2015 Pension de-risking

In this article we discuss how changes in interest rates, Pension Benefit Guaranty Corporation premiums, the new Society of Actuaries mortality tables and regulatory developments may affect plan sponsor decisions to de-risk (or not de-risk) defined benefit plan liabilities in 2015. For purposes of this article, by de-risking we mean paying out a participant’s benefit as a lump sum and thereby eliminating the related liability.

The article updates analysis we previously presented in 2013 and 2014. This is a technical article, but for some sponsors there are millions of hard dollars at stake.

Example

We are going to illustrate the effect on the de-risking decision of these developments with an example: the de-risking gain/loss with respect to a terminated vested 50 year-old participant who is scheduled to receive an annual life annuity of $1,000 beginning at age 65.

Summary

We begin with the bottom line. For our example participant, the cost of paying out a lump sum in 2015 is $5,981. Potential savings associated with paying out a lump sum benefit in 2015 for this participant are summarized in the following chart:

2015 savings (present value) from de-risking example participant

Flat-rate premiums | $1,578 |

Variable-rate premiums (only available to plans with certain funding and demographic characteristics) | $2,313 |

New mortality tables | $359 |

So, settling a liability of $5,981 this year can save the company as much as $4,250 (71% of the benefit value!) versus leaving the participant in the plan.

Interest rates

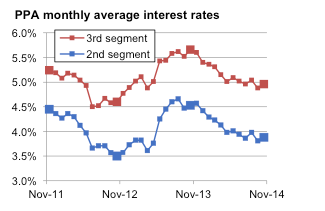

De-risking involves paying out the present value of a participant’s benefit as a lump sum. The interest rates used to calculate that present value are the Pension Protection Act (PPA) ‘spot’ first, second and third segment rates for a designated month. Many sponsors set the lump sum rate at the beginning of the calendar year, based on prior year November interest rates, so that participants will know what rate will be used to calculate their lump sum for the entire year. Under such an approach, for 2015 the lump sum rates would be the November 2014 PPA spot rates.

The following chart shows PPA November spot second and third segment rates for the period 2011- 2014 (November rates highlighted):

As this data indicates, over the period 2012-2015, lump sum valuation interest rates peaked in November 2013 (used for lump sums paid in 2014). Since then, rates have gone down; the critical medium (second segment, years 6-20) and long-term (third segment, years 21+) rates for November 2014 went down (relative to November 2013) by more than 60 basis points.

The following chart shows the cost of a lump sum payment for our example participant for 2013, 2014 and 2015 for a sponsor using a prior year’s November spot rate.

Cost of lump sum payment – annual $1,000 deferred vested benefit beginning at age 65/participant is 50

2013 | $6,466 |

2014 | $5,119 |

2015 | $5,981 |

Clearly, the interest rates used to determine lump sum amounts have a significant impact on resulting benefits. From the table above, we see that the cost of paying lump sums in 2014 was 21% lower than in 2013, while the cost in 2015 is 17% higher than 2014.

PBGC premiums

Reducing participant headcount, e.g., by paying out lump sums to terminated vested participants, reduces the PBGC flat-rate premium and may, depending on plan funding and demographics, reduce the variable-rate premium. Premiums for the current year are based on headcount for the prior year. So de-risking in 2015 will reduce premiums beginning in 2016.

PBGC flat-rate premiums

The PBGC flat-rate premium was $49 in 2014, increasing to $57 in 2015 and $64 in 2016, and indexed to average wage increases thereafter. If we assume the participant in our example dies at age 85, these premiums will be made for the next 35 years, totaling almost $3,200, with a present value today (at 4%) of $1,578. In other words, the cost of paying PBGC headcount premiums for this participant is more than 25% of the value of the participant’s entire benefit.

Variable-rate premiums

In our article Reducing pension plan headcount reduces risk and PBGC premiums, we discussed how de-risking can, in some cases, dramatically reduce the variable-rate premium. The logic of that is not especially intuitive. The gains come from the headcount-based cap on variable-rate premiums that applies beginning in 2013.

The following chart describes the headcount-based cap for the period 2013-2016

Plan years beginning in | Per Participant Cap |

2013 | $400 |

2014 | $412 |

2015 | $418 |

2016 (and after) | $500 |

Oversimplifying, depending on plan funding and demographics, de-risking (that is, lump summing-out) one participant in 2015 may save a sponsor $500 per year in PBGC variable premiums beginning in 2016 (on top of the $64 headcount premium savings.)

