De-risking in 2024 – DB lump sums

In this article we provide an analysis of a specific de-risking issue for 2024: how higher 2023 interest rates may affect sponsor decisions to de-risk (or not de-risk) defined benefit plan liabilities via a lump sum window in 2024.

This will be the first of three articles on defined benefit plan finance – our next article will cover Pension Benefit Guaranty Corporation premiums and the standard vs. alternative election, and our final article will discuss funding challenges in the context of rising interest rates.

A Brief History of Interest Rates (1984-2020)

Between 1984 and 2020, long-term interest rates declined from all-time highs (above 13%) to all-time lows (below 3%), creating a persistent headwind for anyone involved in managing Defined Benefits (DB) pensions for more than 35 years.

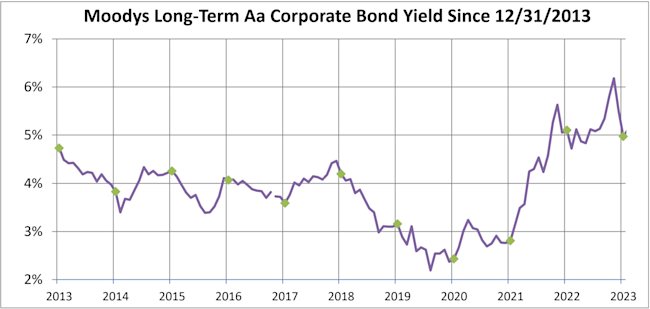

Since 2020, however, interest rates have moved higher, briefly exceeding 6% in late 2023 before ending the year at around 5%, the highest rates seen in more than a decade. The chart below shows the behavior of long-term rates between the end of 2013 and the end of 2023:

Lump Sum Interest Rate Changes

One impact of higher interest rates is to de-risk pension liabilities by offering certain participants an additional option to take their benefit in a one-time payment or lump sum. Higher interest rates could make this more cost-effective for the plan.

This plays out differently for different DB plan sponsors. Plans that include an ongoing lump sum provision (or other accelerated form of payment) must specify a “lookback month” (used to determine the lump sum valuation interest rate) and a “stability period” (to determine the period over which that rate will apply) in their plan documents.

At one extreme, a “1-month lookback” and “1-month stability period” means lump sum rates change monthly, based on the most recent rates available. For plans using this method, lump sum values declined during 2023 as rates rose (similar to annuity purchases, which are always marked to market). And lump sums in 2024 will increase/decline as 2024 interest rates (month by month) decline/increase.

At the other extreme, a (calendar year) plan using a “5-month lookback” and “1-year stability period” used August 2022 rates to calculate lump sums for all of 2023 and will use August 2023 rates to calculate lump sums for all of 2024. These plans will see a sharp drop in lump sum values between December 2023 and January 2024.

For purposes of 2024 lump sum windows, sponsors should understand what constraints, if any, apply to the choice of “lookback month and stability period” in connection with the window.

Higher Pension Lump Sum Interest Rates Are Providing Cost-Effective Solutions

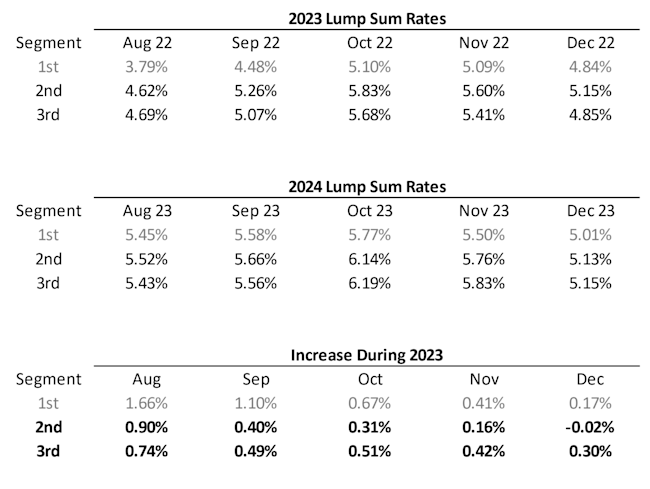

The table below summarizes the five sets of PPA segment rates (in effect, monthly spot rates) available for calendar year plans (August, September, October, November, and December) for 2023 and 2024 with a “1-year stability period,” and the “delta” (increase in rates for 2023 vs. 2022 lookback months) for each lookback month. (Note, “1st segment” rates are generally not significant for most lump sum calculations.)

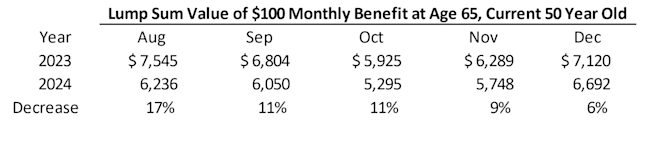

The table below translates these rates into lump sum values for a 50 year old participant with a life annuity benefit of $100 per month payable beginning at age 65:

For calendar year plans with a 1-year stability period, 2024 pension lump sums for this participant are 6%-17% lower than 2023 lump sums. This is on top of an even larger drop in lump sum values between 2022 and 2023.

For plans contemplating a 2024 lump sum window that have latitude with respect to lookback month and stability period, it’s worth noting that interest rate volatility during late 2023 means different lookback months produce very different 2024 lump sum values (the October lookback month produces a lump sum 20% lower than the December lookback month).

Final Thoughts

Higher interest rates mean lower pension liabilities. The foregoing sketches out how higher rates will be expressed for plan sponsors that pay lump sums and considerations for sponsors contemplating a lump sum window in 2024.

In the next article, we will discuss PBGC premiums – a critical cost of doing business for DB plans – how the standard vs. alternative method for determining a plan’s underfunding (technically, its unfunded vested benefits or “UVBs”) will affect the calculation of premiums in 2024, and options sponsors may have with respect to that calculation.

October Three’s comprehensive approach to pension risk transfer ensures positive outcomes for organizations of all sizes. Let us offer a customized solution tailored to your needs so your plans beneficiaries are taken care of for years to come.