December 2015 Pension Finance Update

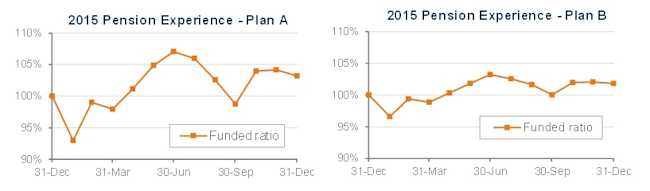

Pension plans lost a bit of ground in December due to stock market declines, but ended 2015 modestly ahead. Both model pension plans we track1 were down last month: Plan A lost 1%, ending the year up 3%, while Plan B dropped a fraction of 1% but still finished up close to 2% during 2015.

Assets

Stocks lost ground in December: the S&P 500 dropped close to 2%, NASDAQ was down 2%, the small-cap Russell 2000 lost 5%, and the overseas EAFE index was 3% lower on the month. For 2015, the S&P 500 added 1% and the NASDAQ was up 6%, but the Russell 2000 declined more than 4% and the EAFE index was down more than 1%.

A diversified stock portfolio lost more than 2% in December, finishing 2015 up just 1%.

For bonds, 2015 was a bit worse. Bonds lost less than 1% last month as interest rates edged up a bit. For the year, a diversified bond portfolio ended the year close to even, with short duration bonds up a bit, long duration bonds down a couple percent, and Treasuries performing slightly better than corporate bonds due to increasing credit spreads.

Overall, our traditional 60/40 portfolio lost 2% in December, ending the year up 1%, while a conservative 20/80 portfolio dropped 1% last month, finishing 2015 even.

Liabilities

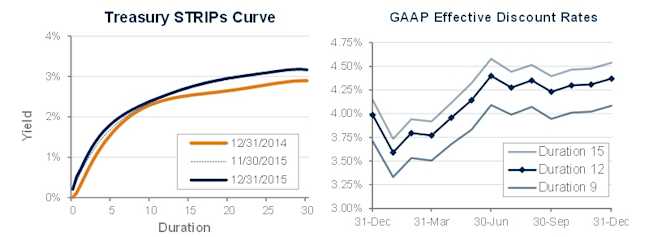

Both funding and accounting liabilities are now driven by market interest rates. The graph on the left compares Treasury STRIPs yields at December 31, 2014, and December 31, 2015, and also shows the movement in rates last month. The graph on the right shows our estimate of movements in effective GAAP discount rates for pension obligations of various duration during 2015:

Interest rates edged up less than 0.1% during December. Corporate bond yields ended the year almost 0.40% higher than at the end of 2014 and close to 0.80% higher than the all-time lows in January. Treasury yields rose about 0.25% during 2015, as credit spreads increased 0.15% during the year. Last month’s move pushed liabilities down a fraction of 1%, ending the year 2% below their December 31, 2014 level – a bit less for short duration plans, and a bit more for long-duration plans.

Summary

All told, 2015 saw pension sponsors improve funded status by 2%-3%, due almost entirely to higher interest rates shaving a couple percent off of pension liabilities. Considering that total pension obligations continue to exceed $2 trillion, this translates to about a $50 billion improvement in total, similar to the impact of a typical year’s aggregate contributions.

Looking Ahead

The Obama Administration and Congressional leaders passed a budget this fall that includes a third round of pension funding relief since 2012. The upshot is that pension funding requirements over the next several years will not be appreciably affected by current low interest rates (unless these rates persist). Required contributions for the next few years will be lower and more stable than under prior law.

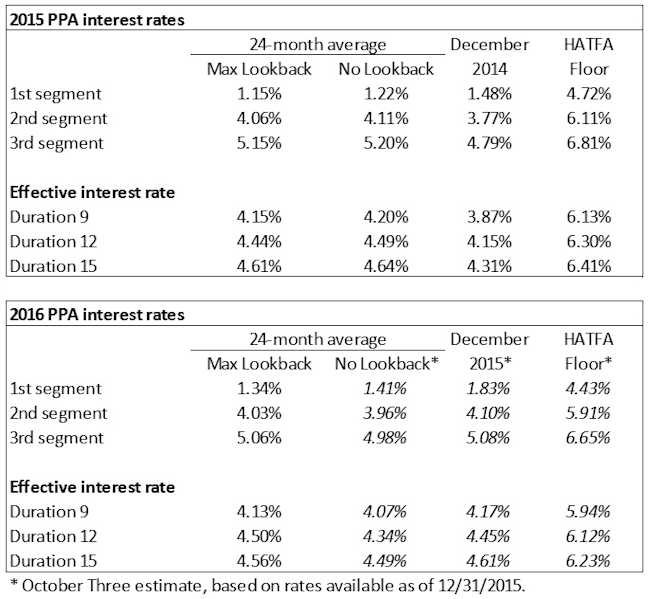

Discount rates moved up a bit last month. We expect most pension sponsors will use effective discount rates in the 3.9%-4.6% range to measure pension liabilities at year-end 2015.

The table below summarizes rates that plan sponsors are required to use for IRS funding purposes for 2015, along with estimates for 2016. Pre-relief, both 24-month averages and December ‘spot’ rates, which are still required for some calculations, such as PBGC premiums, are also included.

1 Plan A is a traditional plan (duration 12 at 5.5%) with a 60/40 asset allocation, while Plan B is a cash balance plan (duration 9 at 5.5%) with a 20/80 allocation with a greater emphasis on corporate and long-duration bonds. For both plans, we assume the plan is 100% funded at the beginning of the year and ignore benefit accruals, contributions, and benefit payments in order to isolate the financial performance of plan assets versus liabilities.