Measuring UVBs for variable-rate premiums – the alternative vs. standard method election

Defined benefit plan sponsors may have an opportunity to reduce 2020 variable-rate premiums.

Defined benefit plan sponsors that (1) currently using the standard (spot-rate) method to determine unfunded vested benefits (UVBs) for purposes of calculating Pension Benefit Guaranty Corporation variable-rate premiums, and who (2) have the ability to elect to switch to the alternative (24-month average) method, may have an opportunity to reduce (in some cases significantly) 2020 variable-rate premiums by doing so. This election generally must be made (for a calendar plan) by October 15, 2020.

The decision with respect to this election is made particularly acute by the continuing decline in interest rates over the period 2019-2020.

In what follows, we briefly describe the election, which sponsors may make it, and the market factors that make it significant. We begin with a quick review of the PBGC variable-rate premium calculation.

Variable-rate premiums and valuing UVBs

Currently – in the context of interest rate relief that significantly limits the effect of ERISA minimum funding requirements – for many plan sponsors funding policy is framed with a view to reducing (so far as possible) PBGC variable-rate premiums.

The amount of variable-rate premiums a sponsor pays for 2020 is 4.5% of the plan’s 2020 unfunded vested benefits (UVBs), subject to a $561 per participant headcount cap. UVBs are determined as the present value of plan liabilities (for vested participants) minus the fair market value of plan assets. (With respect to the determination of plan assets for purposes of 2020 variable-rate premiums, see our recent article PBGC to allow contributions made by January 1, 2021 to count for 2020 PBGC variable-rate premium.)

Election of method for measurement of UVBs

In determining UVBs, sponsors have a choice. They can use (for a calendar year plan): (1) December 2019 spot segment rates (the “standard” method) or (2) the 24-month average segment rates used for plan funding (the “alternative” method) (disregarding 25-year average interest rate stabilization).

There are a lot of technicalities in that description – the easy way to think of this is as a choice between end-of-prior year spot rates or 24-month average rates.

A sponsor’s ability to elect the 24-month average method, or to elect out of the spot rate method, however, is limited. Once a particular method (standard or alternative) is elected, the sponsor can’t switch to the other method for five years. So, this decision should generally be made with a view to (among other things) the expected behavior of interest rates over the near- and medium-term.

Election of lookback month for 24-month average

Sponsors using the alternative method may (in some cases) use any one of five lookback months (August-December 2019) as the end-month of the 24-month lookback period. Because of the more or less steady decline in interest rates over the period 2019-2020, choosing an earlier lookback month (ideally, August 2019) will produce the highest UVB valuation interest rate/lowest UVB valuation and the lowest 2020 variable-rate premiums. (A technical note: the election of the lookback month for measurement of UVBs is a function of the plan’s funding method and is made on Form 5500 Schedule B.)

Spot vs. 24-month average rates for 2019, 2020 and beyond

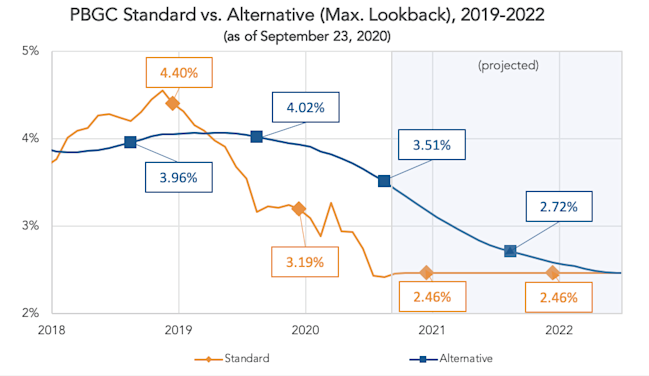

The chart below graphs the spot (standard method) vs. 24-month average (alternative method) rates for 2019-2022, using an August lookback month for the 24-month average determination. We include 2021 because, using an August 2020 lookback month, 2021 rates are already known as of today. 2022 estimates (based on current rates) are more speculative.

While (as we discussed in our article on this topic last year) in 2019 the spot rate method provided some advantage (but at the cost of locking in use of that method for five years and creating a problem for some sponsors that moved to the standard method in 2019), clearly for 2020 and 2021, using the alternative/24-month average method provides a significantly higher UVB valuation interest rate. (Indeed, the size of the spread is unprecedented.)

For 2020, a plan with $80 million in assets and spot rate liabilities of $100 million would owe a variable-rate premium of $900,000 (4.5% x $20 million) under the PBGC standard calculation. Using the 24-month average with August lookback reduces measured liabilities for a typical plan by about $9 million, producing a variable premium under the alternative method of $500,000 and savings of $400,000 this year.

Making the UVB valuation methodology decision

As we cautioned in our 2019 article, switching UVB valuation methods is not without risk, because, once made, the sponsor is locked into the chosen method for five years. This year, however, barring a dramatic increase in rates before the end of the year, we have a pretty good idea that the 2021 24-month average rate (using an August 2020 lookback month) will be significantly higher than the December 2020 spot rate. For our example plan, electing the alternative method in 2020 is expected to reduce the 2021 premium by $500,000 (assuming market rates remain at current levels). Analysis for 2022 is more speculative, but, based on current rates, we estimate another $100,000 in lower premiums under the alternative method in 2022.

Having said that, sponsors will want to consider their view of the trend of future interest rates in making this decision. In this regard, see our article Markets 2020 – DB finance as of the end of June 2020.

A sponsor’s decision as to whether to change to the alternative/24-month average method for the 2020 variable-rate premium calculation will depend on a number of variables, including plan demographics, the plan’s current financial position, investment results, the impact of the variable premium cap, and on-going de-risking activity. With respect to this decision, we would make the following observations:

1. If the current method (spot rate or 24-month average) was first elected for 2016 or later, there is no decision to make – these plans are stuck with the method previously elected (although plans using the 24-month average method may be able to change the lookback month).

2. If the plan is currently using the 24-month average method, sponsors will generally want to stick with it (although in certain circumstances the sponsor may want to consider changing the lookback month).

3. Sponsors of plans that are using the spot rate method and have the ability to switch to the 24-month average method for the 2020 will want to consider the following:

If the plan is at the variable-rate premium headcount cap for 2020, it doesn’t matter which method is used, although which method is used may determine whether the plan is subject to the cap.

The sponsor’s view of interest rates over the next 18-30 months is most significant; beyond that period, even the 24-month average will be strictly a function of future rates.

The sponsor’s decision will be affected by (and may affect) decisions with respect to funding, financial disclosure, and de-risking. These factors should all be considered before making the spot rate vs. 24-month average decision.

* * *

For our $100 million plan, there is potentially $1 million at stake in connection with this decision. Plans with an opportunity here will want to pay close attention to interest rates up until October 15th before making a final decision.

We will continue to follow this issue.