January 2026 Pension Risk Transfer Pricing Update

According to LIMRA, total third quarter PRT sales increased 137% from the second quarter of 2025.

Executive Summary

The Pension Risk Transfer (PRT) market in 2025 demonstrated remarkable resilience. While sales volumes stabilized below the record-breaking highs of 2024, the competitive landscape significantly matured. According to LIMRA, the entry of new carriers has expanded market capacity, broadening access for small and mid-sized plan sponsors and is expected to support PRT activity in future years. Similar to 2024, market conditions in 2025 proved unpredictable, reinforcing the importance of proactive planning and timely execution of de-risking strategies.

LIMRA further reported that third-quarter 2025 PRT sales declined 32% year over year; however, sales were 137% higher than second quarter 2025 levels indicating a meaningful rebound in activity. Total new PRT premium reached $10.6 billion in the third quarter. As the numbers get finalized for 2025, total PRT sales for 2025 is expected to be less than the record breaking results from 2024. Despite year-to-year declines the expanding insurer participation suggests that plan sponsors who act early may be better positioned to navigate market volatility and capitalize on overall de-risking opportunities.

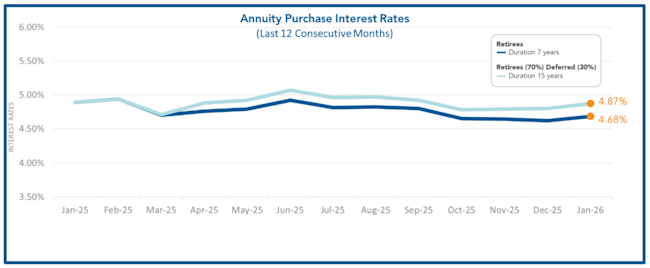

Although there was a slight slump in activity in 2025, there was a noticeable uptick in the second half of the year. This momentum is now carrying into the new year. Annuity purchase interest rates remain steady as we begin the new year, with the average duration-7 rate at 4.68% and the average duration-15 rate at 4.87%. While many plan sponsors are busy closing out 2025 activities, engaging an annuity search firm early can help them evaluate strategies that best align with their long-term de-risking objectives.

Pricing Update

Premium volumes in 2025 declined materially compared to the last two years; however, market momentum remains strong as we enter 2026. Annuity purchase interest rates have demonstrated notable stability, continuing trends observed throughout 2025. At the start of 2026, the average duration 7 was approximately 4.68%, while the duration 15 rate was approximately 4.87%. By comparison, in 2025, the overall average duration 7 annuity rate was 4.78% and the average duration 15 annuity purchase rate was 4.89%. These figures reflect only modest movement, underscoring a relatively stable pricing environment. Given this stability, plan sponsors should understand that the current stable market conditions present favorable times for initiating annuity purchase transactions. Engaging with an annuity brokerage firm early in the process can help sponsors capitalize on available pricing opportunities while advancing long-term pension de-risking objectives.

Historical Activity

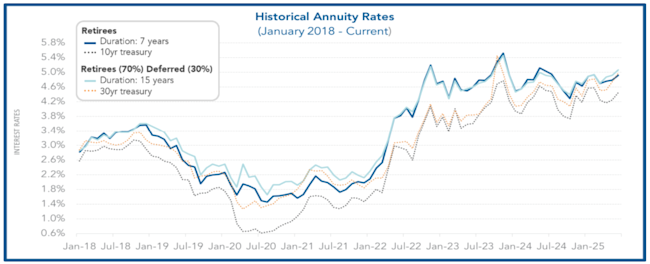

Annuity purchase interest rates and treasury yields continue to fluctuate over time, reflecting ongoing variations in market conditions. The 10-year treasury rates correlate with the duration 7 annuity purchase interest rate. Similarly, the 30-year treasury rates correlate with the duration 15 annuity purchase interest rate. To start 2026, the 10-year treasury rate started the month at 4.18% and the 30-year treasury rate started at 4.84%. Both rates have been relatively stable since that initial observation. Similar to annuity purchase interest rates, Treasury rates also remained relatively stable last year despite the uncertainty driven by the 2025 political landscape.

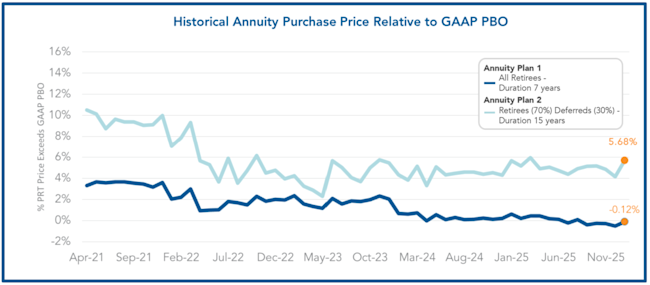

Annuity Costs Relative to GAAP

The graph below shows the spread between the annuity purchase price and the GAAP projected benefit obligation (PBO), also referred to as the accounting book value. This month, the spreads of Annuity Plan 1 and Annuity Plan 2 widened. For Annuity Plan 1, the spread is -0.12% while Annuity Plan 2’s spread widened to 5.68%. As annuity purchase rates increase, purchase prices drop relative to the PBO. Please note that the PBO figures shown do not include future overhead costs—such as administrative expenses and PBGC premiums—that plan sponsors would incur by retaining participants in the plan.

Kicking off 2026

As noted, the PRT market in 2025 was slower than in 2024, particularly during the first half of the year. Activity picked up in the second half, with several carriers declining opportunities after reaching their annual capacity. We’re now seeing that momentum from the third and fourth quarters carry into 2026.

While it’s no secret that many plan sponsors are currently tied up wrapping up 2025 priorities, those with de-risking goals should engage an annuity search firm early. In today’s market, timing matters. Early engagement provides the runway needed to develop a thoughtful strategy and build a well-prepared de-risking plan. There are several critical steps that take time before going to market—confirming the most appropriate approach, ensuring participant data is in good order (to avoid potential carrier loadings), and establishing a realistic transaction timeline.

Delaying engagement with an annuity consultant can lead to missed windows in the PRT market, reduced insurer appetite, and potentially higher costs. If de-risking is on your roadmap, now is the time to connect with an annuity search consultant to discuss strategy and develop a proactive path forward.

For additional information or inquires about the pension risk transfer marketplace, contact Mark Unhoch: munhoch@octoberthree.com.

Submission box. If you want to see some topics covered, submit here

*October Three advises plan sponsors through every step of the Pension Risk Transfer (PRT) process. Through long established relationships with insurers in the PRT marketplace, October Three collects annuity purchase rates for Duration 7 years and Duration 15 years on a monthly basis. We have constructed 2 hypothetical annuity plans which have been valued using the latest mortality tables and mortality improvement scales. Annuity Plan 1 contains retirees only and has a liability duration of 7 years. Annuity Plan 2 contains 70% retirees and 30% deferreds and has a liability duration of 15 years. Monthly annuity rates are determined by taking the average Duration 7 and Duration 15 interest rates provided from the insurers. Annuity Plan 1 was valued using the average of the Duration 7-year interest rates collected from insurers and Annuity Plan 2 was valued using the average of the Duration 15-year interest rates collected from insurers. Using the collected annuity purchase rates and 2 hypothetical annuity plans, we have produced the following graphs representative of actual PRT market activity and the corresponding impact on pension plans.