June 2025 Pension Risk Transfer Pricing Update

While current market dynamics offer a timely opportunity for plan sponsors looking to de-risk, the upcoming expiration of the 90-day U.S. tariff extension may suggest market volatility.

Executive Summary

Annuity rates are up nearly 20 basis points since the beginning of the year corresponding to a downward trend in annuity pricing, creating a favorable de-risking environment amid improved plan funding. With the 90-day tariff extension closing soon, plan sponsors should act quickly before volatility returns.

The pause on major U.S. tariffs has fueled a market rally, building on the momentum sparked by the earlier 90-day extension. These conditions offer a strategic window for plan sponsors to explore opportunities. However, this window is quickly coming to a close.

Engaging an annuity search firm early in the Pension Risk Transfer (PRT) process enables strategic planning, thorough data preparation, and a deeper understanding of plan provisions—key factors in ensuring successful outcomes for both plan sponsors and participants. High-quality data and well-defined plan provisions help avoid costly delays and increase insurer engagement, ultimately leading to more competitive pricing. Given the unpredictability of market conditions, early preparation positions plan sponsors to act swiftly when favorable opportunities arise.

Pricing Update

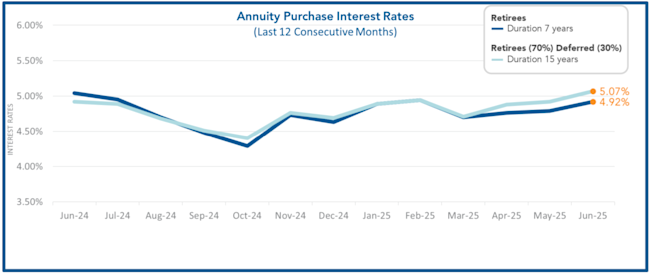

Annuity Purchase Interest Rates

Annuity purchase interest rates have risen since last month, leading to a corresponding decrease in annuity pricing. As of now, the average duration-7 rate stands at 4.92%, and the average duration-15 rate is at 5.07%—marking an increase of nearly 20 basis points since the start of the year. As noted in the recent Pension Finance Update higher interest rates combined with strong equity market performance have contributed to improved pension plan funding levels. This combination of strengthened funded status and more favorable annuity pricing presents a compelling opportunity for plan sponsors considering de-risking. While the initial tariff announcement caused significant market disruption, the 90-day extension has created a temporary window of stability. With this window closing quickly and market volatility potentially on the horizon, plan sponsors are encouraged to act swiftly to take advantage of current market conditions.

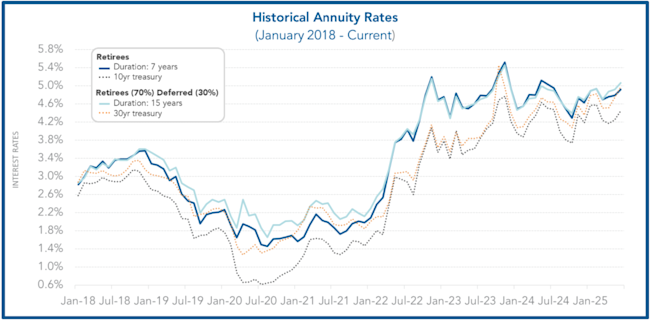

Historical Annuity Rates

Annuity purchase interest rates and Treasury yields fluctuate over time as seen in the graph below, underscoring the need for timely decision-making in a dynamic market. This month, the 10-year Treasury rate rose to 4.46% and the 30-year to 4.99%, despite both experiencing slight declines since early June. The duration-7 annuity purchase rate generally aligns with the 10-year Treasury, while the duration-15 rate correlates with the 30-year. Recent yield stability may create favorable pricing conditions, presenting plan sponsors with a timely opportunity to engage. With the 90-day tariff extension nearing its end and further market shifts likely, plan sponsors are encouraged to consult with annuity search firms to develop a proactive strategy and capitalize on this window.

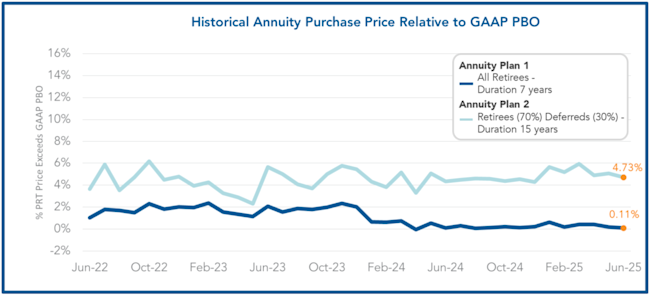

Annuity Costs Relative to GAAP

The graph below shows the spread between the annuity purchase price and the GAAP projected benefit obligation (PBO), also referred to as the accounting book value. Over the past month, this spread narrowed to 4.73% for Annuity Plan 1 and to 0.11% for Annuity Plan 2. As annuity purchase rates decrease, purchase prices rise relative to the PBO. This shrinkage may suggest an opportune time for Plan Sponsors looking to de-risk to transact. Please note that the PBO figures shown do not include future overhead costs—such as administrative expenses and PBGC premiums—that plan sponsors would incur by retaining participants in the plan.

The Value of Early Engagement with an Annuity Search Partner

Engaging an annuity search firm early in the de-risking process is essential to executing a successful Pension Risk Transfer (PRT). Early engagement allows for thoughtful planning and strategic consultation to ensure optimal outcomes for plan participants and plan sponsors.

A Pension Risk Transfer involves multiple complex components, each of which must be carefully considered and thoroughly understood. One of the most critical components of a successful transaction is data quality. Is the data complete? Are there gaps or discrepancies? Does it accurately reflect the current plan population? Partnering with an annuity search firm that can help identify and fill these holes is beneficial to the plan sponsor. Otherwise, poor data hygiene can lead to delays, increased costs, or limited insurer engagement.

An experienced annuity consultant analyzes and interprets plan provisions to identify elements that may raise concerns for potential insurers. When such elements are found, early engagements allows time to develop an action plan with creative solutions to mitigate concerns and maximize insurer participation. Accurately capturing and fully understanding plan provisions is key to achieving the most competitive pricing and selecting the most suitable insurer for the plan participants.

Timing is also a critical factor. While market conditions cannot be predicted, opportunities often emerge with little notice. Being fully prepared and armed with ready to go data positions plan sponsors to act quickly when the timing is right. Early preparation with a qualified partner is not just smart—it is strategic.

For additional information or inquires about the pension risk transfer marketplace, contact Mark Unhoch: munhoch@octoberthree.com.

Submission box. If you want to see some topics covered, submit here

*October Three advises plan sponsors through every step of the Pension Risk Transfer (PRT) process. Through long established relationships with insurers in the PRT marketplace, October Three collects annuity purchase rates for Duration 7 years and Duration 15 years on a monthly basis. We have constructed 2 hypothetical annuity plans which have been valued using the latest mortality tables and mortality improvement scales. Annuity Plan 1 contains retirees only and has a liability duration of 7 years. Annuity Plan 2 contains 70% retirees and 30% deferreds and has a liability duration of 15 years. Monthly annuity rates are determined by taking the average Duration 7 and Duration 15 interest rates provided from the insurers. Annuity Plan 1 was valued using the average of the Duration 7-year interest rates collected from insurers and Annuity Plan 2 was valued using the average of the Duration 15-year interest rates collected from insurers. Using the collected annuity purchase rates and 2 hypothetical annuity plans, we have produced the following graphs representative of actual PRT market activity and the corresponding impact on pension plans.