DOL mulls ‘lifetime income’ illustrations for DC benefit statements

DOL considers ‘lifetime income’ illustration for DC benefit statements July 2, 2013

The Department of Labor has released an “Advance notice of proposed rulemaking” (ANPR) describing changes to rules for defined contribution plan benefit statements that it is considering. The new rules would require that DC benefit statements include disclosure of an estimated lifetime stream of payments based on (1) the participant’s current account balance and (2) the participant’s account balance projected to retirement.

The ANPR initiative is part of the Administration’s broader effort to get participants to view their DC benefits as, ultimately, the source of a ‘lifetime income.’ Quoting the ANPR:

Workers today face greater responsibility for managing their assets for retirement, both while employed and during their retirement years. This greater responsibility is primarily a result of the trend away from defined benefit plans, where a worker’s retirement benefit is typically a specified monthly payment for life, and toward defined contribution plans, where typically contribution, asset allocation, and drawdown decisions are assigned to the participant. Managing finances in order to provide income for life for oneself and one’s spouse is a tremendously difficult but important task. The rule under consideration by the Department would provide participants with information that the Department believes will ease the burden of this task.

In this article we discuss key elements of the ANPR.

Summary of the proposal under consideration

Let’s begin by noting that this is not a proposed regulation. It’s a description of a proposal DOL is ‘considering.’ Thus, the goal of this ANPR “is to provide an early opportunity for interested stakeholders to provide advice and input into the policy development of future proposed regulations.”

Briefly, the proposal being considered is to change current benefit statements regulations to require that the administrator of a DC plan include in each benefit statement four items:

(1) The participant’s current account balance (required under current rules).

(2) The estimated lifetime stream of payments that that current account balance could ‘buy’ at normal retirement age.

(3) The participant’s account balance projected to the participant’s normal retirement age, assuming continued contributions, increased for (inflation-adjusted) earnings.

(4) The estimated lifetime stream of payments that the projected account balance could ‘buy.’

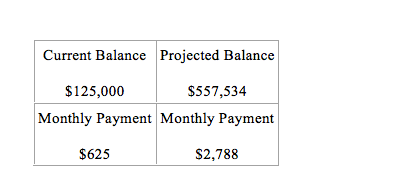

DOL provides the following example of such a disclosure:

The presentation of this data on a participant’s or beneficiary’s benefit statement might look something like this:

DOL’s idea is to present these numbers in terms of ‘today’s dollars,’ so projections of benefits will include a cost of living ‘deflator.’

This relatively simple description raises a number of questions which we address in the rest of this article.

To project or not to project?

The first ‘threshold’ issue DOL confronted in this initiative was whether to require that an administrator describe the stream of payments the participant’s current balance could ‘buy’ or a projected stream of payments, taking into account future contributions and investment earnings from the statement date to retirement age. DOL is considering requiring both.

‘Draw down’ vs. life annuity?

The second ‘threshold’ issue was whether, for purposes of, e.g., the ‘monthly payment’ in the above example, to convert a participant’s account balance into a stream of payments using a ‘draw down’ or ‘life annuity’ methodology. Under the ‘draw down’ method the participant withdraws each year a fixed dollar amount or a fixed percentage (e.g., 4%) of the account until the account is gone. A life annuity approach calculates a (monthly) payment for the participant’s lifetime based on mortality and interest rate assumptions. In the ANPR DOL adopted the life annuity approach.

Key variables

Given those ‘threshold’ decisions, there are several variables that will affect the calculations. With respect to projecting the value of a participant’s account balance to normal retirement age, the key variables are: (1) the assumed rate of future contributions; (2) the assumed investment returns; and (3) the assumed rate of inflation.

With respect to the conversion of the participant’s account balance into an annuity-based ‘lifetime stream of payments,’ the key variables are: (4) the assumed (post-retirement) mortality; and (5) the assumed (post-retirement) interest rate.

Rules for projections

With respect to projections, DOL is considering providing both a general rule and a safe harbor.

The general rule being considered is: “projections shall be based on reasonable assumptions taking into account generally accepted investment theories.” The projection must, however, be expressed in current dollars and take into account future contributions, investment returns, and inflation. Generally, DOL’s idea is, within these limits, to allow room for ‘best practices’ developed in, e.g., education and advice software currently in use.

Under the safe harbor the administrator would assume: (1) contributions continue to normal retirement age at the current annual dollar amount, increased at a rate of 3% per year; (2) investment returns of 7% per year (nominal); and (3) inflation of 3% per year. Thus, if this year’s contribution is $10,000, then next year’s contribution would (under the 3% per year increase assumption) be assumed to be $10,300. The 7% nominal investment return / 3% inflation assumption nets out roughly to an assumed 4% ‘real’ return.

One of the major concerns of some sponsors with respect to illustrations of account projections is the possibility of litigation where actual results underperform projections. In that context, it’s not clear how many sponsors will be willing to produce benefit statements that include projections that significantly deviate from those you would get if you used the safe harbor assumptions.

Rules for converting an account balance to a stream of payments

Under the rule DOL is considering, in calculating the lifetime income that a participant’s account balance can ‘buy,’ the administrator may generally use any mortality and interest rate assumptions it chooses so long as each assumption is “reasonable taking into account generally accepted actuarial principles.”

DOL also is considering providing the following safe harbor assumptions:

A mortality assumption determined under Tax Code section 417(e)(3)(B) (generally used in calculating lump sum benefits in defined benefit plans).

An interest rate assumption based on the 10-year constant maturity Treasury securities rate.

Cost and risk

DOL acknowledges that commenters on its (2010) Request for Information (RFI) on lifetime income options and witnesses at the related (2010) hearing did not believe that mandated ‘lifetime income’ disclosure was appropriate. “According to these individuals, mandating lifetime income illustrations would be expensive and may expose plan fiduciaries to litigation from plan participants and beneficiaries for a variety of reasons.”

DOL believes concerns on both these issues – cost and litigation risk – are ‘overstated.’ It is, however, asking for information and comments on the cost issue. DOL believes that concerns about litigation may be addressed by a clear disclaimer and use of the safe harbors.

Conclusion

It should be emphasized that this is not even a proposed rulemaking. Rather, DOL is, in effect, circulating for comment a proposal it is seriously considering. Quoting DOL:

[T]he Department has not concluded that the [ANPR’s] regulatory framework is the only or best approach. The Department intends to consider all reasonable alternatives to direct regulation, including whether there is a way short of a regulatory mandate to get plan administrators voluntarily to provide their participants and beneficiaries with constructive and helpful lifetime income illustrations.

The final decision on all of the issues we have considered in this article remains open: (1) whether either or both of current and projected account balances should be used; (2) how projections should be made; (3) how the conversion to a stream of payments should be made; (4) whether there should be safe harbors and how they should work; and (5) (indeed) whether there should be mandated lifetime income disclosure at all.

DC plan sponsors will want to consider whether the framework DOL is considering makes sense for their plan participants and whether it can be improved. Critically, they will want to evaluate with counsel whether lifetime income disclosure may increase litigation risk, whether the safe harbors DOL is considering reduce or eliminate that risk, and whether those safe harbors will work for their plan, at a reasonable cost.

We will continue to follow this issue.