Measuring UVBs for variable-rate premiums – the alternative vs. standard method election due October 16, 2023

As we discussed in detail in March (Reducing PBGC premiums in 2023 – the significance of the standard/alternative method election), for many plans, the amount of PBGC variable-rate premiums the plan will owe this year depends on whether the plan can use the standard (spot-rate) method, rather than the alternative (24-month average) method, to value PBGC “unfunded vested benefit” (UVB) liabilities. An election to change from the alternative method to the standard method generally must be made (for calendar year plans) by October 16, 2023. Because of the 5-year lock-up rule (see below), plans that elected the alternative method in 2019 or later may not elect to switch to the standard method for 2023.

Because of the significance (and timeliness) of the alternative vs. standard method election for many sponsors, in this article we update the March 2023 analysis, beginning with the bottom line.

Bottom line: The combination of (a) an unprecedented gap between standard and alternative interest rates due to the sharp increase in rates since 2021 and (b) the steep increase in the premium rate, from 0.9% of UVBs in 2013 to 5.2% in 2023, means that the dollar amounts at stake with respect to the VRP calculation dwarf all past years. For a typical $100 million plan, the decision could easily be worth $1 million or more.

Some plans are already using the standard method and face no issue. Others may be overfunded enough to avoid the PBGC VRP on either basis, while yet others may see the VRP capped under either method.

Every plan should understand their current situation; if they aren’t in one of the above groups, the VRPs at stake are likely material to plan operation.

Affected sponsors currently using the alternative method, who are not subject to the 5-year lock-up, should strongly consider switching to the standard method by the October 16, 2023, deadline.

The effect of the method used for measurement of UVBs

In determining UVBs, sponsors have a choice. They can use (for a calendar year plan): (1) December spot segment rates (the “standard” method) or (2) the 24-month average segment rates used for plan funding (the “alternative” method). (In all cases, 25-year average interest rate stabilization is disregarded.)

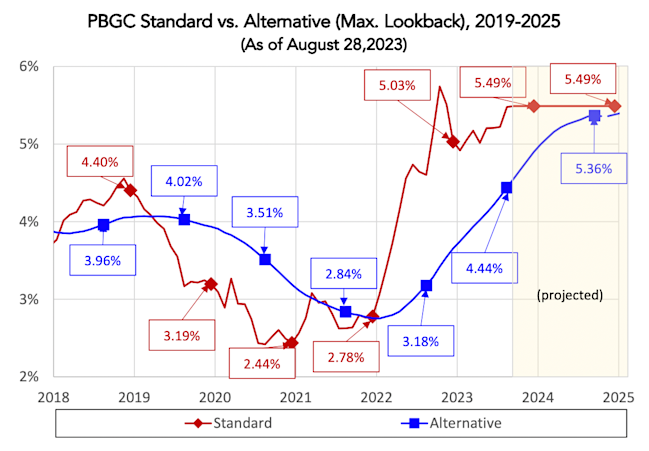

The chart below illustrates how unprecedented the 2023 divergence between standard (5.03%) and alternative (3.18%) method interest rates is.

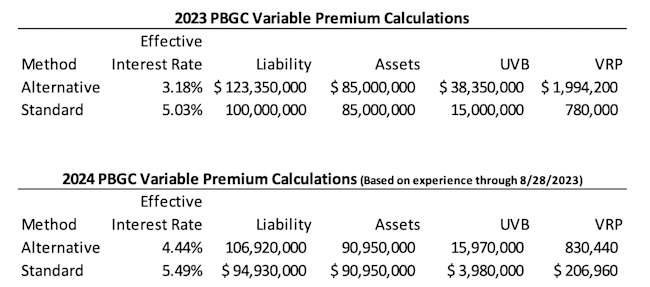

Note that market interest rates (red line) have moved higher still so far in 2023, which means the benefit of the standard method will likely carry over to 2024, barring a sharp drop in rates (100 basis points or more) between now and the end of the year. The tables below summarize the standard and alternative method PBGC calculations for a generic duration 12 plan that was 85% funded in 2023, assuming plan assets earn a 7% return during 2023.

Moving to the standard method in 2023 is worth $1.2 million to the plan this year and (assuming no change in rates between now and year-end) another $0.6 million next year.

Note how the alternative method significantly overstates “market” liabilities at 1/1/2023. Even plans that report they are fully funded on their balance sheets may be subject to a hefty VRP this year under the alternative method.

All of the foregoing is to say: any plan currently on the alternative method should understand what their 2023 (and 2024) PBGC premiums look like and what they can do about it.

Evaluating the five-year lock-up risk

Switching to the standard method in 2023 will significantly reduce 2023 premiums for many sponsors – that is, in effect, money-in-hand – and likely produce additional savings in 2024.

A sponsor’s ability to change methods (standard vs. alternative) is, however, limited. Once a particular method (standard or alternative) is elected, the sponsor can’t switch to the other method for five years. Thus, sponsors who have elected the alternative method in 2019 or later will not be able to switch to the standard method in 2023.

For those who can, the risk with respect to switching to the standard method is that interest rates will, by the end of 2026, go down to such an extent that the alternative (24-month average) method will produce a higher valuation interest rate and lower VRPs. We discuss this five-year lock-up risk generally in the side-bar.

With respect to the 2023 election specifically, interest rates would have to fall by more than 100 basis points by the end of 2023 in order to erase 2024 savings, so it is unlikely the decision this year will cost the plan next year.

Results after 2024 are more speculative, but interest rates would need to fall by 250 basis points in the next three years (back to all-time low rates below 3%) in order for the alternative method to reverse the interest rate gap seen in 2023 and erase the 2023 savings.

