Implications of MAP-21 for DB plan finance

In this article we project MAP-21interest rates to the end of the decade. We then consider the implications of MAP-21 relief for plan funding and sponsor decisions about the management of plan finance. (For detail on how MAP-21 works, see our article Pension Funding Relief / PBGC Premium Increases.)

Cash only

MAP-21 affects minimum funding rules under ERISA. It does not affect accounting. The law is primarily of interest to plan sponsors for whom the upcoming pension contributions are a ‘big deal.’

Moreover, while at the margin changes in plan contribution requirements will always have some effect, MAP-21’s changes are most significant where a plan is material relative to the sponsor’s own financial situation, e.g., where plan liabilities and funding requirements are large relative to market capitalization.

MAP-21 and the future

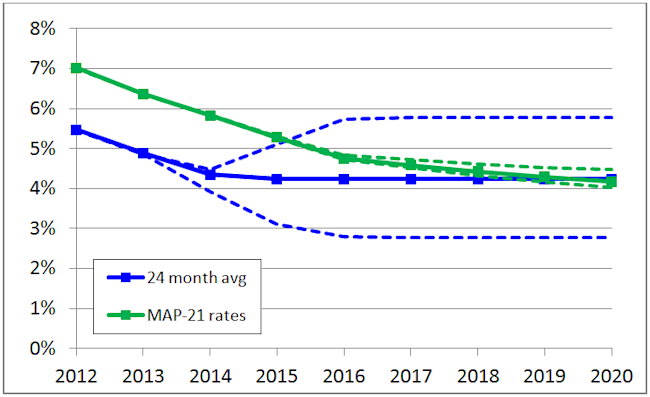

The following chart projects to 2020: (1) MAP-21 rates; (2) 24-month average rates (i.e., the rates that would have applied but for MAP-21); and (3) sensitivity — 24-month average rates if rates go down 100 basis points or up 200 basis points.

Chart 1 — Projected MAP-21 “effective” rates compared to 24-month average rates — “medium duration” plan (dashed lines reflect interest sensitivity)

Methodology: IRS has only published 2012 MAP-21 rates. We are projecting to 2020 based on those rates; IRS has indicated that it may change its methodology. We assume a plan with a “medium” duration, although the relationship illustrated above holds for most pension plans.

What does this mean?

From this chart we draw the following (tentative) conclusions:

If interest rates stay flat, (“typical”) DB plan sponsors enjoy declining “downside” funding protection through 2019 (the solid green line remains above the solid blue line until 2020.)

For a considerable part of that period the protection (the “relief”) is significant in terms of the size of the “increase” in valuation interest rates that MAP-21 provides.

Even when (in, e.g., 2019) the relief is not very significant, the effect of the “floor” – the fact that rates cannot go lower – is significant.

If interest rates go down, the protection will last longer; if rates go up, the protection will phase-out sooner (and, of course, it will be less necessary.)

“Relief from funding”

One element of this analysis bears further discussion. One effect of MAP-21 is to reduce the amount of cash that a sponsor has to put into a plan. That relief continues to the end of the decade, but it gets smaller as MAP-21 relief “phases down.”

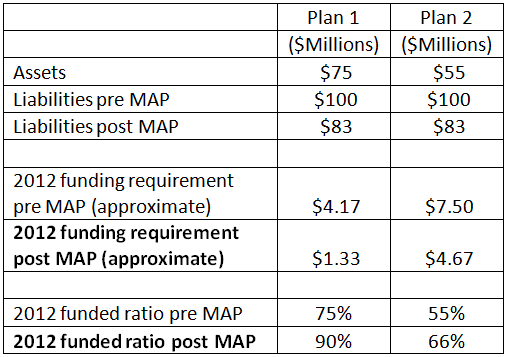

To get a feel for how significant that funding relief is, consider the examples in the table below (for the sake of simplicity, we are assuming no new benefits are being earned). The examples reflect a (typical) reduction in the plans’ 2012 liability of 17% due to relief. (We discuss the value of 2012 relief further in our article 2012 segment rates under MAP-21 released by IRS.)

