2020 lessons learned – lump sum de-risking in the context of steeply declining interest rates

Defined benefit plan valuation interest rates have declined nearly 200 basis points since late 2018. Interest rate stabilization has significantly mitigated the effect of this decline on plan funding. GAAP accounting (e.g., balance sheet disclosure) is, however, indexed to current rates, and the steep declines in interest rates have presented a number of challenges and opportunities for defined benefit plan sponsors.

Defined benefit plan valuation interest rates have declined nearly 200 basis points since late 2018. Interest rate stabilization has significantly mitigated the effect of this decline on plan funding. GAAP accounting (e.g., balance sheet disclosure) is, however, indexed to current rates, and the steep declines in interest rates have presented a number of challenges and opportunities for defined benefit plan sponsors.

In this article we present some “lessons learned” with regard to 2020 lump sum de-risking (paying out a participant’s benefit as a lump sum and thereby eliminating the related liability). In a follow-on article we will discuss 2020 annuity settlements.

Framework

Let’s begin by being clear about timing. Lump sums paid out in 2020 will affect year-end 2020 financials, 2021 ERISA minimum funding, and 2021 Pension Benefit Guaranty Corporation premiums.

In a context of stable interest rates, the de-risking decision has, for some time, been driven by increases in PBGC premiums. Cost savings from reducing headcount has generally come from (1) lower PBGC headcount premiums (we estimate the 2021 headcount premium will be $85/per participant), (2) lower variable-rate premiums (VRPs) for plans at the VRP headcount cap (we estimate the 2021 headcount cap will be $579 per participant), and (3) reduced ongoing administrative costs.

Significant declines in interest rates over the past two years have highlighted another cost savings – for many plans, in the context of rapidly declining interest rates, the cost of lump sums is (significantly) lower than the book (and “real”) value of the related plan liability. The savings de-risking generates in this context will, for many plans, significantly outweigh PBGC-premium related savings. A “backward looking” PBGC VRP valuation rate cuts the other way, producing, e.g., VRP increases for plans not at the VRP headcount cap.

A “backward looking” lump sum valuation interest rate and its implications

Lump sum de-risking involves paying out the present value of a participant’s benefit. The interest rates used to calculate that present value are the Pension Protection Act (PPA) “spot” first, second and third segment rates for a designated month. Many sponsors set the lump sum rate at the beginning of the calendar year, based on the spot rates in a prior year “lookback” month, so that participants will know what rate will be used to calculate their lump sum for the entire year.

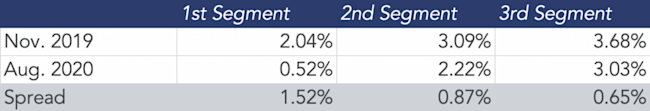

A plurality of plans use a November lookback month. Under such an approach, for 2020 the lump sum rates were the November 2019 PPA spot rates. Below is a comparison of November 2019 and current (August 2020) IRS segment rates (which are a reasonable approximation of current market DB valuation interest rates).

Table 1: 2020 lump sum rates vs. market

Given this approach, one consequence of the steep 2019-2020 decline in interest rates is (and has been) that the cost of paying lump sums is (significantly) below the current value of the liability, under GAAP but also “in real life.” One way of thinking about this is that the cost of a lump sum is significantly below the cost of an annuity, not just because (as has been axiomatic) annuity carriers charge a margin over book, but also (and much more significantly) because annuities are priced currently and lump sums are (for many plans) priced using a November 2019 interest rate.

Another “backward looking” valuation interest rate that may affect some sponsors is the rate used for the calculation of PBGC VRPs.

A “backward looking” PBGC variable-rate premium valuation interest rate and its implications

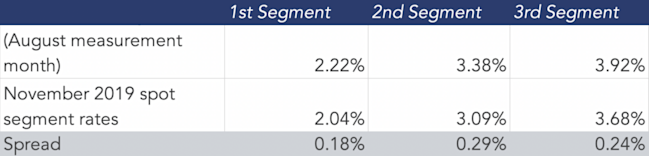

Plans that are able to use the alternative method for calculating unfunded vested benefits (UVBs) for purposes of determining PBGC VRPs value liabilities based on a “backward looking” 24-month average of market interest rates ending (for 2021) August 2020. (Remember: lump sums paid out in 2020 affect the 2021 VRP calculation.)

