2020 lessons learned – annuity settlements for small benefits

Even for plans not at the VRP headcount cap, with respect to (relatively) smaller benefits, annuity settlement may be an efficient strategy. For almost all pension plans, there exists a threshold, greater than zero, below which these settlements make sense.

In October we discussed the math of annuity settlements in the context of the decline in interest rates over 2019-2020.

Our conclusions were that (generally): (1) annuity settlements will (because of the carrier’s premium-over-book) increase “real life” plan underfunding and produce a one-time balance sheet “loss;” (2) they will also accelerate ERISA plan funding; (3) for plans at the VRP headcount cap, the (one-time) balance sheet loss will be more than offset by a significant (annual) gain from reduced headcount; (4) for plans not at the VRP headcount cap, a headcount reduction may be a net negative, i.e., gains from reduced PBGC headcount premiums and administrative costs may not produce enough net savings to offset the annuity carrier’s premium-over-book.

Special case: small benefits

In this article we want to zero in on conclusion (4): even for plans not at the VRP headcount cap, with respect to (relatively) smaller benefits, annuity settlement may be an efficient strategy. For almost all pension plans, there exists a threshold, greater than zero, below which these settlements make sense.

Framework

Timing: Unlike lump sums, which may involve use of a dated interest rate for lump sum valuation, annuity settlements generally reflect current market conditions. In this analysis, we’re going look at annuities settled in early 2021, assuming that interest rates remain stable between now and the end of 2021. Such a settlement will affect year-end 2021 financials, 2022 ERISA minimum funding, and 2022 PBGC premiums.

Key factors: As we discussed in our previous article on annuity settlements, three (main) factors determine the financial consequences of an annuity settlement:

(1) The premium-over-book (generally, insurance carrier margin) the annuity costs. For purposes of this article we are going to assume that (generally) an annuity settlement costs 102% of the book value of a liability.

(2) Whether the plan is at the VRP headcount cap. Generally, the savings of plans at the VRP headcount cap are so significant that they more than offset other costs from the transaction. For 2022, we estimate the VRP headcount cap will be $597. This article is focused on plans not at the VRP headcount cap.

(3) The (regular) PBGC headcount premium and administrative costs. For 2022, we estimate the regular headcount premium will be $88 and that administrative costs will be $30 per participant/per year.

These three factors imply a relatively simple formula for determining whether paying out an annuity is – based on the size of the benefit – financially efficient. In what follows, we compare different participants with different size benefits, to illustrate where the break-even point is.

Example – when the annuity settlement does work, and when it doesn’t

Assumptions:

Three retirees:

GAAP liability with respect to Participant A = $25,000

GAAP liability with respect to Participant B = $59,000

GAAP liability with respect to Participant C = $100,000

Annuity payment to each participant @ a 2% premium.

A discount rate of 2.5% for the present value of future PBGC headcount premiums and administrative costs.

Rate of increase in PBGC headcount premium and administrative costs of 2.5%.

Expected duration of annual costs (e.g., life expectancy or time to plan termination) of 10 years.

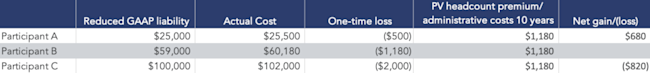

The following table presents the gains/(losses) from a reduction in participant headcount for each participant on these assumptions.

Gains/(Losses) from headcount reduction for a plan not at the VRP headcount cap

The math here is very straightforward. On our assumptions, the present value (per capita) of savings from any headcount reduction is $1,180. To the extent that the carrier premium-over-book on a liability is less than that amount, headcount reduction saves money. Thus (again, on these assumptions) the plan saves money reducing headcount/annuitizing any benefit with a present value of less than $59,000. That translates to a monthly benefit of, roughly, $590.

These numbers would (obviously) change as the key factors – e.g., carrier premium-over-book, discount rate, and assumed increase in future costs – change.

Issues to consider

Impact on variable premiums. Generally, buying annuities will increase a plan’s UVB modestly, because of differences in assumptions (interest and mortality). For plans paying variable premiums, any increase in variable premiums will reduce the value of buying annuities. For plans using the alternative method to value UVBs, an annuity settlement often may (somewhat counterintuitively) increase the plan’s VRPs more substantially. For these plans, this additional cost element should be taken into account. For plans not paying VRPs, the analysis is as straightforward as the math above implies.

Possible implications for post-transaction portfolio strategy. Sponsors that hold significant fixed income investments in the plan’s portfolio to hedge riskier (shorter term) liabilities may want to consider rebalancing as these de-risking transactions take those liabilities off the plan’s books.

Effect on ERISA minimum funding. Buying annuities (with plan assets) to settle liabilities will generally reduce an underfunded plan’s funded status for purposes of ERISA minimum funding requirements, because the participant’s benefit is being paid out “in full” (plus the carrier premium) whereas it had only been funded “in part.” This is likely to result in some acceleration of required plan funding.

Effect on employer accounting. Many plans have experienced large losses this century that have yet to be reflected in corporate earnings. For these employers, settling pension liabilities can trigger accelerated recognition of these losses.

Interest rate trend. As always with de-risking transactions, the sponsor’s view of future interest rate trends will matter.

* * *

We will continue to follow this issue.