De-risking in 2016

In this article we discuss how changes in interest rates, Pension Benefit Guaranty Corporation premiums and mortality tables may affect sponsor decisions to de-risk (or not de-risk) defined benefit plan liabilities in 2016. For purposes of this article, by de-risking we mean paying out a participant’s benefit as a lump sum and thereby eliminating the related liability.

This is a technical article, but for some sponsors there may be significant dollars at stake.

Example

We are going to illustrate the effect on the de-risking decision of these developments with an example: the de-risking gain with respect to a terminated vested 50 year-old male who is scheduled to receive an annual life annuity of $1,000 beginning at age 65.

Summary

We begin with the bottom line. For our example participant, increases in interest rates have decreased the base cost of de-risking, vs. 2015, by around $300. On our assumptions, if a 50 year-old male with a $1,000 benefit had been paid out in 2015, the cost would have been $6,818; in 2016 the cost would be $6,514.

As discussed in detail below, the savings from de-risking comes from reduced PBGC premiums and the avoidance of increased costs from the adoption of new mortality tables. Those savings for the example participant are summarized in the following table:

**2016 savings (present value) from de-risking example participant**

PBGC flat-rate premiums | $1,800 |

New mortality tables | $200 |

PBGC variable-rate premiums (only available to plans with certain funding and demographic charcteristics) | $2,300 |

Total | $4,300 |

Thus, de-risking in 2016 produces significant savings in current and future PBGC premiums.

Interest rates

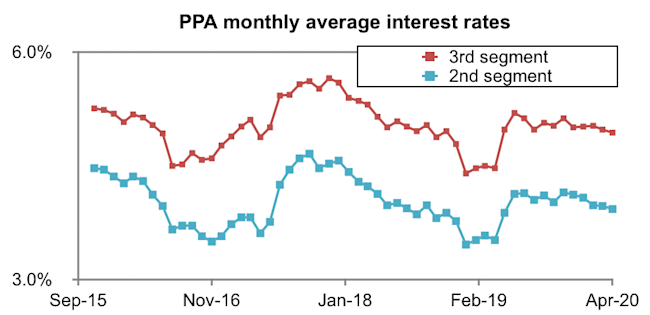

De-risking involves paying out the present value of a participant’s benefit as a lump sum. The interest rates used to calculate that present value are the Pension Protection Act (PPA) “spot” first, second and third segment rates for a designated month. Many sponsors set the lump sum rate at the beginning of the calendar year, based on prior year November interest rates, so that participants will know what rate will be used to calculate their lump sum for the entire year. Under such an approach, for 2016 the lump sum rates would be the November 2015 PPA spot rates.

The following chart shows PPA November spot second and third segment rates for the period 2011- 2015.

As this data indicates, November 2015 interest rates were up (marginally) vs. November 2014 rates and are (again, marginally) higher than current rates.

The following table shows the cost of a lump sum payment for our example participant for 2013-2016 for a sponsor using a prior year’s November spot rate.

**Cost of lump sum payment — annual $1,000 deferred vested benefitbeginning at age 65/participant is 50**

2013 | $7,421 |

2014 | $5,827 |

2015 | $6,818 |

2016 | $6,514 |

(For purposes of this calculation, rather than doing a strict Tax Code 417(e) calculation, we simply assume the participant has a 21-year life expectancy at age 65.)

So the effect of the change in interest rates has been to reduce (marginally) the cost of de-risking our example participant, relative to 2015.

PBGC premiums

Reducing participant headcount, e.g., by paying out lump sums to terminated vested participants, reduces the PBGC flat-rate premium and may, depending on plan funding and demographics, reduce the variable-rate premium. Premiums for the current year are based on headcount for the prior year. So de-risking in 2016 will reduce premiums beginning in 2017.

PBGC flat-rate premiums

The PBGC flat-rate premium is $64 per participant for 2016; it increases to $69, $74 and $80 in 2017, 2018 and 2019 respectively and is increased for (wage) inflation thereafter. Discounting annual premiums for 36 years (assuming the participant lives to age 86) yields a present value of around $1,800.

Variable-rate premiums

In our article De-risking and the PBGC variable-rate premium we discussed how de-risking can, in some cases, dramatically reduce the variable-rate premium. The logic of that is not especially intuitive. The gains come from the headcount-based cap on variable-rate premiums. In 2016 the headcount cap is $500 per participant. Oversimplifying, depending on plan funding and demographics, de-risking (that is, lump summing-out) one participant in 2016 may save a sponsor $500 per year in PBGC premiums beginning in 2016.

As plan funding improves, however, this savings will go away. For purposes of our example we’re going to assume the plan “funds its way out” of the per participant variable-rate premium cap after 5 years. Discounting annual premiums of $500 for 5 years, using a 2.5% interest rate, yields a present value of around $2,300.

For details on the effect of de-risking on the variable-rate premium, we refer you to our article.

Effect of new mortality tables

At the end of 2014 the Society of Actuaries finalized new mortality tables for private DB plans. While the SOA subsequently modified those tables in a way that will in most cases somewhat reduce their impact, they generally will increase liability valuations.

IRS is expected to update the mortality tables that plans must, under the Tax Code and ERISA, use in calculating lump sums in 2017, although there has been some speculation that adoption of the new tables may be delayed to 2018. The effect of the adoption of the new tables on lump sum valuations will depend on a number of factors, but (again) generally they will increase lump sum valuations.

For purposes of our example, if our 50 year old is paid a lump sum before the new tables are adopted, we assume (somewhat arbitrarily) the plan will avoid a 3% mortality assumption-driven increase in cost. 3% of $6,514 is a one-time saving of around $200. (This effect will vary depending on the age and gender of the participant.)

Note: we are characterizing payment of a lump sum before new mortality tables go into effect as producing a “savings.” That “savings,” however, is different from the PBGC premium savings discussed above. The PBGC premium savings are “real money” that sponsors will have to pay in 2017 if they do not reduce participant headcount. The gains from paying a lump sum before new mortality tables go into effect are more speculative.

Finally, sponsors may wish to consider whether, and how, to explain the effect of soon-to-be-adopted mortality tables on a participant’s decision to take a lump sum, either as part of a de-risking transaction or simply in the course of an ordinary retirement.

* * *

Increases in lump sum valuation interest rates have, for plans using prior year November rates for lump sum calculations, made de-risking in 2016 marginally less expensive than it was in 2015. Because of increased PBGC premiums, de-risking continues to produce substantial savings.

We will continue to follow this issue.