2019 Increases for Retirement Plans, Social Security

The Social Security Administration just announced benefit increases effective in 2019. Current retirees will receive a cost-of-living increase, beginning in January 2019, of 2.8%, reflecting the increase in CPI-W between the 3rdquarter of 2017 and the 3rdquarter of 2018.In addition, the maximum amount of earnings subject to Social Security tax will increase in 2019 from $128,400 to $132,900, based on a 3.5% increase in the ‘national average wage’ during 2017.These changes will affect benefits for currently retired individuals, as well as those contemplating retirement. Employers who sponsor retirement plans that are ‘coordinated’ with Social Security in some fashion will also see an impact on benefits earned and payable under such plans.

The Social Security Administration just announced benefit increases effective in 2019. Current retirees will receive a cost-of-living increase, beginning in January 2019, of 2.8%, reflecting the increase in CPI-W between the 3rd quarter of 2017 and the 3rd quarter of 2018.

In addition, the maximum amount of earnings subject to Social Security tax will increase in 2019 from $128,400 to $132,900, based on a 3.5% increase in the ‘national average wage’ during 2017.

These changes will affect benefits for currently retired individuals, as well as those contemplating retirement. Employers who sponsor retirement plans that are ‘coordinated’ with Social Security in some fashion will also see an impact on benefits earned and payable under such plans.

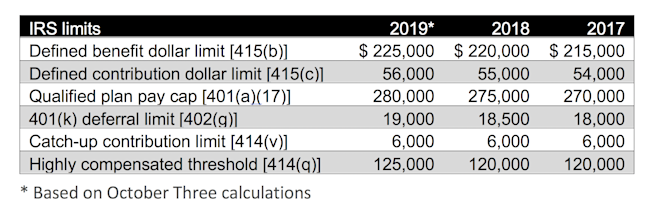

IRS limits

IRS will soon release limits applicable to retirement plans for various purposes in 2019, based on a 2.64% increase in CPI-U between the 3rd quarter of 2017 and the 3rd quarter of 2018. Based on this increase, we expect increases in some, but not all, limits applicable to retirement plans in 2019. The table below summarizes our calculations for 2019, along with values for 2018 and 2017:

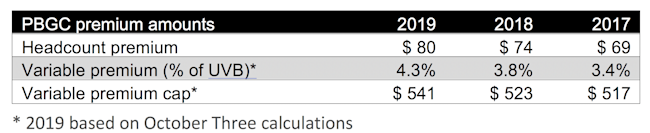

PBGC amounts

The increase in national average wages also drives some key amounts used in calculating PBGC premiums. Relevant amounts for 2019 (along with 2018 and 2017) are summarized below:

We note that 2019 headcount premium ($80) is set by law (but will increase based on national average wages in future years), while the variable premium rate (4.3%) and variable premium cap ($541) are based on the 3.5% increase in national average wages during 2017.