Pension Finance Update September 2023

Pension finances were mixed during September, as falling stock markets were largely offset by still higher interest rates.

Pension finances were mixed during September, as falling stock markets were largely offset by still higher interest rates. Both model plans we track(1) were close to even last month: our traditional Plan A was flat and remains up 8% for the year, while the more conservative Plan B lost a fraction of 1%, but is still 1% ahead through the first three quarters of 2023:

Assets

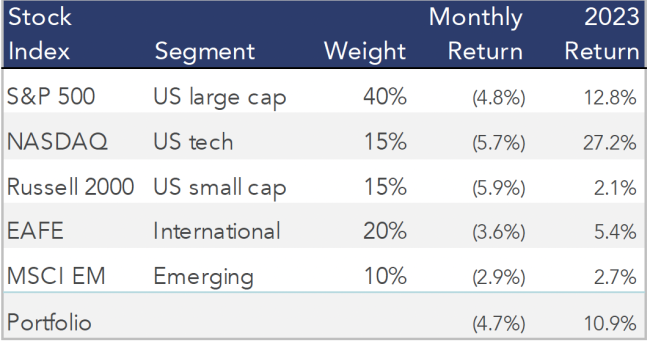

All major stock indexes fell again in September. A diversified stock portfolio lost almost 5% last month but remains up 11% through the first three quarters of 2023:

Treasury yields jumped 0.5% in September, while corporate bond yields rose 0.4%. As a result, bonds lost 3%-5% last month. For the year, a diversified bond portfolio is now down 2%-4%, with long duration Treasuries doing worst.

Overall, both plans we track lost ground last month: Plan A lost 4% during September but remains up 5% for the year, while Plan B lost 3% last month, ending September even for the year.

(1) Plan A is a traditional plan (duration 12 at 5.5%) with a 60/40 asset allocation, while Plan B is a largely retired plan (duration 9 at 5.5%) with a 20/80 allocation with a greater emphasis on corporate and long-duration bonds. We assume overhead expenses of 1% of plan assets per year, and we assume the plans are 100% funded at the beginning of the year and ignore benefit accruals, contributions, and benefit payments in order to isolate the financial performance of plan assets versus liabilities.

Liabilities

Pension liabilities (for funding, accounting, and de-risking purposes) are driven by market interest rates. The first graph below compares our Aa GAAP spot yield curve at December 31, 2022 and September 30, 2023, and it also shows the movement in the curve last month. The second graph below shows our estimate of movements in effective GAAP discount rates for pension obligations of various duration so far this year:

Corporate bond yields increased 0.4% during August. As a result, pension liabilities fell 3%-6%, ending the third quarter down 3%-5% for the year.

Summary

Pensions have endured two months of falling stock markets on the strength of remorselessly higher interest rates; during September, the 10-year Treasury yield exceeded 4.5% for the first time in 16 years. The graphs below underscore the power of higher rates for pension sponsors, which have translated to generally positive news during the first three quarters of 2023:

Looking Ahead

Pension funding relief was signed into law during March of 2021, and additional relief was provided by November 2021 legislation. The new laws substantially relaxed funding requirements over the next several years, but the increase in rates since 2021 has eroded the impact of relief.

Discount rates jumped across the board last month, while a flat yield curve continues to compress rates for plans of different durations. We expect most pension sponsors will use effective discount rates in the 5.6%-5.8% range to measure pension liabilities right now, the highest rates seen since 2009.

The table below summarizes rates that plan sponsors are required to use for IRS funding purposes for 2023, along with estimates for 2024. Pre-relief, both 24-month averages and December ‘spot’ rates, which are still required for some calculations, such as PBGC premiums, are also included.

* October Three estimate, based on rates available as of 9/30/2023.