Chart 2 — Effect of a 17% reduction in liability valuations for 2012

The 2012 minimum required contribution goes down 68% for Plan 1 and 38% for Plan 2. Plan 1 moves out of “less than 80%” benefit restriction status, and Plan 2 moves out of “less than 60%” restriction status.

We provide this information simply to show that MAP-21 funding relief will, for some plans at least, be a “big deal” in 2012 (and, for that matter, 2013). It will reduce funding requirements significantly (relative to what they would have been), and it will increase funded ratios significantly.

As noted, this effect of MAP-21 – a function of the difference between the green line and the blue line in Chart 1 – will go down considerably over the decade.

Bottom line: in the short run, sponsors will have more cash than they otherwise would have.

“Relief from risk”

But another effect of MAP-21 is to reduce sponsors’ “downside” funding risk. If interest rates go down further (from current levels), the MAP-21 floor will be effective into the next decade. Fundamentally, sponsors will (to a great extent) know what interest rates are (for funding purposes), and that they can’t get worse, for a very long time. (Further decreases in interest rates will reduce the floor, but because the impact is averaged over 25 years, it will generally be marginal, as shown in Chart 1.)

Because of this “relief from risk” effect, the need for sponsors to hedge downside funding risk is significantly reduced. What does that mean?

Ordinarily, in order to reduce exposure to the possibility that interest rates may go down further, a sponsor would have to employ some sort of “LDI” (liability driven investment) strategy: enter into an (overlay) swap or simply buy more fixed income securities.

Under MAP-21, certainty about the lower bound of interest rates will reduce the need for swaps-based hedging. The issue of asset allocation is a little more complicated.

Sponsors generally face two financial risks with respect to plan funding — asset performance risk and interest rate risk. Investment in fixed income securities reduces both of these risks. That is, bonds are generally thought to be a safer investment than equities. And they “hedge” interest rate risk — as interest rates go down, the value of the bond (generally) goes up. With the lower bound of valuation interest rates (more or less) fixed by MAP-21 for the next several years, the attractiveness of investing in bonds to hedge interest rate risk is significantly reduced.

Direction of interest rates

PPA funding rules for DB sponsors have been described as “pay me now or pay me later.” In some sense this is true of any DB funding policy, with the real question being “how much later?” and PPA answering “not more than seven years.”

MAP-21 represents the fourth “tweaking” of PPA funding rules since the law became effective in 2008, largely in response to unprecedented movements in financial markets over the past four years. Each iteration has pushed the date of required full funding for DB sponsors farther off into the future, allowing employers to buy some additional time to cope with financial turmoil.

As we discuss in our article How low can you go? Interest rates and DB plans, current costs are to a great extent driven by interest rates and the decline in interest rates over the last 30 years. The effect over the last 10 months has been particularly dramatic and was part of what drove support for MAP-21 relief.

If interest rates go up in the short run, or if the long-term downward trend of interest rates reverses, then sponsors may conceivably not have to “pay later.” MAP-21 in effect will allow sponsors to ignore what will have turned out to be a “temporary” decrease in rates. If sponsors feel compelled to hedge downside interest rate risk — through swap transactions or going “long” bonds — they generally would not benefit from this increase in rates. MAP-21 allows them to avoid this situation and thus the opportunity (at least) to capture the “value” of a future rise in interest rates.

Three major qualifications —

The purpose of the foregoing discussion is to illustrate the consequences of MAP-21 relief under certain conditions. In that regard, we emphasize the following:

We assume no knowledge of the direction of future interest rates.

IRS has said that it is considering using a different methodology for the calculation of MAP-21 rates for 2013 and later. A different methodology will produce different results (although the principles are likely to remain the same).

None of the foregoing has anything to do with earnings or other accounting consequences, which are unaffected by MAP-21.

Returns and interest rates

A fourth qualification is worth making separately. The issue of interest rate risk with respect to DB plans is (to say the least) non-transparent and not always well understood. To the extent that low interest rates are correlated with low asset performance, money “saved” from interest rate relief may have to be “paid later” anyway, as funding “shortfalls” are driven by poor asset performance. This is particularly likely if low interest rates persist for the foreseeable future.

* * *

We expect that as sponsors consider further the impact of MAP-21 on plan finance they will develop a variety of strategies in response.

We will continue to follow these issues.