Congressman Neal reintroduces retirment savings legislation

Congressman Richard Neal (D-MA) has introduced legislation — the “Retirement Plan Simplification and Enhancement Act of 2013” (H.R. 2117) — which would make a number of changes to the Tax Code and ERISA. The bill is similar to last year’s H.R. 4050, the “Retirement Plan Simplification and Enhancement Act of 2012,” which we wrote about at the time, although there are a number of changes.

The bill is to a large extent a laundry list of improvements to the current system, addressing such issues as 401(k) participation, retirement income, annuities and simplification of administration. Thus, while it’s unclear whether in the current Congressional climate this bill will move, when there is a legislative opportunity to consider retirement savings issues, one or more of the bill’s proposals may well be taken up.

In this article we review the key provisions of the bill affecting corporate DB and DC plans.

Changes to the 401(k) automatic enrollment/automatic increase safe harbor rules and a new safe harbor

H.R. 2117 would eliminate some caps on the safe harbor for 401(k) nondiscrimination (ADP) testing that was added by the Pension Protection Act (PPA) and add a new safe harbor. To put these changes in context, we’re going to review briefly how the PPA safe harbor (currently) works.

Background — PPA safe harbor

The PPA safe harbor applies to certain plans that provide for automatic enrollment and an automatic increase in contributions.

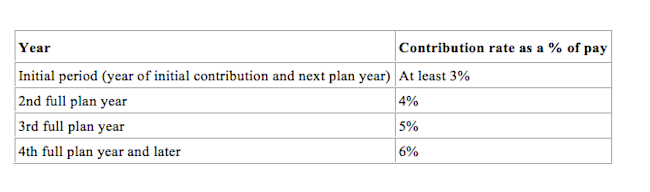

To qualify for the safe harbor (and thereby avoid having to run the ADP test), each eligible employee must be enrolled in the plan at a minimum contribution rate of 3% of pay (subject to the employee’s right to elect out). That contribution rate continues for the year of the initial contribution and for the subsequent year (the “initial period”). Thereafter, it must be increased at least 1 percentage point per year until a 6% rate is reached, after which no further increases are required. If the plan does provide for further automatic increases, the top rate cannot exceed 10%.

The following table summarizes these rules.

Employees have the right to increase, decrease or elect out of any “automatic” contribution.

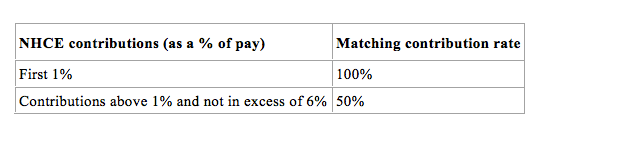

In addition, the sponsor must either make a non-matching contribution for all covered non-highly compensated employees (NHCEs) of at least 3% of pay or make matching contributions as summarized in the following table.

Changes proposed by H.R. 2117 — elimination of caps

H.R. 2117 would, for purposes of the PPA safe harbor described above, eliminate the 10% cap on automatic contributions and change the escalation rate – “3%,” “4%,” etc. – to “at least 3% (but not greater than 10%),” “at least 4%,” etc.

Both these changes have widespread support. The current rules (with the ‘caps’) have been criticized by some who believe allowing the use of a higher ‘escalation’ percentage would lead to higher savings for some employees.

New safe harbor

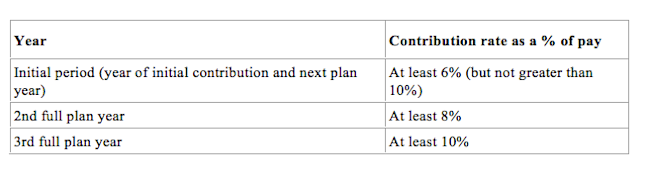

H.R. 2117 also would add a new automatic contribution/automatic increase safe harbor that would use higher default contribution rates, as summarized in the following table.

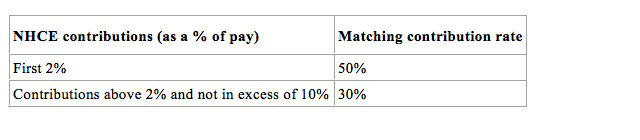

To qualify for the new safe harbor, the sponsor would have to make matching contributions for NHCEs as summarized in the following table.

A match higher than the 50% or 30% rate may be used, so long as the match rate does not increase as an employee’s rate of contributions increases.

The bill includes a tax credit for small employers establishing this sort of safe harbor. And the Secretary of the Treasury is instructed to prescribe rules that “clarify, simplify, and provide safe harbors” with respect to the application of notice requirements and the timing of required percentage increases.

