De-risking in 2021 – Part 1

In this article we provide our standard analysis of de-risking: how changes in interest rates and Pension Benefit Guaranty Corporation premiums may affect sponsor decisions to de-risk (or not de-risk) defined benefit plan liabilities in 2021.

In this article we provide our standard analysis of de-risking: how changes in interest rates and Pension Benefit Guaranty Corporation premiums may affect sponsor decisions to de-risk (or not de-risk) defined benefit plan liabilities in 2021. For purposes of this article, we focus solely on de-risking by paying out a deferred vested participant’s benefit as a lump sum and thereby eliminating the related liability.

Our analysis reflects that fact that (generally) interest rates declined throughout 2020. We note, however, that for 2021 (thus far) interest rates are increasing – valuation interest rates are up around 35 basis points since the beginning of the year – and that fact presents a number of significant and complicating issues for sponsors considering de-risking.

In our next article (De-risking in 2021 – Part 2) we will discuss: (1) The possibility that annuity (rather than lump sum) settlement may in some circumstances be less expensive than lump sum payment. (2) The possibility that if rates remain higher in 2021, de-risking in 2022 is likely to be less expensive. And (3) The possibility that, if rates remain higher, paying a lump sum this year may produce an increased balance sheet net liability.

These factors may make the de-risking decision a complicated one for some sponsors. In this first article, however, our intent is to keep the analysis relatively simple, and just focus on the (increased) cost of lump sums vs. the (increased) cost of PBGC premiums in 2021.

We begin with a brief summary of our conclusions, followed by a more detailed analysis.

Summary

Bottom line: The cost of de-risking will (again) dramatically increase in 2021 (vs. 2020). The savings from reduced PBGC premiums has also increased (although only marginally).

Those reduced PBGC premiums represent a real gain to the plan sponsor, whereas the de-risked participant’s benefit will have to be paid at some point, either in 2021 or at ultimate retirement.

We illustrate our analysis of the effect of interest rates and PBGC premiums on the de-risking decision by using a (relatively simple) example: the cost-of-benefit and de-risking gain with respect to a terminated vested 50 year-old participant who is scheduled to receive an annual life annuity of $1,000 beginning at age 65.

For our example participant, decreases in interest rates (November 2019 vs. November 2020) have increased the 2021 base cost of paying this participant a lump sum benefit, vs. 2020, by around $1,480 (17%). On our assumptions, if a 50 year-old individual with a $1,000 benefit had been paid out in 2020, the cost would have been $8,948; in 2020 the cost would be $10,428.

The savings from de-risking this participant come from reduced PBGC premiums – an (assumed) present value of $2,073 in PBGC flat-rate premiums and $2,778 in PBGC variable-rate premiums (only available to plans subject to the variable-rate premium cap).

The savings in PBGC premiums are, of course, “real” savings – PBGC premiums function (more or less) like a tax. On the other hand, the cost of the lump sum is offset by the associated reduction in total liabilities.

The de-risking calculation is, of course, relative and dependent on the sponsor’s view of, e.g., future interest rate trends and the cost/savings of paying a participant all benefits this year vs. paying them next year vs. simply paying them when due (e.g., beginning at age 65). (We will discuss these issues in our next article.)

What follows is a detailed discussion of these conclusions.

Interest rates

De-risking involves paying out the present value of a participant’s benefit as a lump sum. The interest rates used to calculate that present value are the Pension Protection Act (PPA) “spot” first, second, and third segment rates for a designated month. Many sponsors set the lump sum rate at the beginning of the calendar year, based on the spot rates in a prior year “lookback” month, so that participants will know what rate will be used to calculate their lump sum for the entire year. A plurality of plans use a November lookback month, which we use in our example. Under such an approach, for 2021 the lump sum rates would be the November 2020 PPA spot rates.

