Implications of MAP-21 for DB plan finance – 2013

Implications of MAP-21 for DB plan finance - 2013

Last year we reviewed the effect of newly adopted rules under the “Moving Ahead for Progress in the 21st Century Act” (MAP-21) in our article Implications of MAP-21 for DB plan finance. At that time, we concluded that if interest rates stayed flat (as of the summer of 2012), typical DB plan sponsors would have ‘downside’ funding protection under MAP-21 through 2020.

Since last year’s article interest rates have increased, and there is some talk that the long term downward trend in rates, which began back in October of 1981, may have ended. In this article we update our analysis of the effect of MAP-21 on funding to reflect current interest rates.

Background

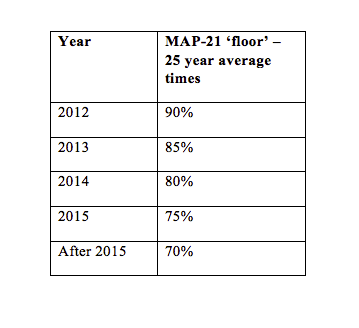

Generally, under the Pension Protection Act, valuation interest rates are determined using a corporate bond yield curve, averaged over 24 months and then broken down into three ‘segment rates’ – short-, medium- and long-term. MAP-21 put a ‘floor’ under the PPA rates, equal to the average of rates for the 25-year period ending with September 30 of the preceding calendar year, multiplied by a percentage, as follows:

Rates for 2013

So, for 2013, liability valuation rates can be no lower than 85% of the average of rates for the 25-year period ending with September 30, 2012.

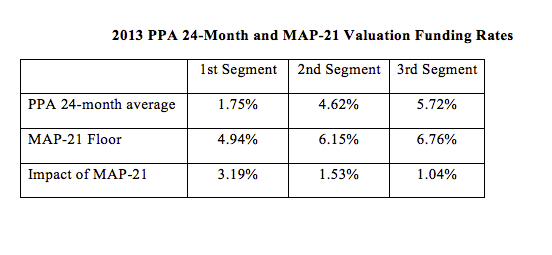

The table below shows the (Pre-MAP) PPA 24-month and MAP-21 valuation funding rates applicable in 2013. PPA 24-month average rates are based on the 24-month average ending with August 2012.

For most pension sponsors, the 2nd and 3rd segment rates are the real ‘drivers’ of pension liabilities. As shown above, for 2013, MAP-21 allows rates that are 1.0%-1.5% higher than under prior law, which translates to a decrease in pension liabilities of 15%-18%.

Increase in rates in 2013

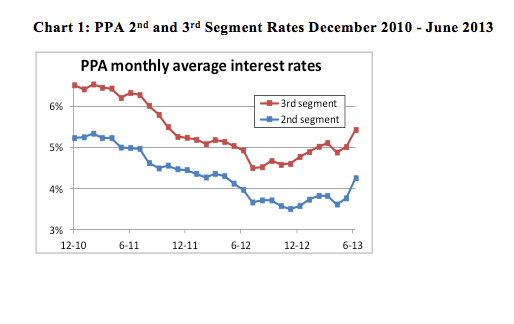

The following chart shows what has happened to the PPA 2nd and 3rd segment rates (ignoring 24-month averaging) over the past two and one-half years.

Projection

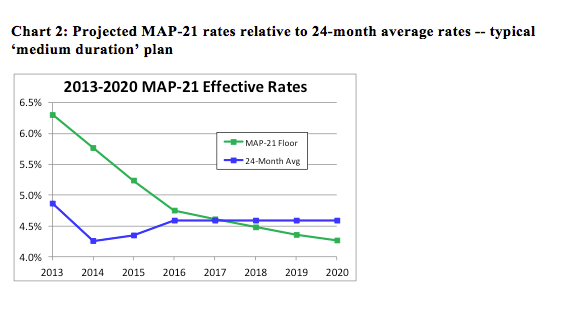

So – the recent interest rate trend has been up. Unless rates fall back, MAP-21 ‘relief’ will end well before 2020. The following chart calculates the single ‘effective rate’ for a typical pension plan through 2020 based on both PPA 24-month average rates and MAP-21 floor (estimates based on actual interest rates as of July 19, 2013, assuming no future change in rates).

The increase in rates since last summer, if sustained, means that MAP-21 ‘relief’ is expected to ‘phase out’ much sooner than we expected last year (2017, rather than 2020).

“Relief from funding”

Even as rates go up, MAP-21 will continue to provide significant funding relief in 2014 and 2015. Assuming current rates ‘hold’ (are constant into the future) most plans will again enjoy liability ‘relief’ of 15%-18% for 2014 and 10%-12% in 2015.

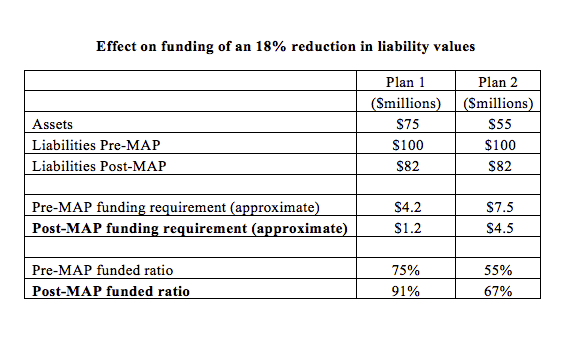

To get a feel for how significant that funding relief is, the following table illustrates the effect on funding of an 18% reduction in liability values on two example plans.

What is the trend?

Of course, a lot depends on what happens to interest rates in the rest of the year and beyond. Federal Reserve policy is unclear. And it’s also unclear how much effect Federal Reserve policy has had on interest rates. (We discuss this and related issues in our articles How low can you go? Interest rates and DB plans, and Pensions in 2013 – trends in interest rates and de-risking.)

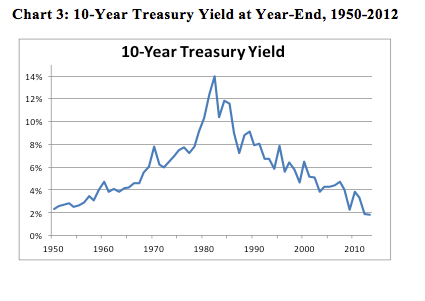

The chart below provides a broader perspective that may be useful in interpreting the increase in rates seen in the past twelve months.

Is the data for the last year or so (see Chart 1), showing interest rates going up, a ‘signal’ of the end of a thirty year bull market in bonds, or is it just ‘noise?’ Obviously, it remains to be seen. But if rates continue to increase it will have a significant (and positive) impact on pension finance.

In the meantime, it is increasingly looking like the summer of 2012 may have been an ‘expensive’ time to de-risk pension assets – certainly more expensive than today.

And the MAP-21 legislation, by providing ‘relief from the risk’ of lower interest rates, may have encouraged employers to postpone de-risking decisions. With the benefit of hindsight, such a decision has paid off handsomely in the past year.

We will continue to follow this issue.