Cash Balance Plan vs. 401(k): The Pros, Cons, and Differences

In this article, we explore the pros, cons, and differences between Cash Balance plans and 401(k)s to share how organizations might use these retirement vehicles to support employee retirement goals.

What is a 401(k) plan?

A 401(k) plan is a well-known type of Defined Contribution plan, and one of the most popular retirement vehicles today. As a Defined Contribution plan, the investment risk of a 401(k) is shouldered by the participant. The participant, and in some cases the employer, makes contributions to the account, which grows based on investment performance.

What is a Cash Balance Plan?

Cash Balance plans are a type of Defined Benefit retirement plan. In general, Defined Benefit plans are a type of retirement plan where employers promise a specific retirement benefit, typically a monthly payment for life based on factors like salary and years of service. Employers shoulder investment risk in these structures. An example would be a traditional pension plan.

Among Defined Benefit plans, Cash Balance plans can be an effective vehicle for high-income individuals to increase their yearly retirement savings.

How does it work?

Cash Balance plans grow each year through two types of credit:

Pay credit: This is a set percentage of a participant’s compensation or a fixed dollar amount paid into the account by the plan sponsor.

Interest credit: There are two types of interest credit today, fixed and variable-rate.

Fixed interest credits are tied to an index rate, such as a treasury rate.

Variable-rate interest credits are based on the investment return of the underlying plan assets. As a result, they are more common as they align the growth of the account balance with the growth of the assets directly, minimizing risk and volatility to the plan sponsor.

The employer shoulders the investment risk in Cash Balance plans, ensuring the promised account balance regardless of market fluctuations. The end result is a guaranteed retirement benefit, either as a lump sum or converted into a lifetime annuity, based on the employee’s tenure, earnings, and the plan’s pay and interest credits.

401(k) Pros and Cons

401(k) plans can be effective vehicles to save for retirement. However, like most retirement plans, they come with pros and cons.

Pros:

Taxes: Contributions are pre-tax or tax-free after retirement if you’re using a Roth 401(k), and investments grow without being taxed, increasing compounding interest.

Additional contributions: Some employers will match contributions up to a percentage, bolstering savings.

Automatic savings: Contributions are pulled directly from the employee’s paycheck after they have been selected.

Portable: 401(k)s can be rolled into other 401(k) or similar retirement vehicles if the individual changes or leaves an employer.

Cons:

Employee responsibility: The employee shoulders investment risk, meaning retirement savings can be impacted by market performance.

Limited accessibility: 401(k) plan distributions are frequently limited to specific circumstances, including changing jobs, upon reaching age 59 and a half, and disability.

Longevity risk: 401(k) plans do not provide guaranteed lifetime income, meaning individuals have the potential to outlive their savings.

Contribution limits: 401(k) plans generally have lower contribution limits, making them less attractive for high-income individuals looking to save more for retirement.

Cash Balance Plan Pros and Cons

Pros:

Tax-deferred status: As qualified retirement plans, cash balance plans are tax-differed. Participants do not pay taxes on their retirement savings until they make withdrawals, and employers’ contributions are tax-deductible when made, reducing the organization’s taxable income.

Larger contributions/accruals: Cash balance plan contribution limits increase as participants age and earn more, enabling participants to increase their retirement savings while often reducing their annual tax burden.

Increased visibility: Cash balance plans enable participants to see their balance and watch as their account grows each year, delivering a similar participant experience as a 401(k) plan.

Flexible payout options: Participants can choose a lump-sum payout that can be rolled over into IRAs or other retirement plans for continued tax-deferred growth, or they can convert some or all of their balance into a lifetime annuity.

Greater protection for participants: Cash balance plans also benefit from enhanced protection under the Employee Retirement Income Security Act (ERISA), to safeguard participants' accrued benefits from creditors. Plans are also often insured by the Pension Benefit Guaranty Corporation (PBGC), further enhancing their reliability if a plan sponsor fails to meet its financial obligations.

Cons:

No self-directed investments: While participants can accumulate significant benefits within a cash balance plan, they cannot decide how the assets backing those benefits are invested. Instead, the plan sponsor makes the investment decisions, and the returns generated are shared among all plan participants.

Limited flexibility to change contribution levels: A notable limitation of cash balance plans is the inability for participants to change the amount of money routed into the cash balance plan each year. However, many plan sponsors will amend the plan every three to four years, allowing participants to modify their benefit accrual.

Accessibility of funds: Unlike 401(k) plans, which may offer loans or hardship withdrawals, Cash Balance plans are designed to be permanent, with no option for elective contributions. Withdrawal timing is limited to a distributable event, such as retirement, termination, death, disability, or the participant reaching a specified age, when the plan may allow them to access their account balance.

Added costs: Cash Balance plans can lead to higher costs. For instance, an actuary must review and certify plans each year to ensure compliance and proper funding. Employers should consider these additional expenses as part of the overall benefits package offered to employees.

Additional rules: Cash Balance plans come with their own set of rules and restrictions, which require an actuary to ensure compliance with IRS laws and regulations.

Who Is a Cash Balance Plan Best For?

Cash Balance plans can offer significant tax savings and support long-term retirement goals, but they aren’t for everyone.

Generally, Cash Balance plans are the best fit for the following three groups:

Professional services: CPAs, lawyers, doctors, IT consultants, etc.

Owner-only businesses

High earners with consistent income

Can I Have a Cash Balance Plan and a 401(k)?

Yes, and in many cases, combining a Cash Balance and 401(k) plan can offer significant advantages that offset some of the disadvantages of each plan by combining the flexibility of a 401(k) with the reliability and increased savings of a Cash Balance.

For example, where participants can’t adjust how their retirement assets are invested in a Cash Balance plan, they can make discretionary changes to a 401(k). Furthermore, Cash Balance plans deliver greater security in retirement, making up for the inherent risks of a 401(k) plan.

Naturally, managing both plan types comes with additional costs, so whether the advantages are worth it will depend on your organization’s goals. Visit our Cash Balance and Hybrid plan service page to learn more about these unique plan structures.

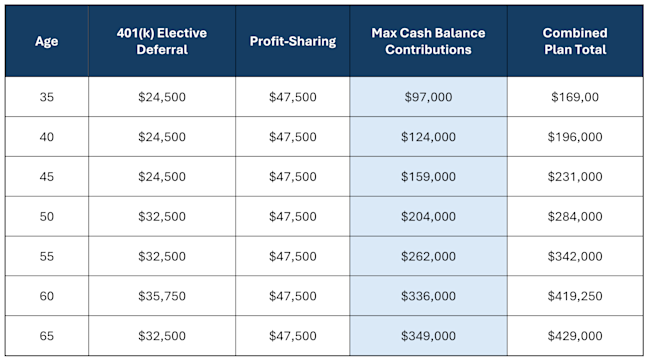

What are the Maximum 401(k) and Cash Balance Contribution Limits for 2026?

As mentioned earlier, high-income individuals may benefit the most from a Cash Balance plan, as it offers greater yearly retirement savings compared to a 401(k). This table displays estimated contribution limits for 2026 to provide a general idea of how much one might save under each structure.

Selecting the Best Plan for You

We recommend consulting with a financial professional before determining whether a Cash Balance plan is right for your unique scenario. Feel free to explore our service page or schedule time directly with October Three Partner John Lowell if you’d like to learn more about Cash Balance or Hybrid plans.