How DC participants are doing, in four charts

The transformation of retirement finance from a defined benefit (benefit-based) to defined contribution (account-based) project has transferred the retirement savings project (and its attendant risks/opportunities) from employers to participants. In this article, we take a look at how DC participants are doing, reviewing the effect of the last five years of financial market performance on DC plans/participants and the DC retirement savings project.

The transformation of retirement finance from a defined benefit (benefit-based) to defined contribution (account-based) project has transferred the retirement savings project (and its attendant risks/opportunities) from employers to participants. In this article, we take a look at how DC participants are doing, reviewing the effect of the last five years of financial market performance on DC plans/participants and the DC retirement savings project.

DC retirement income finance – turning savings into retirement income

Financing retirement income is, in most respects, relatively intuitive for DB plan sponsors, who have been living with an accounting regime that requires them to book asset and interest rate performance to the balance sheet currently.

In a DC plan, the performance of a participant’s “pile of assets” is also very intuitive – it operates like a brokerage account. But the significance of changes in interest rates is more obscure … until the participant starts thinking about retiring and about how much income he will need to cover expenses. Because interest rates (in effect) describe the “price” of income – how much it will cost to turn a pile of assets into income, to pay for expenses in retirement. That obscurity is in part why it has been so difficult to get participants interested in a “retirement income solution” for DC plans.

Key financial variables for a participant nearing retirement

To track “how DC participants are doing,” we’re going to focus on a participant who is 55 years old at the beginning of 2021, looking to retire at age 65. As of January 1, 2021, he had enough money – $186,826 – to buy a deferred-to-65 annuity of $1,000 per month. How has he done over the last five years, that is, since January 1, 2021?

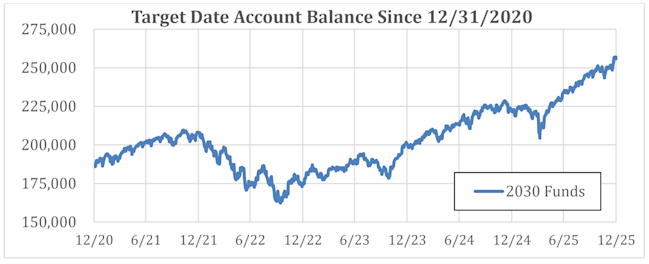

Asset performance – modest returns on the TDF’s 2030 fund over the last five years

Let’s start with the asset side. Over the last five years, this participant’s account, invested in his plan’s 2030 TDF, has grown to $255,921. His asset pile is up 37% over five years, or 6.5% per year. (Note, for this purpose we averaged returns on the three top public target date funds.)

The impact of inflation

But much of that return is simply a “money illusion,” as the buying power of his assets was significantly eroded by five years of inflation – CPI increased around 20% between December 2020 and December 2025).

Adjusting for inflation, the value of the account balance at December 31, 2025 (in 2020 dollars) is $205,709. That’s only a 10% increase in (generic) purchasing power. If the participant wanted to withdraw his money to buy widgets (or to buy food and pay the rent), he could only buy 10% more widgets/food/rent at the end of 2025 than he could at the end of 2020 – that’s (more or less) just a 2% annual “real” return on his savings.

So, on the asset side, our participant has (in “real dollars”) gotten a modest real return on his savings.

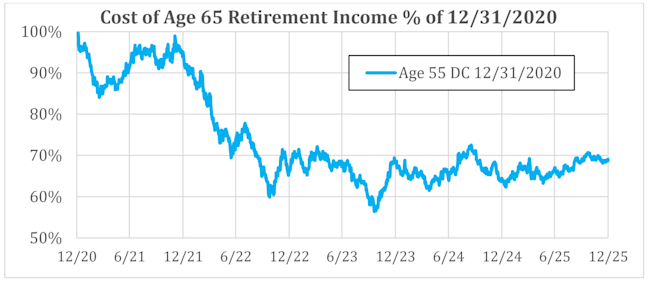

But wait – the cost of (retirement) income has gone down – a lot

But this money isn’t for buying widgets, it’s for buying retirement income. And interest rates are up more than 300 basis points (from 2% to above 5%) since the end of 2020 (much of the reason for the poor asset performance), reducing the cost of age 65 retirement income by more than 30%, despite the fact that the participant is now five years closer to retirement.

This is an extraordinary gain for our participant.

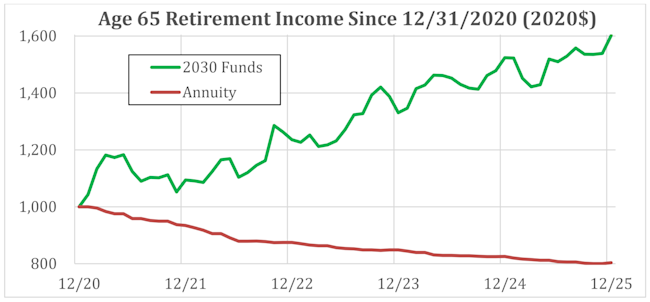

A 60% increase in the participant’s real retirement income

When you put it all together, the 2030 fund has increased the real lifetime income at age 65 the participant can buy with his pot of money by around 60% over the past five years.

