February 2026 Pension Risk Transfer Pricing Update

Strong pension funding levels and favorable interest rate conditions present a promising start for plan sponsors considering de-risking strategies for 2026.

Executive Summary

The Pension Risk Transfer marketplace gained strength in the fourth quarter of 2025, and that momentum has poured over into 2026. With market conditions remaining both favorable and stable, plan sponsors should engage with an annuity search firm early to effectively monitor developments in the market and capitalize on de-risking opportunities.

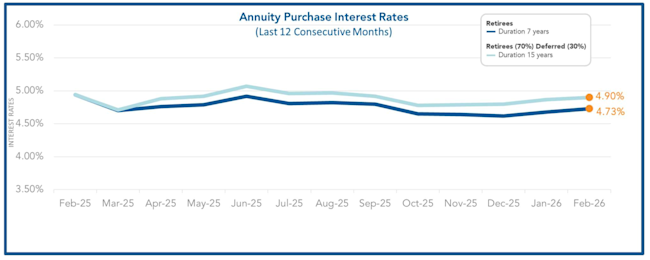

With another month of an upward trend in annuity purchase interest rates, annuity pricing remains attractive and aggressive. This month, annuity purchase rates increased for both key durations, with the duration 7 rate rising to 4.73% and the 15-year rate climbing to 4.90%. Combined with strong pension funding levels, plan sponsors looking to de-risk should continue to push for settling their plan liabilities. With the marketplace bustling with insurer participation, this presents more aggressive and competitive bidding making pension risk transfers more valuable.

Interest in de-risking strategies is expanding beyond single-employer plans, with public and multiemployer plans increasingly exploring PRT options. Improved funding levels and favorable market conditions have created new opportunities for these plans, many of which previously lacked the financial flexibility to pursue annuity transactions.

Pricing Update

Building on trends that emerged in the second half of 2025, annuity purchase rates have continued to demonstrate that same steady outlook in 2026. This month, annuity purchase rates rose for both key durations, with the duration 7 rate rising to 4.73% while the duration 15 rate climbed to 4.90%. Since October 2025, the duration 7 annuity purchase rate has increased approximately 8% overall, while the duration 15 annuity purchase rate has risen by roughly 11%. As noted in the Pension Finance Update, pension finances have improved significantly over the last seven years, and January added to that momentum. With funding levels improving and annuity purchase rates presenting attractive levels, plan sponsors are presented with a strategic window of opportunity. The first step is initiating a discussion. In this market, interest rates shift daily, and future movement remains unpredictable. The best steps for plan sponsors are to connect with annuity search firms to clarify objectives, evaluate the best options, and ensure data is well prepared. While these steps may seem simple, the process could take time, and with unexpected changes in the market, early timing is everything to ensure proper resources and accommodation are secure to tackle the process as effectively as possible.

Historical Activity

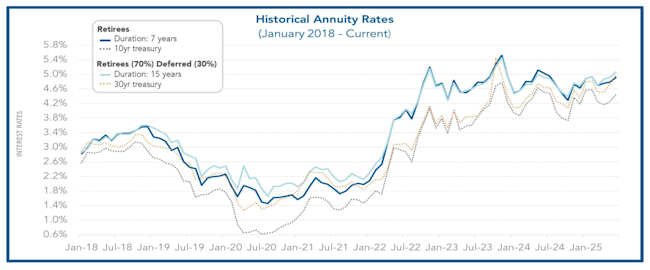

Year to date, the 10-year treasury rate has averaged approximately 4.22%, while the 30-year treasury rate has averaged around 4.85%. The 10-year treasury rates correlate with the duration 7 annuity purchase interest rate. Similarly, the 30-year treasury rates correlate with the duration 15 annuity purchase interest rate. In January, the Federal Reserve chose not to cut rates due to steady inflation. Based on historical data, annuity purchase rates and treasury yield fluctuate over time, with rates currently much higher than they were 5 years ago. With insurers’ capacity refreshed in the new year and market conditions holding stable, plan sponsors who want to de-risk should be motivated to transfer liabilities and leverage the fluctuations to “lock in” favorable rates.

