How will the Fed interest rate increase affect pension plans?

On Wednesday, December 16, 2015, the Federal Reserve Federal Open Market Committee announced that it had “decided to raise the target range for the federal funds rate to 1/4 to 1/2 percent.” The target range has been, for the last seven years, 0 to 1/4 percent – so this represents, roughly, a 25 basis point increase in short term rates.

For most defined benefit plans interest rates are the most significant variable in plan valuations. In this article we review how the Fed’s action may affect DB plan sponsors’ (1) financial statements, (2) funding and (3) de-risking decisions. We begin with a discussion of the effect of the Fed’s action on interest rates generally.

Interest rates – generally

The FOMC action only affects short-term rates. Most DB plan liabilities are, however, not short-term. Thus the effect of the Fed rate increase on DB plan finance will depend on the extent to which it results in changes in rates across the yield curve. With respect to that issue, different analysts have different views: some, for instance, believe that an increase in short-term rates may lead to a decrease in long term rates, due to a combination of lower inflation expectations and, potentially, lower growth prospects.

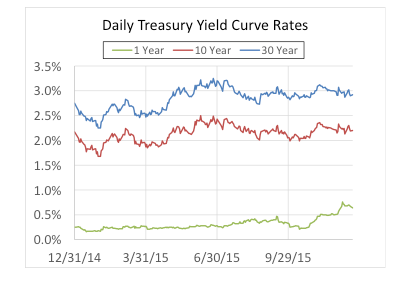

Below is a chart showing 1-, 10- and 30- year Treasury Yield Curve rates for 2015 (through December 21).

Source: United States Treasury

Note that while short-term rates have responded to the Fed announcement by moving higher in recent weeks, long-term rates are all, even after the FOMC announcement, below their June highs.

Bottom line: it’s not at all obvious that the FOMC rate increase will translate into higher DB liability valuation rates.

There is also another unknown: will there be further Fed rate increases? The answer to that question depends on how markets and the economy react to this one. In its statement, the FOMC said “In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2% inflation.”

Optimistic and pessimistic scenarios

In this context, to consider how the Fed action might affect DB plan valuations, we use two different scenarios (out of a nearly infinite number of possible ones):

Optimistic: Fed short-term interest rate increases result in a 50 basis point increase in rates across the yield curve. (We call this ‘optimistic’ because of its effect on DB plan finance – higher interest rates = lower liabilities.)

Pessimistic: Medium-term rates are unchanged and long-term rates go down 50 basis points.

These scenarios aren’t intended as predictions. Rather they are simply a way to understand how different interest rate conditions will affect DB plan finance.

Now let’s turn to the possible effect of these changes on DB sponsor accounting, funding and de-risking.

Accounting

Considering the effect of changes in rates on two different types of plans, shorter duration (e.g., 9 years) and longer duration (e.g., 15 years), 2015 valuation interest rates at maturities up to at least 15 years are higher under either scenario (optimistic or pessimistic) than they were at the end of 2014, reducing pension liabilities for most sponsors. Under a pessimistic ‘flattening yield curve’ scenario, however, much of this reduction could be cancelled by the impact of lower long-term rates, particularly for the longer duration plan.

We consider these issues, and also discuss the effect of changes in mortality assumptions, in detail in our article Accounting impact of changes in interest rate and mortality assumptions.

Funding

The story here is very simple: Under almost any foreseeable scenario, for funding, liability valuations have, in effect, been insulated from market interest rate changes by interest rate stabilization. We provide a detailed analysis of this effect in our article Funding impact of changes in interest rate and mortality assumptions. We note that, since we posted that article (in August), Congress passed the Bipartisan Budget Act of 2015, extending interest rate stabilization relief for another three years.

De-risking

By ‘de-risking’, we mean settling a liability either by paying out a lump sum or buying an annuity. The cash cost of paying out a lump sum is determined by federal rules; the cash cost of an annuity is determined by market rates. In both cases, the accounting effect is determined by Financial Accounting Standards Board rules.

With respect to lump sums, valuation interest rates get different treatment under cash and accounting rules. The amount of a lump sum to be paid out (the cash cost to the plan) is determined based on PPA ‘spot’ first, second and third segment rates for a designated month. Many sponsors set the lump sum rate at the beginning of the year, based on prior year November interest rates, so that participants will know what rate will be used to calculate their lump sum for the entire year. For those sponsors, the lump sum interest rate for 2016 will generally be pegged at November 2015 spot rates. Those rates reflects conditions before the Fed rate increase, but as the chart at the top indicates, rates were actually higher in November than they are now.

For accounting (that is, for purposes of determining the amount of liabilities that will be subtracted from the balance sheet when a lump sum is paid out), the lump sum valuation interest rate is typically set based on prior-year December 31 spot rates. So, e.g., for accounting purposes the lump sum interest rate for 2016 is based on the December 31, 2015 rates.

If, on the one hand, we get a spike up in interest rates before year-end (which we haven’t seen yet), so that December year-end interest rates are higher than November interest rates, then in 2016 it may cost sponsors more in cash to pay out a lump sum than the sponsor will be able to write off for financial statement purposes. If, on the other hand, interest rates stay flat through year-end, so that December year-end interest rates are lower that November rates, then in 2016 it may cost sponsors less (cash vs. accounting) to pay out a lump sum.

That phenomenon is, however, only an accounting-cash mismatch. As our first chart indicates, December 2015 medium- and long-term rates are up (marginally) relative to December 2014, and that will generally make de-risking marginally ‘cheaper’ in 2016 relative to 2015.

At this point it is probably not useful to speculate about the effect of end-of-2016 interest rates on de-risking in 2017.

For a more detailed discussion of these issues, see our article De-risking activity: Impact of interest rate and mortality assumption changes.

* * *

We will continue to follow this issue.