De-risking in 2022 – Part 1

In this article, we provide our standard analysis of de-risking: how changes in interest rates and Pension Benefit Guaranty Corporation premiums may affect sponsor decisions to de-risk (or not de-risk) defined benefit plan liabilities in 2022. For purposes of this article, we focus solely on de-risking by paying out a deferred vested participant’s benefit as a lump sum and thereby eliminating the related liability.

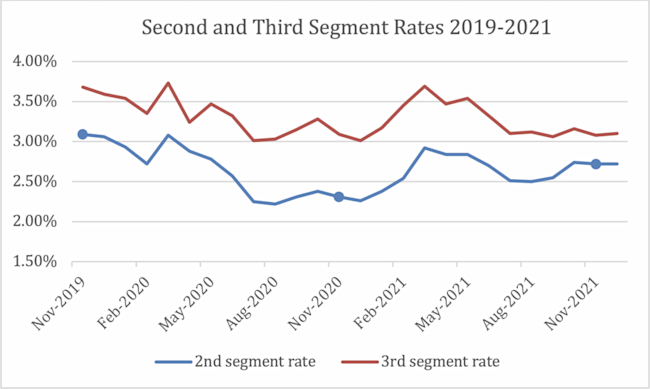

Our analysis reflects the fact that, while somewhat volatile, interest rates increased over 2021, with medium-term (2nd segment) rates up around 40 basis points (longer-term, 3rd segment rates were generally flat). These increasing rates present a number of significant and complicating issues for sponsors considering de-risking.

In our next article (De-risking in 2022 – Part 2) we will discuss: (1) The possibility that annuity (rather than lump sum) settlement may in some circumstances be less expensive than lump sum payment. (2) The possibility that if rates remain higher in 2022, de-risking in 2023 is likely to be less expensive. And (3) the possibility that, if rates remain higher, paying a lump sum this year may increase 2023 PBGC variable-rate premiums and produce an increased balance sheet net liability.

These factors may make the de-risking decision a complicated one for some sponsors. In this first article, however, our intent is to keep the analysis relatively simple, and just focus on the 2022 cost of lump sums vs. the cost of PBGC premiums.

We begin with a brief summary of our conclusions, followed by a more detailed analysis.

Summary

Bottom line: Because of increasing interest rates, the cost of de-risking in 2022 is slightly lower than in 2021. On the other hand, the savings from reduced PBGC premiums has increased, as those premiums have (marginally) increased.

We illustrate our analysis of the effect of interest rates and PBGC premiums on the de-risking decision by using a (relatively simple) example: the cost-of-benefit and de-risking gain with respect to a terminated vested 50 year-old participant who is scheduled to receive an annual life annuity of $1,000 beginning at age 65.

For our example participant, increases in interest rates (November 2020 vs. November 2021) have marginally reduced the 2021 base cost of paying this participant a lump sum benefit, vs. 2021, by around $210 (2%). On our assumptions, if a 50 year-old individual with a $1,000 benefit had been paid out in 2021, the cost would have been $10,428; in 2022 the cost would be $10,218.

The savings from de-risking this participant come from reduced PBGC premiums – $3,240 in PBGC flat-rate premiums and, where a plan is subject to the variable-rate premium headcount cap, $3,000-$6,000 in PBGC variable-rate premiums (depending on how long it will take for the plan to “fund-out” of the variable-rate premium cap).

The savings in PBGC premiums are, of course, “real” savings – PBGC premiums function (more or less) like a tax. On the other hand, the cost of the lump sum is offset by the associated reduction in total liabilities.

Finally, the de-risking calculation is relative and dependent on the sponsor’s view of, e.g., future interest rate trends and the cost/savings of paying a participant all benefits this year vs. paying them next year vs. simply paying them when due (e.g., beginning at age 65). (We will discuss these issues in our next article.)

What follows is a detailed discussion of these conclusions.

Interest rates

De-risking involves paying out the present value of a participant’s benefit as a lump sum. The interest rates used to calculate that present value are the Pension Protection Act (PPA) “spot” first, second, and third segment rates for a designated month. Many sponsors set the lump sum rate at the beginning of the calendar year, based on the spot rates in a prior year “lookback” month, so that participants will know what rate will be used to calculate their lump sum for the entire year. A plurality of plans use a November lookback month, which we use in our example. Under such an approach, for 2022 the lump sum rates would be the November 2021 PPA spot rates.

The following chart shows PPA spot second and third segment rates for the period 2019-2021.

Chart: PPA monthly average interest rates

As this data indicates, November 2021 2nd segment rates were up significantly (40 basis points) vs. November 2020 rates, while 3rd segment rates were flat.

As noted, based on these rates, the cost of de-risking our example participant decreased 2%, from $10,428 in 2020 to $10,218 in 2021.

(For purposes of this calculation, rather than doing a strict Tax Code 417(e) calculation, we simply assume the participant has a 21-year life expectancy at age 65.)

PBGC premiums

Reducing participant headcount, e.g., by paying out lump sums to terminated vested participants, reduces the PBGC flat-rate premium and may, depending on plan funding and demographics, reduce the variable-rate premium. Premiums for the current year are based on headcount for the prior year. So de-risking in 2022 will reduce premiums beginning in 2023.

PBGC flat-rate premiums

We are (conservatively) estimating the 2023 PBGC flat-rate premium to be $90 (the 2022 rate of $88 adjusted for one year of wage inflation).

For purposes of our analysis, we assume no inflation-related increases in PBGC premiums after 2023. We have not discounted the valued of saved premiums; our assumption is that wage inflation (by which premiums increase) will roughly offset real interest rates. On that (simplified) basis, the savings from the elimination of 36 years of PBGC flat-rate premiums for our example participant is $3,240. (Obviously, if the plan is or is expected to be terminated before 36 years, the savings will be less.)

Variable-rate premiums

In our article Reducing pension plan headcount reduces risk and PBGC premiums we discuss how de-risking can, in some cases, dramatically reduce the variable-rate premium. The logic of that is not especially intuitive. The gains come from the headcount-based cap on variable-rate premiums. We estimate (again, based on one year wage inflation) the 2023 headcount cap to be $600. Oversimplifying (and again assuming that the real discount rate is offset by increases in the cap based on wage inflation), depending on plan funding and demographics, de-risking (that is, lump summing-out) one participant in 2022 may save a sponsor $600 per year in PBGC premiums beginning in 2023.

As plan funding improves, however, these savings will go away. For purposes of our example we consider two alternative scenarios: the plan “funds its way out” of the per participant variable-rate premium cap after 5 years or 10 years, yielding savings of $3,000/$6,000.

Tradeoffs

As we discussed at the top, the saving, via reduced PBGC premiums, is “real” – it can be thought of in the same way as the savings from a reduction in taxes. The cost of a 2022 lump sum is not in the same category (that is, it is not “real”), because it is offset by a similarly decreased liability carried on the sponsor’s books.

There is, however, a cash flow effect: if a plan (on a market basis) is underfunded, paying out (100% of) a benefit will increase underfunding and may increase minimum funding requirements, although substantial increases in interest rate stabilization relief have made this possibility less likely in many cases.

* * *

We note that the savings from de-risking/headcount reduction remain significant. The wild card with respect to the cost of de-risking is the direction of future interest rates, especially as interest rates have continued to increase in 2022.

In our next article we will discuss how increasing interest rates in 2022 may complicate the de-risking decision.