December 2025 Pension Risk Transfer Pricing Update

As 2026 planning gets underway, plan sponsors considering de-risking strategies should engage an annuity search firm early to develop a clear plan for the year ahead.

Executive Summary

Overall premium volume and transaction activity in the pension risk transfer market during the first half of 2025 was lower compared to the unprecedented levels recorded in 2023 and 2024. This deceleration was driven in part by a reduction in jumbo transactions, which had previously higher premium totals and contributed to the record-breaking figures seen in earlier years. Despite this relative slowdown and despite the Federal Reserve’s ongoing rate-cute cycle, including its most recent reduction this month, the PRT market continued to perform strongly. Favorable plan funding levels, attractive interest rates, and sustained market enthusiasm supported continued robust activity. Conditions in 2025 have also strengthened the expectations that the market’s positive trajectory will carry into the new year.

Pension plan funding ratios posted strong gains overall this year, placing many defined benefit plans looking to de-risk in a strong position. This increased financial footing created favorable conditions for plan sponsors to initiate transferring their liabilities. According to the Pension Finance Update, corporate bond yields fell by a few basis points last month, reaching a new low for the year. However, despite this recent decline, the broader corporate bond environment and pension plan finances generally remained strong, contributing to a positive performance overall.

Pricing Update

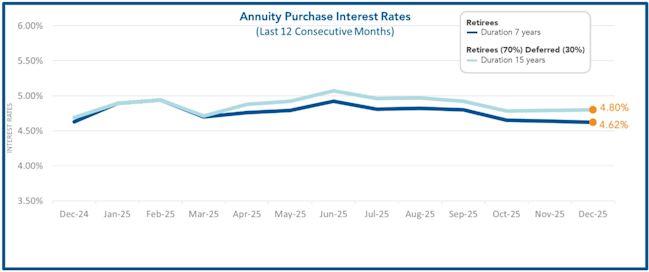

As you can see from the graph below, the last two quarters of 2025 have been notably stable, with minimal variation in both the average duration 7 and average duration 15 annuity purchase interest rates. Going into December, the average duration 7 rate experienced a modest decline of two basis points from last month, settling at approximately 4.62%. In contrast, the average duration 15 rate increased slightly, rising one basis point to reach 4.80%. With insurance carriers reaching capacity constraints for 2025, it is crucial for plan sponsors to engage with a pension risk transfer specialist early in the year to ensure a timely execution. This period presents a strategic window for plan sponsors to address their defined benefit plan liabilities. As 2025 comes to an end, momentum in the pension de-risking landscape remains strong, prompting insurers to already be actively preparing for anticipated transaction activity in 2026.

Historical Activity

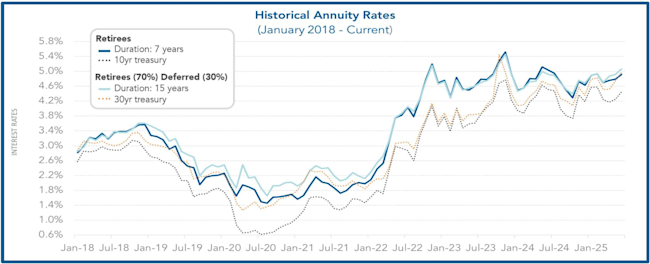

Annuity purchase interest rates and treasury yields continue to fluctuate over time, reflecting ongoing variations in market conditions. In 2025, the 10-year treasury rate averaged about 4.30% year to date and the 30-year treasury rate averaged around 4.77% year to date. Both averages were higher than the corresponding averages observed in 2024. At the start of this month, the 10-year treasury rate started at about 4.09% and the 30-year treasury rate at 4.74%. Both rates have shown continued increase since that initial observation.

Annuity Costs Relative to GAAP

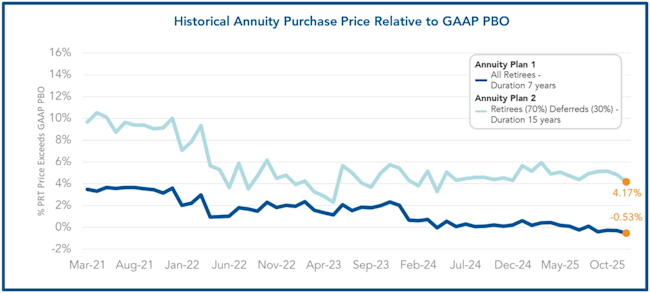

The graph below shows the spread between the annuity purchase price and the GAAP projected benefit obligation (PBO), also referred to as the accounting book value. This month, the spreads of Annuity Plan 1 and Annuity Plan 2 narrowed. For Annuity Plan 1, the spread was -0.53% while Annuity Plan 2’s spread narrowed to 4.17%. As annuity purchase rates increase, purchase prices drop relative to the PBO. Please note that the PBO figures shown do not include future overhead costs—such as administrative expenses and PBGC premiums—that plan sponsors would incur by retaining participants in the plan.

2025 PRT Market Highlights

2025 proved to be a pivotal year for the PRT market. While overall transaction volume declined from the prior year—driven largely by a slow first half—momentum returned in the second half as plan sponsors rushed to market to transact before year-end. By the fourth quarter, some insurance carriers expressed capacity constraints and were unable to participate in transactions for the remainder of the year. Improved plan funding levels earlier in the year reshaped plan sponsor behavior. Many plan sponsors that had previously deferred termination were finally positioned to execute, resulting in a larger share of annuity transactions tied to full plan terminations rather than carve-out strategies. Despite the economic uncertainty faced in 2025, annuity purchase interest rates remained stable. To lock in such favorable rates, the Pension Risk Transfer marketplace saw a meaningful increase in buy-in placements compared to recent years. Insurers saw more interest in smaller buy-in transactions, signaling a strategic shift toward the lower end of the market. If you’re interested in learning more about the Pension Risk Transfer marketplace in 2025, check out this Forbes article written by the CEO of October Three.

Wishing you a happy and safe holiday season from all of us at October Three.

For additional information or inquires about the pension risk transfer marketplace, contact Mark Unhoch: munhoch@octoberthree.com.

Submission box. If you want to see some topics covered, submit here

*October Three advises plan sponsors through every step of the Pension Risk Transfer (PRT) process. Through long established relationships with insurers in the PRT marketplace, October Three collects annuity purchase rates for Duration 7 years and Duration 15 years on a monthly basis. We have constructed 2 hypothetical annuity plans which have been valued using the latest mortality tables and mortality improvement scales. Annuity Plan 1 contains retirees only and has a liability duration of 7 years. Annuity Plan 2 contains 70% retirees and 30% deferreds and has a liability duration of 15 years. Monthly annuity rates are determined by taking the average Duration 7 and Duration 15 interest rates provided from the insurers. Annuity Plan 1 was valued using the average of the Duration 7-year interest rates collected from insurers and Annuity Plan 2 was valued using the average of the Duration 15-year interest rates collected from insurers. Using the collected annuity purchase rates and 2 hypothetical annuity plans, we have produced the following graphs representative of actual PRT market activity and the corresponding impact on pension plans.