August 2015 Pension Finance Update

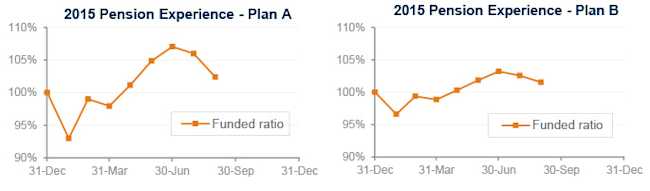

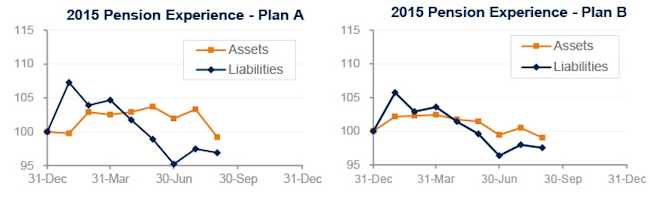

Fears of a slowdown in China rippled through financial markets in August, producing drops in stock markets around the world and erasing most of the ‘cushion’ pension sponsors had built up during 2015. Both model pension plans we track lost ground in August – Plan A slipped more than 3% and Plan B lost more than 1% on the month – but both plans remain up about 2% on the year through August.

Assets

Stocks suffered across the board during August, with all major indices (S&P 500, NASDAQ, small-cap Russell 2000, and overseas EAFE) losing 6%-7% during the month. For the year, the NASDAQ remains up by 1% and the EAFE index has been flat, but the S&P 500 and Russell 2000 are now down 3% during 2015.

A diversified stock portfolio lost more than 6% in August, and is now down 1%-2% through the first eight months of 2015.

Bonds lost less than 1% during August, as interest rates inched up a few basis points during the month. For the year, a diversified bond portfolio is flat to down 1%, with short duration bonds and Treasuries performing best so far in 2015.

Overall, our traditional 60/40 portfolio lost 4% during August and is now down 1% for the year, while a conservative 20/80 portfolio also lost 1%-2% last month and is also down 1% for the year.

Liabilities

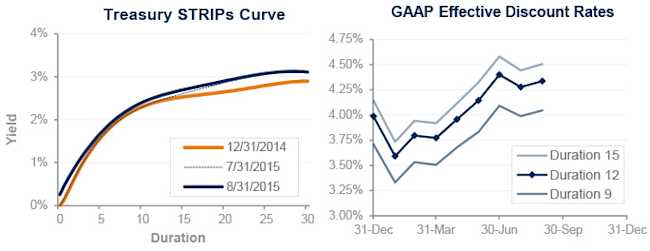

Both funding and accounting liabilities are now driven by market interest rates. The graph on the left compares Treasury STRIPs yields at December 31, 2014, and August 31, 2015, and also shows the movement in rates last month. The graph on the right shows our estimate of movements in effective GAAP discount rates for pension obligations of various duration during 2015 so far:

Interest rates increased less than 0.1% during August and corporate bond yields are now about 0.35% higher than at the end of 2014 (Treasuries have risen about 0.15% this year, so credit spreads have increased 0.2% during 2015.) Last month’s move pushed pension liabilities down fractionally, leaving them 2%-3% lower than at the end of 2014, with long duration plans seeing the biggest decreases.

Summary

Lower stock markets in August erased much of the improvement pension sponsors had seen this year. Pension assets are now underwater for the year, but still slightly ahead of liabilities, which have fallen more due to moderately higher interest rates during 2015.

Looking Ahead

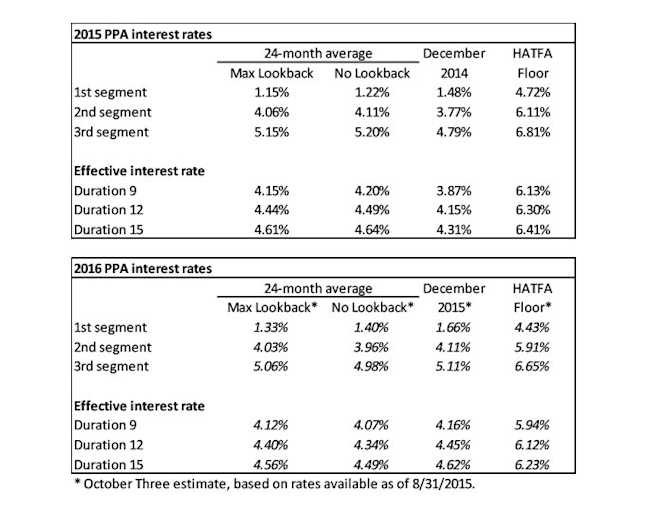

Due to 2014 pension funding relief legislation (HATFA), pension funding requirements over the next few years will not be appreciably affected by current low interest rates (unless these rates persist for several years). Required contributions for the next few years will be lower and more stable than under prior law, but higher pension funding requirements are likely for several years afterwards.

Discount rates edged up a bit last month. Most pension sponsors are using rates of 3.8%-4.5% to measure pension liabilities for accounting purposes in today’s environment.

The table below summarizes rates that plan sponsors are required to use for IRS funding purposes for 2015, along with estimates for 2016. Pre-HATFA, both 24-month averages and December ‘spot’ rates, which are still required for some calculations, such as PBGC premiums, are also included.

1 Plan A is a traditional plan (duration 12 at 5.5%) with a 60/40 asset allocation, while Plan B is a cash balance plan (duration 9 at 5.5%) with a 20/80 allocation with a greater emphasis on corporate and long-duration bonds. For both plans, we assume the plan is 100% funded at the beginning of the year and ignore benefit accruals, contributions, and benefit payments in order to isolate the financial performance of plan assets versus liabilities.