Tax reform and 401(k) fairness

A key element of the debate over comprehensive tax reform and retirement savings tax incentives will be the fairness of the current 401(k) system. In this article we review current fairness arguments and the data that opponents and proponents put forward in support of their views.

Upside-down incentives

The following is from a 2005 paper by William G. Gale, J. Mark Iwry, and Peter R. Orszag:

[P]ension tax preferences are worth the least to lower-income families, and thus provide minimal incentives to the households that, on average, most need to save for their basic needs in retirement. The tax preferences instead give the strongest incentives to higher-income households, which least need to save more to achieve an adequate retirement living standard. These higher-income households are also disproportionately likely to respond to pension tax incentives by shifting assets from taxable to tax-preferred accounts, with the net result that pensions serve as a tax shelter, rather than as a vehicle to increase saving.

The Gale-Iwry-Orszag paper describes the current system as providing an “upside-down set of incentives,” a phrase now commonly used by critics.

While the view that the current system is unfair may not be a majority view, it is held by some prominent policymakers. J. Mark Iwry is currently Senior Advisor to the Secretary of the Treasury and the Deputy Assistant Secretary (Tax Policy) for Retirement and Health Policy at the U.S. Treasury Department. Mr. Iwry is regarded by many as the most influential pension policy expert in the Administration. Peter R. Orzag was, until his resignation in July, 2010, head of the Office of Management and Budget. And William G. Gale is the Arjay and Frances Miller Chair in Federal Economic Policy in the Economic Studies Program at the Brookings Institution and was the key witness presenting this view at Senate Finance Committee’s hearing “Tax Reform Options: Promoting Retirement Security” held last September.

The argument presented by those holding this view is relatively intuitive. The value of current tax deduction/exclusion for 401(k) contributions and for trust earnings depends on the marginal tax rate paid by the taxpayer benefiting from the deduction/exclusion. Higher paid participants pay higher marginal tax rates, so they wind up with the majority of the tax benefits.

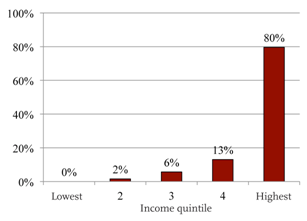

The following chart illustrates the point:

Distribution Of Tax Benefits From Qualified Pension Plans Among Households, By Income Quintile, 2012

Source: Eric J. Toder, Benjamin H. Harris, and Katherine Lim. 2011. “Distributional Effects of Tax Expenditures in the United States.” In Lisa Phillips, Neil Brooks, and Jinyan Li, eds. Tax Expenditures: State of the Art. Toronto, Ontario: Canadian Tax Foundation.

Shifting from deductions/exclusions to tax credits

Critics who point to the “unfair distribution of tax benefits” under the current system generally advocate going to a system under which individuals would receive a tax credit for contributions to a “qualified” retirement plan. One such proposal was put forward by Mr. Gale at the September, 2011 Senate Finance Committee hearing. Under his proposal the current system of deductions would be converted to a flat-rate refundable tax credit — in effect, a matching contribution — of 18 percent of a taxpayer’s retirement savings contributions. Everything else — contributions and earnings — would be taxed at regular rates.

There are other proposals like Mr. Gale’s. Professor Teresa Ghilarducci has a widely publicized tax-credit proposal; and the Administration has proposed an expansion of the Saver’s Credit that could have a similar effect. All of these tax credit proposals shift tax preferences away from high margin taxpayers specifically to, in effect, “everyone saving for retirement.” One way to think of these proposals is as “leveling” the distribution of tax benefits relative to household income.

The difference between a deduction/exclusion and a tax credit

A tax deduction/exclusion generally reduces the income on which you pay taxes. So the value of a tax deduction/exclusion is dependent on your marginal tax rate. Under the current 401(k) system, if your marginal tax rate is 35%, and you contribute $100 to a 401(k) plan, that contribution reduces your income by $100, and your taxes are reduced by $35. If your marginal tax rate is 15%, your taxes are reduced by only $15.

A tax credit reduces your taxes by a specific amount. For instance, Mr. Gale proposes an 18% tax credit for retirement savings contributions. Under his proposal, if you contribute $100 to a plan, that contribution generates an $18 tax credit; your taxes are reduced by $18, regardless of your marginal tax rate. And, generally, retirement savings tax credit proposals provide for a refundable tax credit. So that, if you pay no taxes at all (and so cannot reduce your taxes by $18), then you would get a refund of $18 from the federal government.

The impact of the nondiscrimination rules

Those who disagree with these critics point out that the current system’s nondiscrimination rules are designed to make sure that benefits under qualified plans go to everyone. In 401(k) plans the most obvious nondiscrimination rule is the actual deferral percentage (ADP) test. As a result of these rules, in order to “capture” tax benefits for high paid participants, the employer must make contributions (e.g., matching or nonelective contributions) for low paid participants.