Table 2: 2020 alternative method VRP rates vs. 2020 lump sum rates

As we discussed in the article linked above, in a period of steeply declining interest rates, the alternative method for calculating UVBs allows plans to show lower UVBs and pay a lower PBGC variable-rate premium. For de-risking, however, it means that the value of UVBs taken off the books will be less than the cost of the lump sum. This effect shows up (generally) as an increase in VRPs with respect to headcount reductions for plans that are not at the PBGC VRP headcount cap.

Two example plans

We’d like to illustrate the effect of these factors – backward looking lump sum and PBGC UVB valuation interest rates vs. steeply declining market rates – on two different plans.

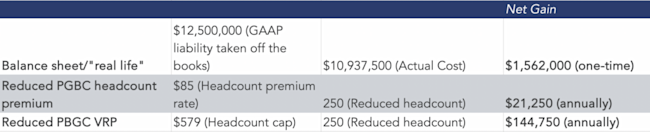

Plan 1 – At the VRP headcount cap for 2021

$100 million in liabilities (at current GAAP/market interest rates)/$70 million in assets.

2,000 participants, including 250 terminated vesteds (TVs).

GAAP liability with respect to each participant = $50,000.

Pays lump sums to 250 TVs.

The following table presents the gains from this reduction in participant headcount.

Table 3: Gains from plan headcount reduction for a plan at the VRP headcount cap

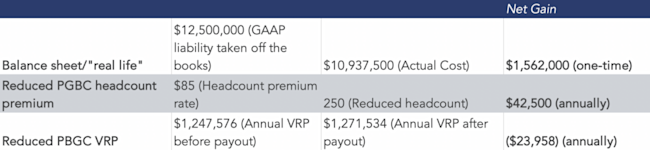

Plan 2 – Not at the VRP headcount cap for 2021

$100 million in liabilities (at current GAAP/market interest rates)/$70 million in assets.

4,000 participants, including 500 terminated vesteds (TVs).

GAAP liability with respect to each participant = $25,000.

Pays lump sums to 500 TVs.

The following table presents the gains from this reduction in participant headcount.

Table 4: Gains (losses) from plan headcount reduction for a plan not at the VRP headcount cap

The loss on VRPs resulting from the headcount reduction is the result of the mismatch between the cost of the lump (based on November 2019 interest rates) and the (even lower) value of the associated UVBs (based on 24-month average interest rates for the period ending August 2020). This effect only applies to plans that (1) are on the alternative method and (2) are not at the VRP headcount cap.

Effect on ERISA minimum funding

Paying out lump sums will generally reduce a plan’s funded status for purposes of ERISA minimum funding requirements, because the participant’s benefit is being paid out “in full” whereas it had only been funded “in part.” The math here is complicated because of the effect of HATFA interest rate stabilization, but in our example, both plans went from 83% funded to 76% funded.

Sponsors will want to consider the effect of lump sum payments on minimum funding requirements – particularly payments that may take the plan below 80% funding (on a HATFA basis), triggering benefit restrictions (including restrictions on lump sums).

Takeaways

For many (perhaps most) DB sponsors, the accounting (and real life) gain from paying lump sums at November 2019 rates will dominate decision making. In both our example plans, the gain – a $1,562,500 one-time gain – is orders of magnitude greater than the gains from reduced PBGC premiums.

We’d like to emphasize, moreover, that this advantage is not “just” an accounting gain. It reflects real life. That is, as we said, the difference between the cost of the lump sum and the cost of settling the liability currently with an annuity is roughly equal to the GAAP balance sheet gain.

That result is strictly an artifact of using a backwards looking valuation rate in the context of steeply declining interest rates. If interest rates steeply increased, this sort of lump sum strategy would produce a loss.

Plans using the alternative (24-month average) method for valuing UVBs and not at the VRP headcount cap will see increased PBGC VRPs from 2020 de-risking, because UVBs for this purpose are valued using even-more “backward looking” interest rates than those used for lump sums.

Whether sponsors will be in the same situation in 2021 will depend on what happens to interest rates over the next 12+ months.

* * *

As noted at the top, we will be providing a follow-on article analyzing the effect of steeply declining interest rates on plan annuity settlements.