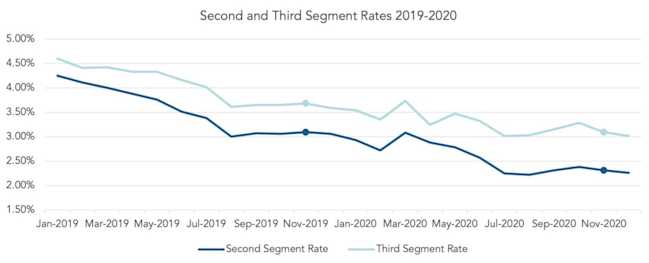

The following chart shows PPA spot second and third segment rates for the period 2019-2020.

PPA monthly average interest rates

As this data indicates, November 2020 interest rates were down significantly vs. November 2019 rates. (We note that the decrease in 2020 rates was significant across all lookback months, with the October 2020 rates marginally higher than other months’ rates.)

As noted, based on these rates, the cost of de-risking our example participant increased 17%, from $8,948 in 2020 to $10,428in 2021.

(For purposes of this calculation, rather than doing a strict Tax Code 417(e) calculation, we simply assume the participant has a 21-year life expectancy at age 65.)

PBGC premiums

Reducing participant headcount, e.g., by paying out lump sums to terminated vested participants, reduces the PBGC flat-rate premium and may, depending on plan funding and demographics, reduce the variable-rate premium. Premiums for the current year are based on headcount for the prior year. So de-risking in 2021 will reduce premiums beginning in 2022.

PBGC flat-rate premiums

We are estimating the 2021 PBGC flat-rate premium to be $88 (the 2020 rate of $86 adjusted for one year of wage inflation).

For purposes of our analysis we assume no inflation-related increases in PBGC premiums after 2021. We use a discount rate of 2.5%, which generally assumes low or no inflation.

Discounting annual premiums for 36 years (assuming our example 50-year old participant lives to age 86) yields a present value of the savings from the elimination of PBGC flat-rate premiums for our example participant of around $2,073.

Variable-rate premiums

In our article Reducing pension plan headcount reduces risk and PBGC premiums we discuss how de-risking can, in some cases, dramatically reduce the variable-rate premium. The logic of that is not especially intuitive. The gains come from the headcount-based cap on variable-rate premiums. We estimate (again, based on one year wage inflation) the 2022 headcount cap to be $598. Oversimplifying (and again ignoring any future inflation adjustment to the cap), depending on plan funding and demographics, de-risking (that is, lump summing-out) one participant in 2021 may save a sponsor $598 per year in PBGC premiums beginning in 2022.

As plan funding improves, however, these savings will go away. For purposes of our example we assume the plan “funds its way out” of the per participant variable-rate premium cap after 5 years. Discounting annual premiums of $598 for 5 years yields a present value of around $2,778. (We note that if the funding relief/interest rate stabilization proposal currently being considered by Congress is adopted, these savings could last for longer than 5 years.)

Tradeoffs

As we discussed at the top, the (marginally increased) saving, via reduced PBGC premiums, is “real” – it can be thought of in the same way as the savings from a reduction in taxes. The (significantly increased) cost of a 2021 lump sum is not in the same category (that is, it is not “real”), because it is offset by a similarly increased liability carried on the sponsor’s books.

There is, however, a cash flow effect: if a plan (on a market basis) is underfunded, paying out (100% of) a benefit will increase underfunding and may increase minimum funding requirements. The effect of such a payment will depend on a number of factors, most importantly ERISA “interest rate stabilization” (AKA funding relief). We discussed minimum funding requirements at 2020 year end in our article Retirement savings finance at the end of 2020. And we note that Congress is currently considering a further extension of ERISA minimum funding relief that would significantly reduce the possibility of a de-risking lump sum generating near term cash flow issues.

* * *

We note that the savings from de-risking/headcount reduction remain significant. The wild card with respect to the cost of de-risking is the direction of future interest rates, especially as interest rates have increased in the first two months of 2021.

In our next article we will discuss how increasing interest rates in 2021 may complicate the de-risking decision.