Fundamentals of PBGC Premiums

The Pension Benefit Guaranty Corporation (PBGC) was created as part of the Employee Retirement Income Security Act of 1974 (ERISA) to insure benefits for participants in qualified defined benefit plans in the event employers who sponsor these plans are unable to fulfill their commitments.

The PBGC oversees two programs, one for “single-employer” plans and another for “multiemployer” plans. The focus of this paper is on the single-employer program.

With limited exceptions (government plans, non-electing church plans, and certain small plans), PBGC coverage is mandatory for all qualified pension plans sponsored in the USA.

PBGC insurance is financed mostly by premiums collected from pension sponsors, not by tax revenue. When the program was first established in 1974, the annual premium rate was $1 per participant. Since then, however, premium rates have escalated dramatically.

Premium Rates

Typically paid annually, each plan’s total premium is equal to the sum of the flat rate premium (FRP) and, for single- employer plans, the variable rate premium (VRP).

FRP = Applicable FRP rate × Number of plan participants

VRP = Applicable VRP rate × Plan’s unfunded vested benefits (UVBs)

The easiest way to think about these two parts is: the FRP generally increases with the size of the plan, and the VRP generally increases with the size of the plan’s underfunding. For this purpose, underfunding is measured by UVBs, equal to the difference between plan assets and the plan’s PBGC vested benefit liability.

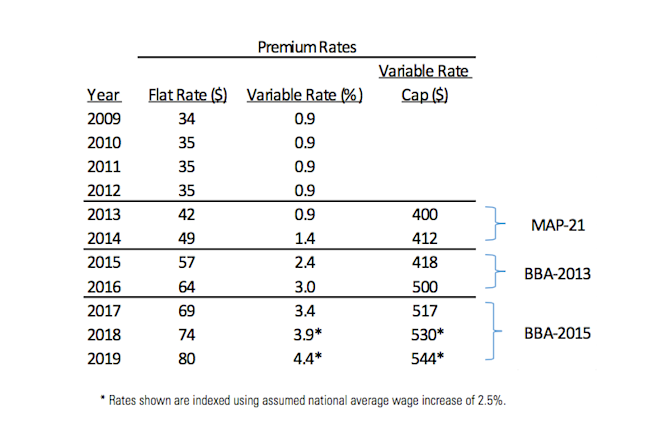

In just the past five years, PBGC premiums have increased in three successive laws passed by Congress and signed by the Administration:

The Moving Ahead for Progress in the 21st Century Act (“MAP-21”) in 2012

The Bipartisan Budget Act of 2013 (“BBA-2013”)

The Bipartisan Budget Act of 2015 (“BBA-2015”)

Beginning with the 2013 premium payment year, MAP-21 also introduced the variable rate premium cap (“cap”), which limits VRPs to a specific dollar amount per participant.

Prior to 2013, premium rates were relatively stable for several years, with the FRP set at $34-$35 and the VRP set at 0.9% of UVBs. With the passage of MAP-21, BBA-2013, and BBA-2015, rates increased per the following schedule:

Having laid out the history of PBGC premium rates above, in our next article we will turn next to the actual cost of premium increases to plan sponsors, in terms of dollars and as a percent of plan assets.