Pension Finance Update January 2026

Pensions started 2026 on a positive note, as equities notched more gains in January.

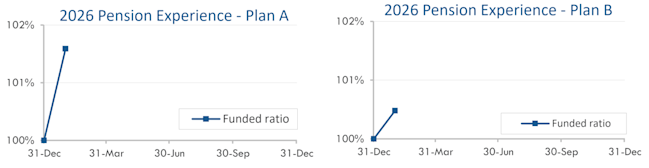

Pensions started 2026 on a positive note, as equities notched more gains in January. Both model plans we track[1] gained ground last month: traditional Plan A improved more than 1%, while the more conservative Plan B gained a fraction of 1% last month:

Assets

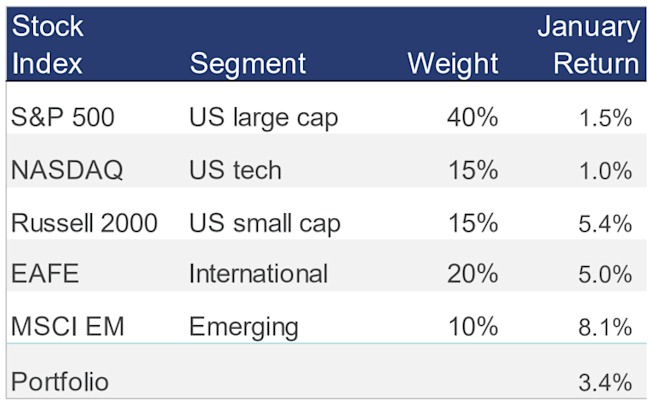

Stocks enjoyed gains in January, led by small cap and overseas markets; a diversified stock portfolio earned more than 3% last month:

Bond yields were mostly unchanged in January, up a bit at long durations. As a result, bonds gained a fraction of 1% last month.

Overall, our traditional 60/40 portfolio gained 2% last month, while the conservative 20/80 portfolio gained 1%.

Liabilities

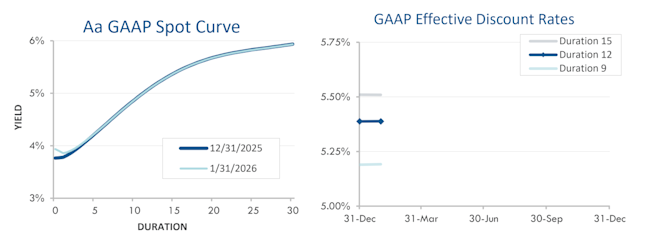

Pension liabilities (for funding, accounting, and de-risking purposes) are driven by market interest rates. The first graph below compares our Aa GAAP spot yield curve at December 31, 2025 and January 31, 2026. The second graph below shows our estimate of movements in effective GAAP discount rates for pension obligations of various duration during 2026:

Corporate bond yields were flat during January. As a result, pension liabilities rose by less than 1% last month.

Summary

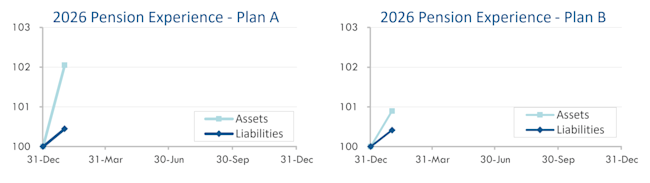

Pension finances have improved dramatically over the past seven years, and January represents another step along that path. The graphs below show the movement of assets and liabilities for our two model plans so far this year:

Looking Ahead

Sustained interest rates above 5% since 2022 have substantially diminished the impact of pension funding relief since 2023. Underfunded plans are likely seeing higher required contributions for the next few years, despite improved pension balance sheets.

Interest rates were essentially unchanged last month. We expect most pension sponsors will use effective discount rates in the 5.2%-5.6% range for financial disclosures right now.

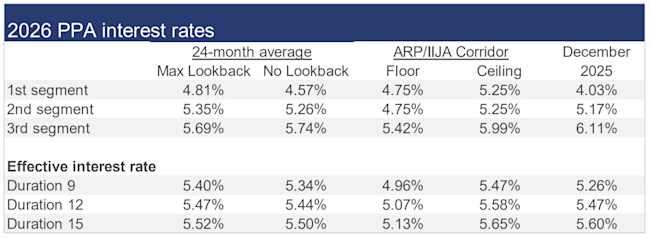

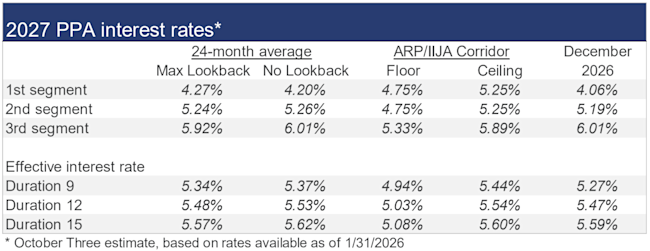

The table below summarizes rates that calendar-year plan sponsors are required to use for IRS funding purposes for 2026, along with estimates for 2027, including the rate “corridor” that applies to the 24-month average rates under funding relief for each segment.

[1]Plan A is a traditional plan (duration 12 at 5.5%) with a 60/40 asset allocation, while Plan B is a largely retired plan (duration 9 at 5.5%) with a 20/80 allocation with a greater emphasis on corporate and long-duration bonds. We assume overhead expenses of 1% of plan assets per year, and we assume the plans are 100% funded at the beginning of the year and ignore benefit accruals, contributions, and benefit payments in order to isolate the financial performance of plan assets versus liabilities.