Interest rates 2020 — signal or noise?

Interest rates 2020 -- signal or noise?

In November 2019 we published an article reviewing interest rates broadly. At that time, interest rates were down 75-100 basis points for the year and nearly 120 basis points from their high in November 2018.

In that context, we identified the key question for DB plan sponsors, for whom plan-related interest rate risk is a significant factor, to be whether the decline in rates experienced since November 2018 represents a “new normal.”

Since our last article, medium- and long-term corporate bond rates have continued to decline – by another 30 basis points. In this article we briefly update our previous analysis and consider the significance of current interest rate trends.

Rates since 1982

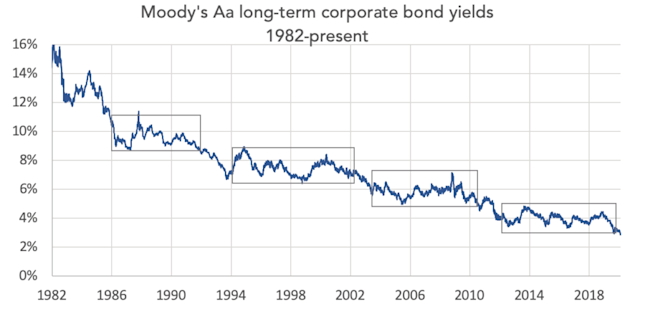

Chart 1 maps yields on long-term corporate bonds since 1982:

Chart 1

The pattern appears to be periods (lasting as long as eight years – e.g., from 1994-2002) of relative stability, followed by an adjustment down, followed by another period of stability. We have “boxed-out” the periods of stability in the chart.

The trend has (for the most part) been in only one direction: down.

2012 – present

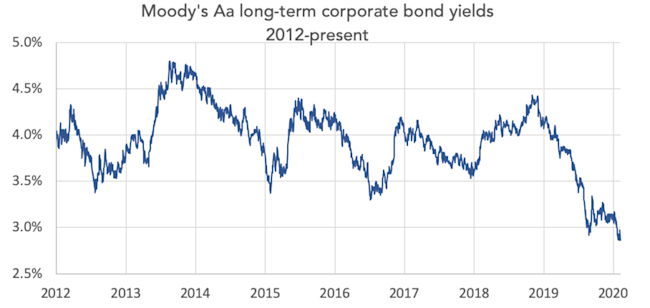

Chart 2 maps the same yields over the most recent period of stability – from 2012 to date:

Chart 2

During this period, yields have moved between highs of around 4.5% and lows of around 3.5%.

Since mid-July 2019, these yields have been (significantly) below 3.5% (2.92% as of February 13, 2020).

Is this a signal?

Let’s return to the question we posed at the top – whether the decline in rates since November 2018 represents a “new normal” – another downward step on the downward stair graphed in Chart 1 – or just a lower version of the current bottom?

With the 2019 rate declines continuing into 2020, notwithstanding a relatively robust economy and neutral-to-ambiguous Fed policy, we would say (provisionally) the current decline looks like a signal, not noise. In other words, we may be in a new, lower interest rate “box.”

Interest rates and de-risking

In our next article on interest rates we will consider the effect of (among other things) changes in interest rates on de-risking in 2020. Because of the interest rate declines in 2019, de-risking in 2020 will certainly be more expensive than it was in 2019. But the trend matters as much as the year-to-year comparison – 2018 rates vs. 2019 rates.

If current rates simply represent the (particularly low) bottom of a 3.5%-4.5% range, then 2020 de-risking is going to look (relatively) expensive. If (on the other hand) they represent a “new normal,” then the cost of 2020 de-risking may be “average.”

* * *

We will continue to follow this issue.