Comparing outcomes – annuitization vs. the TDF – five years of performance

So let’s take a look at the last five years of performance, comparing what would have happened if this participant had either (1) annuitized her account balance at the end of 2020 or (2) invested her account balance in the TDF.

If it’s not clear from what we’ve said so far:

The orange line (annuitization in 2020) in the chart above shows the declining value over time of a 2020 $1,000 per month age 65 annuity as its purchasing power is eroded by post-2020 inflation.

The green line (post-2020 annuitization) shows the (higher) amount of annuity (in “2020 dollars”) that could be purchased with the balance of the participant’s account at the end of any month after 2020, based on TDF earnings up to, and interest rates as of, that (later) date.

The graph underscores the vulnerability of annuities to inflation. For instance, as of December 31, 2022, the 2020 annuity was only worth $875 per month in “2020 dollars” – thus, the participant could buy, with her 2020 annuity, $125 less in goods and services than if we hadn’t seen 6-7% annual inflation in those two years. But if the participant had left her money in the TDF until December 31, 2022, and then purchased an annuity, that annuity would pay $1,236 per month in “2020 dollars.”

Annuitization vs. the TDF, a stark contrast

This result is a little shocking: if the participant delayed purchasing an annuity until the end of 2022, she could buy $361 more in goods and services than she could if she had annuitized at the end of 2020.

And things get worse from there. By the end of 2025, five years of inflation would have eroded the buying power of the 2020 annuity by around 20%. If instead, the participant had left her assets in the TDF and then bought an annuity at the end of 2025, she would have age 65 retirement income worth literally twice as much.

What about younger participants?

The numbers for younger participants show the same trends we describe for our 55 year old, although the magnitude of effects is generally greater because of the longer time horizon and the increase in the portion of the TDF portfolio allocated to equities. Thus, “real” (“2020 dollars”) asset returns for a participant who was 35 year old at the end of 2020 are better (because of the 2050 TDF’s increased allocation to equities) – 27% over five years. And “real” retirement income buying power increases much more (with 30 years to retirement) – but that is a very speculative number. Actual retirement income for this participant will depend on interest rates in 2050.

What is going on here?

In thinking about the DC participant’s project of financing retirement income, we need to consider several factors:

Losses/poor performance of equities and bonds (as in 2022) often correlate with increases in interest rates. This is largely because, as the discount factor (interest rates) goes up, asset values go down.

For those looking to convert an asset pile into income, however, high interest rates are good news. And to be clear, it’s not just bonds we’re talking about – higher interest rates mean higher expected returns to capital generally (i.e., including higher returns on equities).

Obviously, the sweet spot (for an investor whose ultimate goal is to produce income) is any case in which the “income gains” from higher interest rates are greater than the “asset losses.”

Capital markets participants are heterogeneous. Entrepreneurs and investors whose goal is “capital gain” – to build/invest in a growing business – prefer low interest rates and a big pile of money. But retirement savers prefer high (real) interest rates and high returns to capital, producing higher income. The investment strategy/goals of the latter (retirement savers) is fundamentally different from the former (growth investors). What’s good for one may be bad for the other, and vice versa.

The joker in all of this is inflation. In an inflation-free world, the risks that a retirement saver approaching retirement faces could all be solved with a fixed income portfolio. DB sponsors live in that world – their retirement income promise is strictly in nominal dollars. DC participants don’t. The only solutions they have available to deal “explicitly” with inflation risk are very expensive – Treasury Inflation-Protected Securities (TIPS) or an inflation-adjusted annuity (if you can find one). It would seem (in considering the experience of the last five years) that equities may provide some resilience vs. non-inflation protected bonds (which have a mathematically defined vulnerability to inflation).

Takeaways

From all this, we can’t draw any simple spread-sheet driven conclusion. Diversification still remains critical, even as a participant approaches retirement. The bundle of risks the participant faces, however, change. As the participant approaches retirement:

Volatility matters more. A 20% decline in portfolio value is much harder to recover from if, instead of contributions going in, money is going out of the portfolio (as retirement income).

Inflation is an acute risk with respect to bonds and annuities – less so with respect to equities.

Prior to annuitization (or prior to putting the entire portfolio into bonds), the real issue is: the performance of the asset portfolio vs. changes in the cost of income. To only look at the size of the participant’s pile is a mistake.

The “rotation toward fixed income” inherent in current target date fund investment practice as a participant approaches retirement to some extent stabilizes the nominal retirement income produced by the portfolio, although this effect is dependent on the duration target date fund’s bond portfolio.

The older (55+) participant’s portfolio should reflect these concerns.