This new safe harbor was not in last year’s bill. These changes, particularly the addition of a new, more flexible safe harbor using higher rates, will be of interest to sponsors who want to aggressively ‘nudge’ participant contributions higher.

Clarification of application of ERISA 4062(e) rules

Generally, ERISA section 4062(e) applies if “an employer ceases operations at a facility in any location and, as a result of such cessation of operations, more than 20% of the total number of his employees who are participants under a plan established and maintained by him are separated from employment ….”

Oversimplifying somewhat, a 4062(e) event triggers a reporting obligation and allows the PBGC to assess DB plan liability on a “termination basis” and to require funding, escrow or a bond with respect to a portion of that liability. PBGC may also negotiate other concessions in connection with a 4062(e) event. The liability calculations under 4062(e) can get, for lack of a better word, bizarre and produce some very unusual results.

As we discussed in our recent article, PBGC proposes new test for waiver in re-proposed reportable events regulation, PBGC has adopted an expansive definition of “cessation of operations” and required sponsors, e.g., to waive credit balances as part of a settlement.

H.R. 2117 would limit the application of section 4062(e) to situations in which all operations at a facility in a location are ceased and —

The cessation is reasonably expected to be permanent,

No portion of such operations is moved to another facility at a different location,

No portion of such operations is assumed or otherwise transferred to another employer, and

No other operations are reasonably expected to be maintained at the facility.

This proposal considerably narrows the application of section 4062(e) and would go a long way towards limiting PBGC’s ability to apply this rule in what many view as an inappropriate manner. In addition, and somewhat unusually, the PBGC would be directed to, in effect, ‘back off’ on enforcement actions commenced before enactment:

The Pension Benefit Guaranty Corporation shall not take any enforcement, administrative, or other actions pursuant to section 4062(e) of such Act that are inconsistent with [the narrower scope of section 4062(e) described above], without regard to whether such actions relate to a cessation or other event that occurs before or after the date of enactment of this Act.

This language would seem to allow a sponsor to terminate a bond or escrow agreement that it had previously agreed to with PBGC as part of a section 4062(e) enforcement action.

Nondiscrimination rules not to apply to certain closed classes

Where an employer closes a DB plan to new participants (sometimes called a “soft freeze”), Tax Code nondiscrimination issues may over time arise with respect to the grandfathered benefits of the closed class, even where that class of participants is nondiscriminatory at the time of the freeze. This happens when lower paid members of the closed class subsequently leave, are terminated or become higher paid. In addition, over time, the number of participants in the ‘old plan’ may shrink below the minimum participant requirements of Tax Code section 401(a)(26) (the ‘50 participant rule’). Finally, where, e.g., in connection with a “hard freeze” of all DB plan benefits, the sponsor establishes or enhances a DC plan, the sponsor may provide for ‘make whole’ benefits for a closed class of some or all of the participants in the ‘old’ DB plan, and nondiscrimination issues may over time arise with respect to that class.

H.R. 2117 generally ‘fixes’ these issues. Oversimplifying a lot, under H.R. 2117, there would not be a nondiscrimination problem with respect to these sorts of programs where the closed class is nondiscriminatory at the beginning, e.g., at the time of the freeze or the provision of ‘make whole’ DC benefits. 401(a)(26) minimum participant compliance would generally be tested at the time of the freeze.

Allow long-term part-time employees to participate in 401(k) plans

The bill would generally require sponsors of 401(k) plans to cover employees working more than 500 but less than 1,000 hours per year for three consecutive years. Tax Code nondiscrimination and top heavy rules would, however, generally not apply to these employees, and the rule would generally not cover collectively bargained employees.

Expansion of the Saver’s Credit

The Saver’s Credit provides for a non-refundable tax credit equal to up to 50% of the first $2,000 of contributions by certain low-income individuals to a 401(k) plan, IRA or certain other retirement programs. Currently (in 2013), the full 50% credit is payable for joint filers with adjusted gross income (AGI) of $35,000 or less, $17,750 for singles. The credit is ‘phased down’ (reduced to 20% and then 10%) for taxpayers with higher AGIs, with no credit payable for joint filers with AGIs over $59,000, $29,500 for singles. The credit is not refundable – so if the low-income individual does not have a tax liability, the credit cannot be taken.

H.R. 2117 would: (1) make the credit refundable; (2) significantly increase the Saver’s Credit AGI limits; (3) reduce the amount of the credit (although with an increase over time); and (4) double the credit where the credit is contributed to a “designated retirement account.” Here are details on items 2-4.

The full credit would be payable to joint filers with AGIs up to $65,000, $32,500 for singles, with a $20,000 ‘phase down’ above those numbers.