As plan funding improves, however, this savings will go away. For purposes of our example we’re going to assume the plan ‘funds its way out’ of the per participant variable-rate premium cap after 5 years. In this case, a lump sum payment in 2015 would reduce variable premiums by more than $2,600 between 2016 and 2020, with a present value (at 4%) of $2,313, 39% of the value of the participant’s entire benefit.

For details on the effect of de-risking on the variable-rate premium, we refer you to the article above.

Effect of new mortality tables

Late in 2014, the Society of Actuaries finalized new mortality tables for private DB plans (see our article Society of Actuaries releases updated mortality tables). At some point in the relatively near future (perhaps as early as 2016), IRS will begin the formal process of updating the mortality tables that plans must, under the Tax Code and ERISA, use in calculating lump sums, to reflect the new SOA 2014 tables/improvement scale.

DB plan sponsors will want to consult their actuary as to the application of the new tables to their plan. The following table projects (based on estimates) the increase in annuity values for minimum funding purposes that would result from the adoption of the RP-2014 mortality tables/improvement scale by IRS for 2016.

Age | Increase | |

Males | 25 | 9.8% |

35 | 7.9% | |

45 | 5.4% | |

55 | 3.6% | |

65 | 4.5% | |

75 | 9.8% | |

85 | 16.9% | |

Females | 25 | 11.8% |

35 | 10.3% | |

45 | 8.3% | |

55 | 6.6% | |

65 | 5.8% | |

75 | 8.0% | |

85 | 10.7% |

Source: Society of Actuaries RPEC Response to Comments on RP-2014 Mortality Tables Exposure Draft

The table does not give an estimate for the increase in cost for our example 50-year old participant; interpolating the estimates for 45- and 55-year old males and females, we come up with an increase of 6.0%.

Using these estimates, de-risking a terminated vested participant in 2015, at a $5,981 value (see above), before the new mortality tables have gone into effect, will avoid a 6.0% increase in cost. 6.0% of $5,981 is a one-time saving of $359.

Note: we are characterizing payment of a lump sum before new mortality tables go into effect as producing a ‘savings.’ That ‘savings,’ however, is different from the PBGC premium savings discussed above. The PBGC premium savings are ‘real money’ that sponsors will have to pay in 2016 if they do not reduce participant headcount. The gains from paying a lump sum before new mortality tables go into effect are more speculative, and, as can be seen from recent experience, they can be swamped by the impact of changing interest rates.

Among other things, we don’t know what the new tables will be; IRS may modify the SOA’s tables.

Finally, sponsors may wish to consider whether, and how, to explain the effect of potential new mortality tables on a participant’s decision to take a lump sum, either as part of a de-risking transaction or simply in the course of an ordinary retirement.

Regulatory initiatives

Another issue that sponsors considering de-risking will want to take into account is regulatory initiatives generally aimed at restricting, or providing special disclosure rules with respect to, de-risking.

Participant advocate groups have been proposing everything from enhanced disclosure to a moratorium and thorough regulatory review of de-risking transactions, as we discussed in our article Concerns over pension de-risking. Thus far, with minor exceptions, no concrete initiatives have been undertaken either by the agencies or Congress. The minor exceptions include IRS’s suspension of Private Letter Rulings on paying lump sums to retirees currently receiving benefits (reported in our 2014 article Update on pension de-risking and PBGC’s proposal “to require after-the-fact reporting of certain risk transfers through lump sum windows and annuity purchases” in 2015 premium filings.

The Administration is, however, interested in the issue. And increased de-risking activity may increase Congressional concern.

There have also been proposals to revise the insurance laws of at least two states (Connecticut and New York) to impose restrictions on de-risking transactions. It is unclear, however, whether any of these proposals will pass.

Nevertheless, there is a distinct possibility that some sort of regulatory effort – probably increased disclosure, but possibly involving substantive restrictions – with respect to de-risking will be made at some point. Sponsors may want to consider that possibility in deciding whether or not to act in 2015.

* * *

Decreases in lump sum valuation interest rates have made de-risking in 2015 more expensive than it was in 2014. But, even with the decrease in interest rates, de-risking may still result in substantial savings.

We will continue to follow this issue.