A recent paper by Eric Toder and Karen Smith of the Urban Institute, Do Low-Income Workers Benefit from 401(k) Plans? (September, 2011), puts numbers to the value of this effect of the nondiscrimination rules. Toder and Smith found that: “low-income workers receive a benefit that is separate from the tax deferral: their total compensation rises due to 401(k) contributions from their employers.”

According to their calculations (based on US Census data):

[A]mong male workers, an additional dollar of employer 401(k) contributions replaces 90 cents of wages for those with high incomes, but only 29 cents for those with low incomes …. Among female workers, an additional dollar of employer 401(k) contributions replaces 99 cents of wages for those with high incomes, but only 11 cents for those with low incomes. These results support the notion that the fringe benefit/wage tradeoff can vary for workers at different income levels. For high-income workers, additional 401(k) contributions are almost fully offset by lower wages. For low-income workers, additional contributions reduce wages only modestly — by just 11 cents to 29 cents per dollar –suggesting that employer contributions increase total compensation for lower-income workers.

In other words, for high paid employees a dollar of contributions (more or less) substitutes for a dollar of wages. For low paid employees it does not. Low paid employees, instead, get a net pay increase (when pay is determined including the dollar of contributions that they get).

The relevance of age

Another “push back” against the argument that the current system is unfair is that income and savings are highly correlated with age. Thus, as (currently) low income participants get older, the benefits they will get out of the current system will increase.

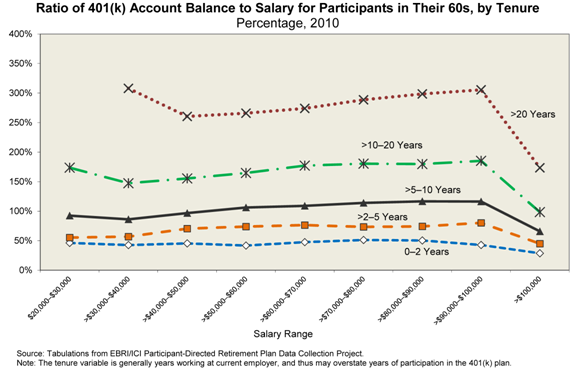

The following chart (from the Employee Benefit Research Institute (EBRI)) indicates that the size of 401(k) benefits (account balances) generally are correlated with age and tenure of a participant, not income level.

Preferences

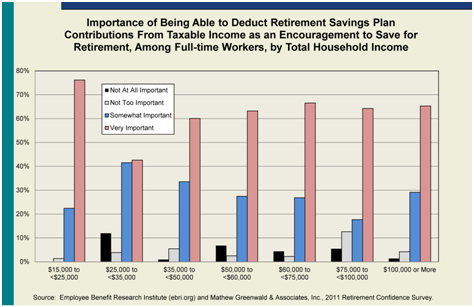

Finally, there is some data that indicates that the current system of deductions/exclusions is preferred by employees regardless of income group. The following chart was produced by EBRI:

EBRI’s conclusion: “Proposals to modify the exclusion of employee contributions for retirement savings plans from taxable income may have unintended consequences …. Instead of reducing the contribution levels of those who might be thought to be most impacted (i.e., those with larger taxable incomes and hence higher marginal tax rates), the [EBRI Retirement Confidence Survey] results suggest that the categories of full-time workers most likely to reduce (in some cases completely) their contributions are those … [w]ith the lowest household income.”

Significance of the plan sponsor

Under the current system, the “fairness equation” is (more or less): high paid/high margin taxpayers get most of the tax benefits, but the nondiscrimination system insures that plan benefits are spread across a “broad cross-section of employees.” If we go to a system of refundable tax credits (where all retirement savers get the same tax benefit, regardless of marginal tax rate or, indeed, regardless of whether they pay any federal income tax), you no longer need the employer to ensure fairness.

Employer sponsorship of retirement savings plans would still provide some key advantages. Large employers can bring scale and efficiency to the retirement savings “process” (most importantly, payroll deduction and recordkeeping). They can get “institutional” pricing for investment services. And they can implement “nudge” strategies — automatic enrollment, automatic increases in contributions, and default investments.

But two obvious questions present themselves: Should employers be given “special” retirement savings tax incentives? (Currently, deductions/exclusions for employer-sponsored plans are much higher than they are under, e.g., an IRA.) And, do most employers want to provide plans that “only” provide a broad-based tax credit that could, possibly, simply be provided through IRA-like vehicles?

* * *

It is likely that in any discussion of comprehensive tax reform, the issue of tax incentives for retirement savings and the fairness of the current system will come up, and the foregoing arguments and data will be discussed. At the same time, sponsors will want to consider these issues and their own view of them, both in the abstract and relative to other key tax reform issues.