6 Key Advantages of a Market-Based Cash Balance Plan

Professional service firms have significantly increased their adoption of Market Based Cash Balance plans over the past twelve years. In addition to the conversion of existing Fixed-Rate plans, virtually every new Cash Balance Plan is incorporating the Market Based design right from the start.

For over a decade, professional service firms have significantly increased their adoption of Market-Based Cash Balance plans. Whether converting from an existing Fixed-Rate plan, or adopting a Market-Based design from the start, nearly every new Cash Balance plan is incorporating the Market-Based design. This is largely because of the advantages Market-Based Cash Balance plans offer. In this article, we explore some of the advantages Market-Based Cash Balance plans provide, to help you determine whether this plan design is best for you and your organization.

1. Contribution Stability

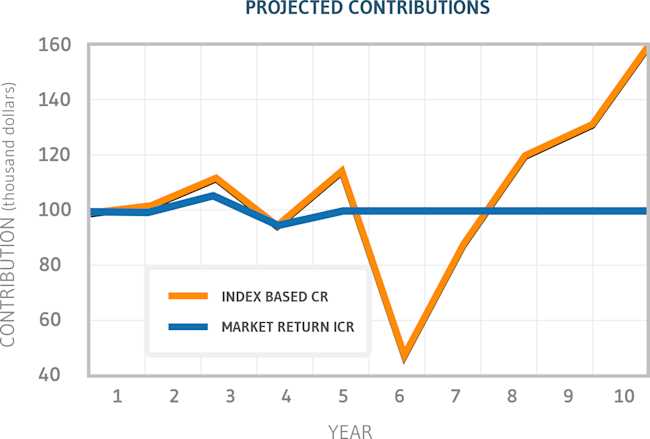

Because actual performance on underlying plan assets (positive or negative) is credited to participant accounts, Market-Based plans rarely need to “true up” or adjust contributions at year’s end to reflect the mismatch of asset return and an internal crediting rate. In contrast, Fixed-Rate design often requires an annual adjustment as returns fail to match the plan’s stipulated rate.

2. Reduced Exposure to Unfunded Benefits

With Market-Based plans, participant accounts (plan benefits) move directly in concert with plan assets. Therefore, it tends to remain 100% funded at all times. Fixed-Rate designs are only aligned at year’s end, so the plan can be underfunded throughout the year and can require substantial unexpected contribution during years when investment performance is sub-par, especially for those with large account balances.

3. Increased Stability as Plan Matures

Unlike every other type of Defined Benefit Plan (Traditional or Cash Balance), Market-Based plans enjoy greater stability in both contributions and funded status as plans mature. Conversely, Fixed-Rate plans become increasingly volatile over time.

4. Assets May Be Allocated to Match Risk Tolerance

Without the perceived need to target a pre-determined rate of return, Market-Based plan sponsors are free to develop an asset allocation that fits their desired risk tolerance and make appropriate adjustments over time.

5. Ability for Participants to Capture “Upside” Potential

With the investment focus taken away from achieving the low interest rate “Bogie,” long-term investment performance is typically better with a Market-Based design, which means a faster-accruing participant benefit.

6. Similarity to the 401(k) Plan Experience

Participants like being able to monitor their 401(k) account balances throughout the year. Cash Balance plans offer the same advantage, especially when valued daily through tools like October Three's Daily Platform.

Start Designing Your Plan Today

Whether you need to reward key executives, reduce tax exposure, or boost retention with long-term wealth-building benefits, October Three can help. Request your free Cash Balance illustration today.