Sidebar: Evaluating five-year lock-up risk generally

The five-year lock-up for changing methods presents sponsors with a set of risks.

First, there is what we’ll call “direction risk.” If over the entire five-year period interest rates go up, and you have elected the alternative method, your valuation interest rate will be consistently lower (and thus produce higher PBGC premiums) than if you had elected the standard method. On the flip side, if over the entire five-year period interest rates go down, and you have elected the standard method, your valuation interest rate will be consistently lower (and thus produce higher PBGC premiums) than if you had elected the alternative method.

Second, there is what we’ll call “December volatility risk.” This is only a feature of the standard method. If (e.g., because of some end-of-year, temporary market panic) interest rates in December spike down, and you are on the standard method, you will be stuck with a significantly lower valuation rate (and higher PBGC premiums) than if that one-month spike down in rates had been smoothed over 24 months.

With regard to these risks, two other factors to consider are plan funding policy and termination/glidepath strategy. If your plan is fully funded and fully “LDI-ed” (the plan’s portfolio is invested in duration matched fixed income assets), the risks we just described generally don’t affect you. Any decline in interest rates (even a “spike down” in rates in December) will be offset by an increase in asset values. For these plans, the standard method will generally be the preferred choice.

And if you (realistically) expect to terminate the plan in the relatively near future (e.g., the next 2-3 years), your “risk window” with respect to your standard vs. alternative method election is shortened.

Plan B – for plans currently locked into the alternative method

As we noted, plans that elected the alternative method in 2019 or later may not elect to return to the standard method for 2023. These plans do, however, have another option. Plan sponsors may elect, for 2023 and beyond, to calculate plan funding (under ERISA’s minimum funding rules) on the basis of a “full yield curve,” in effect marking liabilities to market for minimum funding purposes and using that market rate to value UVBs in calculating its VRP liability. Doing so will produce a result that is (more or less) the same as electing the standard method for valuing UVBs.

Plans that take this approach give up, for ERISA minimum funding, 25-year smoothing of interest rates – the “interest rate relief” that has cushioned many plans from high liability valuations in prior years when valuation interest rates were at historically low levels.

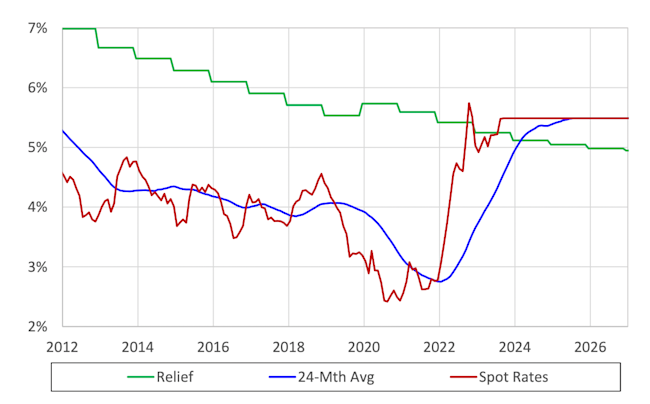

The chart below shows the interplay between market interest rates (red line), 24-month average rates (blue line), and 25-year average funding relief rates (green line) up to now, projected through the end of 2026 assuming no future change in rates.

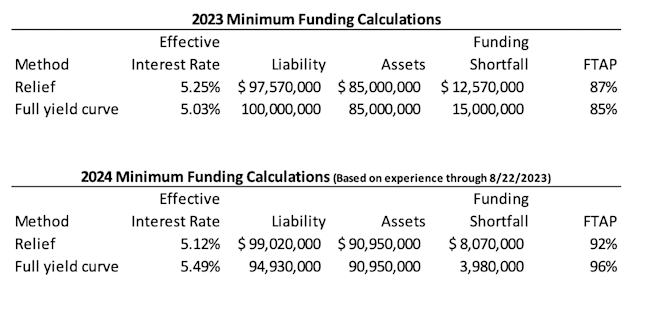

As the chart shows, abandoning funding relief beginning in 2023 produces a slight increase in the plan’s 2023 funding target and a slight reduction in the plan’s AFTAP, but, based on current rates, this decision would actually reduce the plan’s 2024 funding target and increase the 2024 AFTAP (although if rates move down 40 basis points by year-end, the 2024 benefit would be erased).

The tables below summarize the calculations for our sample plan:

For some sponsors, a higher 2023 funding target could increase 2023 quarterly contribution requirements and reduce the plan’s 2023 AFTAP, which may be a complication (and is why we first raised this issue in March), but for many plans, this change would not create a problem. Sponsors considering this strategy should ensure they can make the transition without getting tripped up by minimum funding issues.

The downside risk to adopting the full yield curve for minimum funding purposes is that, once a plan changes its valuation assumption for ERISA minimum funding purposes, it cannot (easily) change it again (e.g., change it back to 25-year averaging) without permission from IRS.

So, if interest rates decline sharply in the next few years, plans that have elected the full yield curve may face higher funding requirements than otherwise.

For frozen plans that are well-funded and in a position to immunize or settle pension liabilities, the benefit of retaining smoothing for minimum funding purposes may well be lower than its cost, i.e., the additional premium incurred in 2023 under the alternative method.

* * *

For affected sponsors, an election to switch to the standard method (or to switch to full yield curve valuation where a switch to the standard method cannot be made) has the potential to save significant VRP costs. The consequences/trade-offs of these elections are, however, significant, and sponsors will want to review them with their consultant.