April 2020 Pension Finance Update

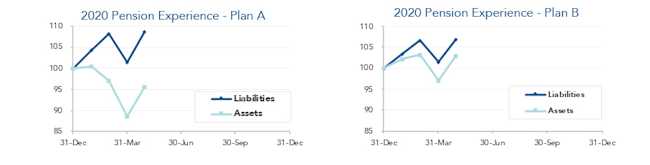

Pensions gained marginally in April, as recovering stock markets offset the impact of falling corporate bond yields. Both model plans we track[1] managed gains of less than 1% for the month but remain substantially down for the year, with Plan A off 12% and Plan B almost 4% through the first four months of 2020:

Assets

Stocks, which lost more than 20% in the first quarter, gained about half of that back last month, but a diversified stock portfolio remains down 12% through April.

Stock Index | Segment | Weight | Monthly Return | 2020 Return |

S&P 500 | US large cap | 40% | 12.9% | (9.2%) |

NASDAQ | US tech | 15% | 15.5% | (0.6%) |

Russell 2000 | US small cap | 15% | 13.8% | (21.0%) |

EAFE | International | 20% | 6.0% | (18.0%) |

MSCI EM | Emerging | 10% | 8.0% | (18.2%) |

Portfolio | 11.5% | (12.4%) |

Treasury rates fell 0.05% in April, but corporate bond yields tumbled 0.5%, reversing much of the blow out in credit spreads seen in March. All flavors of bonds closed the month at or near all-time low yields, posting returns of 2%-5% for the month and 6%-10% for the year, with long duration and Treasuries performing best.

Overall, our traditional 60/40 portfolio gained 8% in April but remains down 4% for the year, while the conservative 20/80 gained 6% last month and is now up 3% through the first four months of 2020.

Liabilities

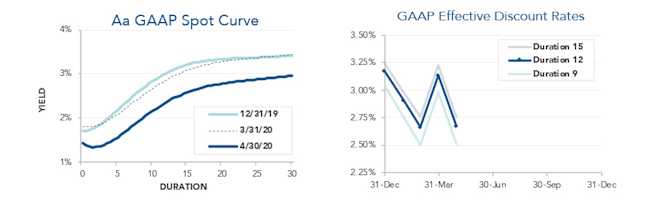

Pension liabilities (for funding, accounting, and de-risking purposes) are driven by market interest rates. The first graph below compares our Aa GAAP spot yield curve at December 31, 2019 and April 30, 2020, and it also shows the movement in the curve last month. The second graph below shows our estimate of movements in effective GAAP discount rates for pension obligations of various duration during 2020:

Corporate bond yields fell close to 0.5% in April, again reaching record low levels. As a result, pension liabilities fell 5%-8% during the month. Liabilities are now 7%-10% higher than at the end of 2019, with long duration plans seeing the largest increases.

Summary

Over the past two months, stock markets and credit spreads have whipsawed, producing enormous volatility for pension finance. Through April, most plans have incurred a substantial loss so far this year, and as yet there is no clear end in sight to the pandemic and its fallout. The graphs below show the movement of assets and liabilities during the first four months of 2020:

Looking Ahead

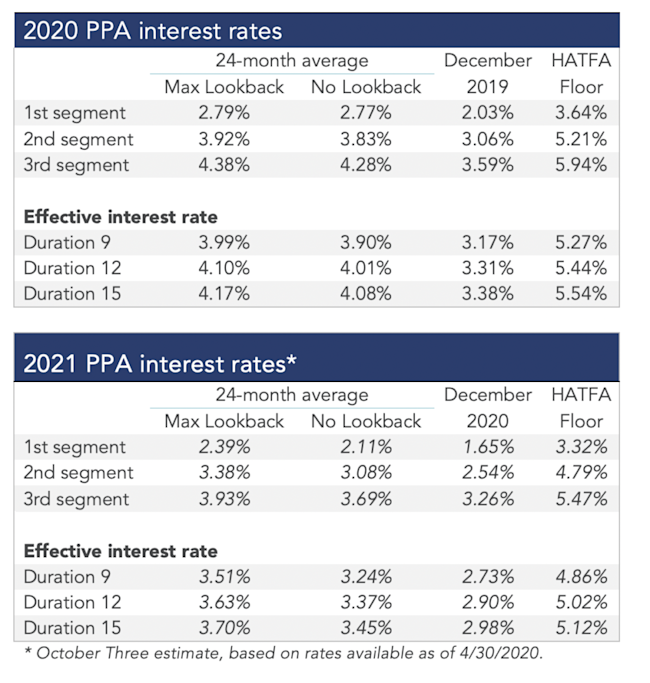

Pension funding relief has reduced required plan funding since 2012, but under current law, this relief will gradually sunset. Given the current level of market interest rates, it is possible that relief reduces the funding burden through 2030, but the rates used to measure liabilities will move significantly lower over the next few years, increasing funding requirements for pension sponsors that have only made required contributions.

2020 experience, if it persists, will not increase required contributions until 2022, compounding higher funding requirements due to the fading of funding relief. There is a reasonable chance we get more relief this year, but at this point it’s too soon to say for certain.

Discount rates moved lower last month. We expect most pension sponsors will use effective discount rates in the 2.4%-2.9% range to measure pension liabilities right now.

The table below summarizes rates that plan sponsors are required to use for IRS funding purposes for 2020, along with estimates for 2021. Pre-relief, both 24-month averages and December ‘spot’ rates, which are still required for some calculations, such as PBGC premiums, are also included.

[1] Plan A is a traditional plan (duration 12 at 5.5%) with a 60/40 asset allocation, while Plan B is a largely retired plan (duration 9 at 5.5%) with a 20/80 allocation with a greater emphasis on corporate and long-duration bonds. We assume overhead expenses of 1% of plan assets per year, and we assume the plans are 100% funded at the beginning of the year and ignore benefit accruals, contributions, and benefit payments in order to isolate the financial performance of plan assets versus liabilities.