Actuarial Services for Pension Plans:

Expertise from Leading Actuarial Consulting Firm

Accelerate Growth by Maximizing Value

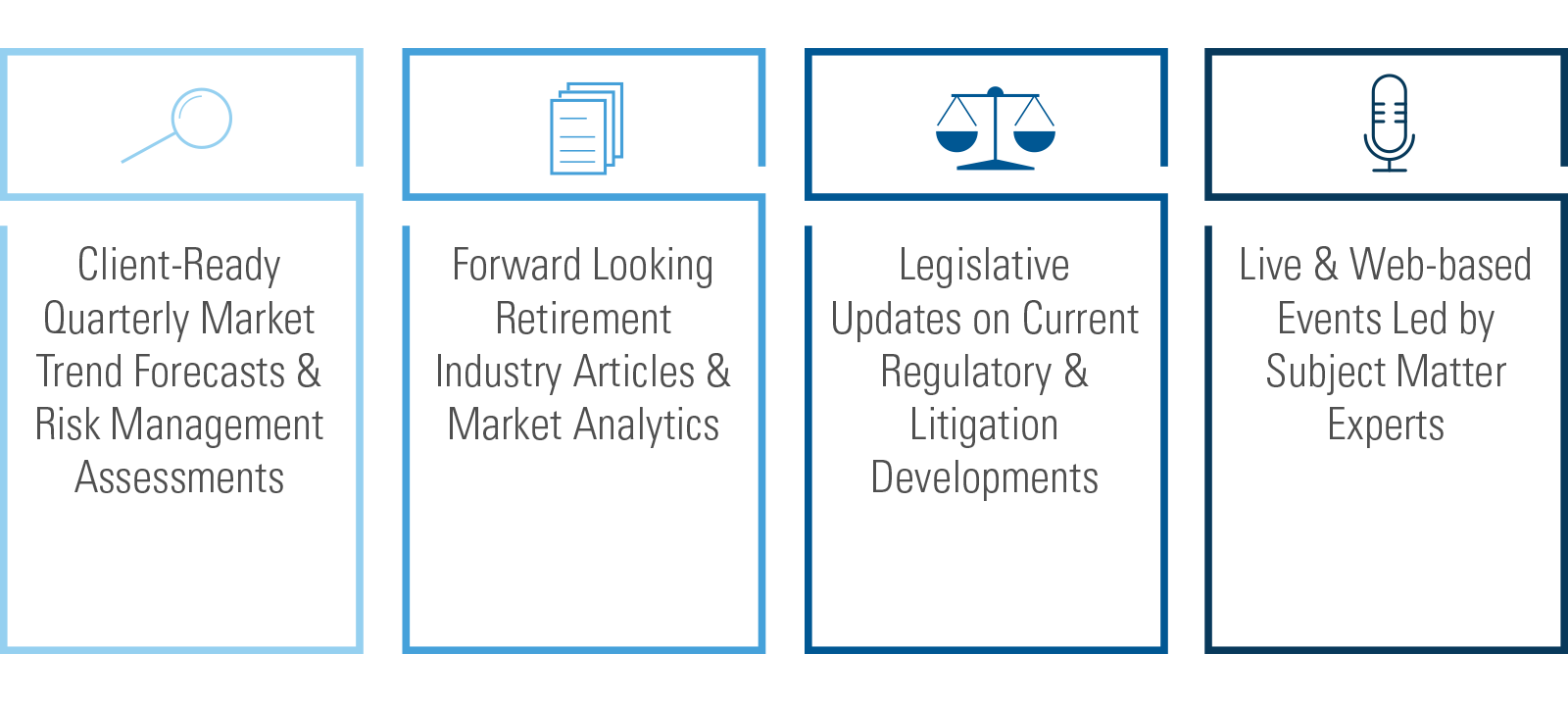

Make sure you keep your clients informed and advance your practice with a curated network of experts and data-driven analytics. Our trusted experts deliver the superior thought leadership you need to help your clients make smarter decisions and stay ahead of current events affecting their retirement plans.

Simplify

Easily stay ahead of the curve with new ideas on emerging market trends, risk management solutions and plan design options

Transparency

Enhance your business and increase client engagement with immediate access to trusted industry thought leadership

Expertise

Leverage our team of retirement industry experts and their over 40 years of financial advisory publications expertise

Unbiased

Deliver an unbiased summary of key plan considerations including current legislative, regulatory and litigation developments

Build Trust

Strengthen your client relationships and keep your network in the know as their go-to advisor on all things retirement

Cost-Effective

Offer meaningful content to your clients while gaining valuable resources for your practice

Competitive Advantage

Preferred access to select reader-friendly content prepared by industry-leading experts.

Our Advisor Support Perspective

Stay up to date with the latest in defined benefit plans with our expert insights. From market updates, to retirement plan management tips, to regulatory news, we’ve got you covered.

Cash Balance Pension Plans: A Complete Guide

When it comes to planning for retirement, one size certainly doesn’t fit all. Employees and businesses need retirement solutions that adapt to their unique circumstances, goals and financial situations — and more organizations are discovering that a cash balance pension plan can be a critical element to help meet their diverse needs.

Secure 2.0 in 2025: What advisors need to know

Concerned by alarming statistics showing that many Americans are underprepared for retirement, the federal government passed the SECURE 2.0 Act in 2022 to enhance retirement savings opportunities.

How an Advisor Won a $100M Plan through a 5500 Deep Dive with Retirement Learning Center

In this case study, we break down how the Retirement Learning Center by October Three helped an advisor seal the deal on a multi-million-dollar plan using data-driven insights.

Contact Mark Dzierzak

Mark is here to answer your questions on how our Plan Advisory Services can support your needs.