The contribution limit ($2,000 under current law) would be decreased to $500 and then would be increased yearly, in $100 increments, from 2014 through 2023, to $1,500 (and inflation-adjusted thereafter).

A new ‘matching contribution’ provision would be added. The credit would be doubled (e.g., from 50% to 100%) if it is paid into a “designated retirement account.” For purposes of, e.g., a 401(k) plan, the credit would generally be treated as an employer contribution.

The Saver’s Credit can be thought of as a government-paid match. Generally the changes included in H.R. 2117 represent an expansion (at least of the availability) of the credit and may be helpful to some 401(k) plan sponsors. It’s unclear, however, how, in the context of, for instance, a 401(k) plan, the matching contribution rule would work. Getting the tax credit from the Treasury to the participant’s account in the 401(k) plan looks like something of an administrative and recordkeeping challenge.

GAO to study applying QJSA rules to DC plans

Defined contribution plans that pay benefits as a lump sum and provide that any death benefit is paid to the participant’s spouse generally do not have to comply with ERISA/Tax Code QJSA rules. Those rules generally require that benefits be paid as a life annuity; where the participant is married, they must be paid as a joint and survivor annuity, with the participant’s spouse as the beneficiary.

H.R. 2117 would require the Government Accountability Office to study the application of the QJSA rules to DC plans and what modifications of current rules would be necessary to do so. This proposal — to apply QJSA rules to DC plans — has been around for some time and has garnered some support but never enough to pass legislation.

Other annuity-related provisions

The bill includes a number of other annuity-related provisions including:

Rules for the “third-party administration” (e.g., by an insurance company) of annuity distributions.

Simplification of the treatment of annuity age and service rules.

Facilitation of the rollover of annuities.

The distribution of certain lifetime income options in DC plans.

Exception from required distributions where aggregate retirement savings do not exceed $100,000

Under the bill, if the aggregate balance to the credit of an employee under all retirement plans does not exceed $100,000 (inflation-adjusted), then the Tax Code minimum distribution rules would not apply. There is also a phase in of the minimum distribution rules where the participant’s aggregate balance exceeds $100,000 by less than $10,000. The present value (to be added to the “aggregate balance”) of defined benefit plan benefits would be determined on a Tax Code 417(e) basis.

Other provisions

Other provisions of the bill affecting corporate retirement plans include:

Directing to IRS and the Social Security Advisory Board to prepare a “retirement handbook” and “retirement readiness checklist.”

Allowing a new plan to be adopted by the tax return due date (with extensions).

A number of provisions targeting small businesses, including an increase in the plan startup credit and direction to Treasury and DOL to fix certain ‘barriers’ to the use of multiple employer plans.

Directing PBGC to establish a “lost pension registry.”

Expanding the Employee Plans Compliance Resolution System, including self-correction of loan errors, self-correction (without excise tax) of certain inadvertent required minimum distribution errors and establishment of specific correction methods for errors in implementing automatic enrollment and automatic escalation features.

Allowing the use of forfeitures to fund employer contributions under 401(k) safe harbors.

Directing DOL, Treasury and PBGC to study ERISA and Tax Code reporting and disclosure requirements and “make such recommendations as may be appropriate to the appropriate committees of the Congress to consolidate, simplify, standardize, and improve the applicable reporting and disclosure requirements so as to simplify reporting for plans … and ensure that needed understandable information is provided to participants ….”

Allowing plan administrators to consolidate certain DC plan notices.

Allowing the provision of certain ‘elect out’ notices (e.g., with respect to automatic enrollment and qualified default investments) to be made on an annual rather than plan year basis.

Directing DOL to produce regulations allowing benchmarking of funds (e.g., for required participant disclosure) that include multiple asset classes (e.g., balanced funds and target date funds) based on a benchmark that is a blend of different broad-based securities market indices.

Allowing a non-spouse beneficiary to make a direct rollover to a qualified plan.

Changing the qualified domestic relations order (QDRO) rules to provide for (1) the segregation of 50% of a participant’s benefits for (at least) 90 days after receipt of a notice of the pendency of a domestic relations proceeding, (2) a $100 a day penalty for failure to provide required information to alternative payees, and (3) the allocation of QDRO administrative costs to all participants.

Creating at IRS a “Participant and Plan Sponsor Advocate.”

* * *

Generally, these proposals will be welcomed by sponsors. The one big item that was in the 2012 bill and not in H.R. 2117 is electronic disclosure, which appears to have become more controversial over the past year.

As of this date, there is no obvious ‘path to final passage’ for this bill. But the proposals are not particularly partisan, and if an appropriate legislative vehicle can be found, one or more of them may move.

We will update you if and when this bill moves forward through the legislative process.