Pension Trends 2025

Cash Balance Plans Take Over and Market Interest Credits Surge

If you're looking at the future of corporate pensions, one trend stands out: Cash Balance Plans have moved from niche to mainstream — and within that space, "market-based interest credits" are stealing the spotlight.

Download the complete PDF report to share with your team and reference anytime

1. Cash Balance Plans: From Underdog to Dominant Player

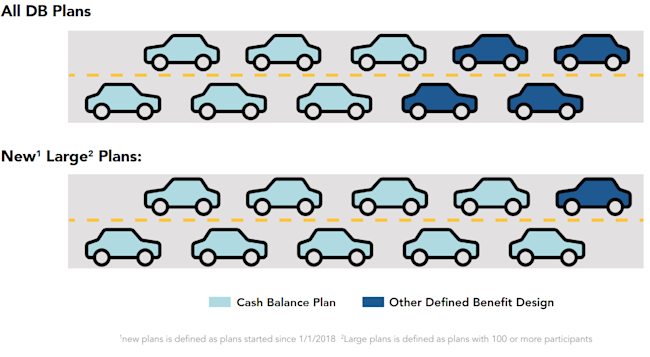

Out of roughly 45,000 defined benefit plans in the U.S., nearly 6 in 10 are now cash balance plans. That's like saying if every plan was a car on a highway, you'd see more cash balance "models" than all other cars on the road put together.

But here's where it gets even more telling:

New plans since 2018: more than 8 in 10 are cash balance

Large companies (100+ participants) with new plans: a staggering 9 in 10 choose cash balance — almost no one else is in the race

2. Not All Cash Balance Plans Are the Same

The "engine" of a cash balance plan is its interest crediting rate — how participant accounts grow each year.

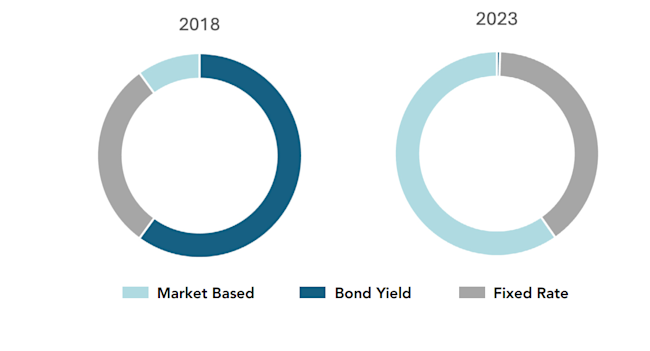

Back in 2018, the split looked like this among over 1,000 plans with 100+ participants:

Bond yield-based: 6 out of 10 (the old-school choice, tied to Treasury rates)

Fixed rate (around 5%): 3 out of 10

Market-based (tied to actual investment returns): just 1 out of 10

Think of it like coffee orders: in 2018, most people were still drinking canned coffee (bond yield), some liked a predictable "medium roast" (fixed rate), and only a few adventurous folks ordered the "specialty brew" (market-based).

3. The Big Flip: 2018 to Today

Fast forward to today's new plans:

Market-based: 6 in 10 (a sixfold jump)

Fixed rate: 4 in 10

Bond yield: statistically close to zero

This isn't just a slow drift — it's a wholesale migration. And it's sticky: 28% of bond-yield plans have frozen benefits, while only 2% of market-based plans have. That's like saying one in every four bond-yield plans is parked in the garage, compared to just one in fifty for market-based.

4. Why the Shift?

Three main accelerators:

1. Legislation

The Pension Protection Act (2006) made market-based designs possible, and Secure 2.0 (2022) cleared remaining roadblocks.

2. CFO Approval

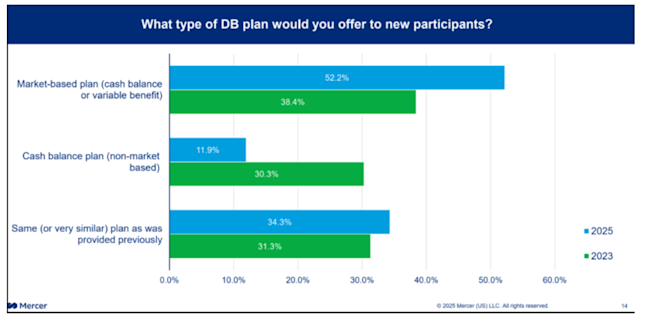

In a 2025 survey by Mercer, over half of large-company CFOs said they prefer market-based CB designs over any other DB plan. Support for non-market designs has dropped sharply.

3. Corporate Case Studies

Big airlines, like Delta, American and Southwest, have adopted market-based CB plans, seeing benefits for both sides:

Employers: little to no risk and more investment flexibility

Employees: a better retirement accumulation vehicle than fixed-rate counterparts

5. The Takeaway

Market-based cash balance plans are no longer the "specialty drink" — they're becoming the house pour.

For large employers designing new retirement plans today, the choice increasingly isn't whether to go cash balance — it's what kind of cash balance. And right now, market-based designs are taking off while other designs are being parked in the hangar.

Conclusion

If history is a guide, today's adoption curve is just the beginning. In five years, we may look back and see market-based cash balance plans not as a bold innovation, but as the new baseline — the pension model against which all others are measured. For employers, the real risk isn't in adopting them — it's in getting left behind.

Cash balance plans are reshaping retirement—find out exactly how they work, and if they're a good fit for your organization.

Take this analysis with you — Download the complete PDF report to share with your team and reference anytime