House Democrats propose new round of stimulus that includes significant DB minimum funding relief

On May 12, 2020, House Democrats introduced the Health and Economic Recovery Omnibus Emergency Solutions Act (HEROES Act), in effect another round of Covid-19-related stimulus legislation. The bill includes a number of provisions related to retirement plans, most importantly, for single employer defined benefit plans, significant revisions to the ERISA minimum funding standards.

In this article we review the bill’s minimum funding proposal and certain other retirement plan related proposals and then (very briefly) consider the outlook for passage of this legislation.

Liberalization of minimum funding rules

The HEROES Act would reduce ERISA defined benefit plan minimum funding requirements in three ways:

1. Increase/extend interest rate stabilization relief:

In the sidebar we review current rules with respect to the interest rate required to be used to determine liabilities for minimum funding purposes under ERISA, as amended by the PPA and HATFA. The HEROES Act would both increase and extend current 25-year average interest rate stabilization relief.

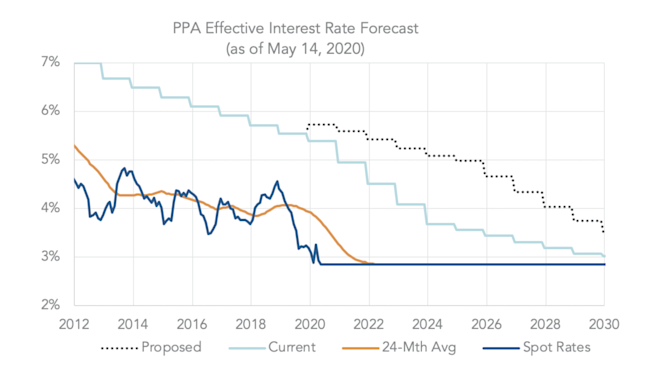

The table below summarizes interest rate stabilization under (current) HATFA rules and (alternatively) under the HEROES Act proposal.

Table 1: Current and proposed interest rate stabilization.

Thus, under the HEROES Act, valuation interest rates would (beginning in 2020) be increased from 90% to 95% of the 25-year average, with that higher percentage relief extended through 2025.

Obviously, in the current very-low interest rate environment, this change would considerably reduce minimum funding requirements.

2. 5% floor on 25-year average rate: The bill provides that “if the average of the first, second, or third segment rate for any 25-year period is less than 5 percent, such average shall be deemed to be 5 percent.” This floor would have the effect of immediately increasing the first segment rate. If interest rates continue at their current levels, this floor will apply to the second segment rate beginning in 2025 and the third segment rate beginning in 2029. By 2030, rates will have reached the lowest level achievable under this law, 3.50%.

The chart below shows the effect of proposals 1 and 2 on valuation interest rates.

Chart 1: Minimum funding under current rules and HEROES Act proposal

3. Amortization bases set to zero as of 2020, 15-year amortization going forward: Current (PPA) rules require amortization of shortfalls over seven years. This change would (again, obviously) allow funding of shortfalls over a much longer period.

We note that changes 1 and 2 would be especially useful to plans/sponsors concerned about falling below the 80% benefits-restriction trigger.

* * *

Sidebar: HATFA, 24-month average and spot interest rates

HATFA rates are minimum funding interest rates determined under the Highway and Transportation Funding Act (HATFA), as amended by the Bipartisan Budget Act of 2015 (BBA). For 2019 and 2020, HATAFA rates are based on 90% of the average of rates for a (trailing) 25-year period. They may generally be used for determining minimum funding, but not for determining PBGC variable-rate premiums. HATFA rates are significantly higher than 24-month average and spot rates in the near term.

24-month average rates are minimum funding interest rates determined under the Pension Protection Act (PPA). They are the average of rates for a (trailing) 24-month period. They are used for determining minimum funding and may (subject to certain limitations) be elected as an “alternative” method for determining PBGC variable-rate premiums.

Spot rates are 1-month average rates and can be thought of (more or less) as market rates. They may (alternatively) be used for plan funding and are the default method for determining variable-rate premiums.

In each case, the index for calculating these rates is high quality corporate bonds.

* * *

No change to PBGC premium rules

As we have discussed (e.g., see our article Markets 2020 – effect on PBGC variable-rate premiums and strategies to reduce them), the funding policy of many sponsors is driven not by ERISA minimum funding rules but by Pension Benefit Guaranty Corporation variable-rate premiums, which function (in effect) as a tax on underfunding, determined (more or less) based on market interest rates, without taking into account interest rate stabilization.

The HEROES Act does not change the variable-rate premium rules. Thus, in effect, if the HEROES Act passes and a sponsor further delays funding, it will likely have to pay higher PBGC premiums.

Other retirement plan-related provisions of the HEROES Act

The bill also:

Provides significant multiemployer plan minimum funding relief: We expect to cover this issue in a follow-on article.

Waives required minimum distribution rules for DC plans for 2019: The CARES Act generally waived the RMD rules for 2020 for DC plans. The HEROES Act would extend this relief to 2019 RMDs, which then could be rolled in to, e.g., an IRA.

Waives the 60-day rollover rule for 2019 and 2020 distributions: These distributions could generally be rolled into an IRA or qualified plan by November 30, 2020.

Clarifies that a plan administrator may rely on employee certification for Covid-19 related loans: The provision would extend the reliance-on-certification rule for distributions to the CARES Act liberalized plan loan rules.

Extends CARES Act 401(k) distribution rule to money purchase plans: The CARES Act suspended 401(k) distribution limitations and liberalized the loan rules for Covid-19 related distributions/loans. The HEROES Act would extend that relief to money purchase plans.

Outlook

This is not (yet) a bipartisan bill, and there is opposition to some of its (non-retirement plan related) proposals. It is likely that negotiations with the Republican-controlled Senate will result in changes.

Nevertheless, many expect another round of Covid-19 related stimulus. And the HEROES Act’s funding relief provisions are likely to raise considerable revenue. With emerging concern about the cost of further stimulus, that feature makes them a likely candidate for inclusion in any final bill.

* * *

We will continue to follow this issue.