annual premiums for 36 years (assuming our example 50-year-old participant lives to age 86) yields a present value of the savings from the elimination of PBGC flat-rate premiums for our example participant of around $1,885.

Variable-rate premiums

In our article Reducing pension plan headcount reduces risk and PBGC premiums we discuss how de-risking can, in some cases, dramatically reduce the variable-rate premium. The logic of that is not especially intuitive. The gains come from the headcount-based cap on variable-rate premiums. We estimate (again, based on one year wage inflation) the 2020 headcount cap to be $555. Oversimplifying (and again ignoring any future inflation adjustment to the cap), depending on plan funding and demographics, de-risking (that is, lump summing-out) one participant in 2019 may save a sponsor $555 per year in PBGC premiums beginning in 2020.

As plan funding improves, however, these savings will go away. For purposes of our example we assume the plan “funds its way out” of the per participant variable-rate premium cap after 5 years. Discounting annual premiums of $555 for 5 years yields a present value of around $2,578.

Effect of changing mortality improvement scales

On October 20, 2017, the Society of Actuaries adopted a new mortality improvement scale (MP-2017), showing an increase in mortality over MP-2016. Quoting the SOA: “most 2017 pension obligations calculated using Scale MP-2017 (with a discount rate of 4.0%) are anticipated to be approximately 0.7% to 1.0% lower than those calculated using Scale MP-2016.” On December 15, 2017, IRS updated applicable mortality tables for 2019, to reflect the SOA’s new scale. As noted, based on the new mortality improvement scale, we estimate that the cost of de-risking our example participant decreased by around $30in 2019.

* * *

Increases in lump sum valuation interest rates have made de-risking in 2019 significantly less expensive than it was in 2018. It is also less expensive vs. a lump sum valuation made using current (first quarter 2019) interest rates. Changes in mortality assumptions in 2019, vs. 2018, have also reduced the cost of lump sums. Sponsors will want to consider these factors in making their 2019 de-risking decision.

We will continue to follow this issue.