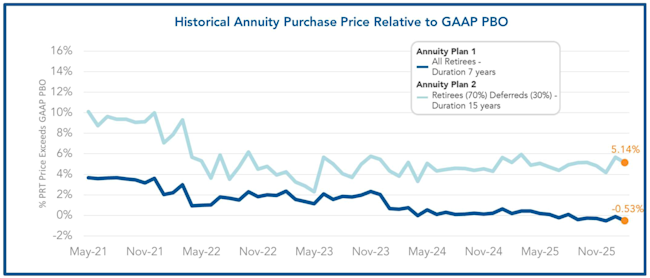

Annuity Costs Relative to GAAP

The graph below shows the spread between the annuity purchase price and the GAAP projected benefit obligation (PBO), also referred to as the accounting book value. This month, the spreads of Annuity Plan 1 and Annuity Plan 2 narrowed. For Annuity Plan 1, the spread is about -0.53%, while Annuity Plan 2’s spread is approximately 5.14%. As annuity purchase rates increase, purchase prices drop relative to the PBO. Please note that the PBO figures shown do not include future overhead costs—such as administrative expenses and PBGC premiums—that plan sponsors would incur by retaining participants in the plan.

Today’s Advantageous PRT Climate

Pension Risk Transfer activity has accelerated rapidly this year. Momentum built in the second half of last year and has carried strongly into 2026, with demand showing no signs of slowing. Plan sponsors are actively exploring PRT transactions at elevated levels as they look to take advantage of favorable conditions. Market supply remains strong and well-positioned to meet the elevated demand. Insurers continue to refine and adjust their underwriting guidelines to align with strategic objectives and optimize growth. At the start of the year, carriers typically have significant capacity as annual financial targets reset, creating a favorable environment for new transactions. As a result, insurers are pricing competitively and actively pursuing attractive opportunities in the market.

Importantly, this surge in interest is not limited to single-employer plans. Public and multiemployer plans are increasingly evaluating de-risking strategies as well. Historically, these plans have been less active in the PRT market, often relying on higher discount rates that made annuity transactions appear less attractive. In addition, funding levels for many of these plans were previously a limiting factor. Today, the landscape looks different. Improved funding levels—driven by favorable market conditions—have created a meaningful window of opportunity. Plans that once lacked the financial flexibility to consider de-risking are now in a position to act.

For multiemployer and public plans, this may be an opportune time to evaluate a pension risk transfer strategy. Sponsors considering a transaction this year should engage an annuity search firm as early as possible. Entering the market in a timely and well-prepared manner positions plan sponsors to achieve stronger outcomes and maximize transaction success.

For additional information or inquiries about the pension risk transfer marketplace, contact Mark Unhoch: munhoch@octoberthree.com.

Submission box. If you want to see some topics covered, submit here

*October Three advises plan sponsors through every step of the Pension Risk Transfer (PRT) process. Through long established relationships with insurers in the PRT marketplace, October Three collects annuity purchase rates for Duration 7 years and Duration 15 years on a monthly basis. We have constructed 2 hypothetical annuity plans which have been valued using the latest mortality tables and mortality improvement scales. Annuity Plan 1 contains retirees only and has a liability duration of 7 years. Annuity Plan 2 contains 70% retirees and 30% deferreds and has a liability duration of 15 years. Monthly annuity rates are determined by taking the average Duration 7 and Duration 15 interest rates provided from the insurers. Annuity Plan 1 was valued using the average of the Duration 7-year interest rates collected from insurers and Annuity Plan 2 was valued using the average of the Duration 15-year interest rates collected from insurers. Using the collected annuity purchase rates and 2 hypothetical annuity plans, we have produced the following graphs representative of actual PRT market activity and the corresponding impact on pension plans.