June 2016 Pension Finance Update

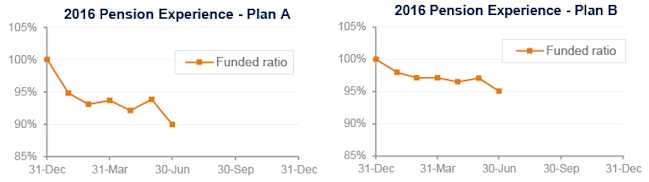

Financial markets have been roiled in the past week by Brexit, adding to pain pension sponsors had already been suffering this year. Both model pension plans we track1 suffered setbacks in June – Plan A lost 4% last month, while Plan B was off 2%. Through the first half of 2016, Plan A is now down 10% and Plan B is down 5%:

Assets

Stocks were mostly down in June: the S&P 500 was flat, but NASDAQ lost more than 2%, the small-cap Russell 2000 was down 1%, and the overseas EAFE index fell more than 4%. For the year, the S&P 500 remains up more than 3% and the Russell 2000 is ahead 1%, but the NASDAQ is down more than 3% and the EAFE index has lost 4%.

A diversified stock portfolio lost 1% during June and is now up less than 1% for the first half of 2016.

Falling interest rates, compounded by Brexit, pushed bonds to their best month of the year in June, generating returns of 2%-4% on the month, with long duration bonds and Treasuries doing best. For the year, bonds are now up 6%-9%, with longer duration bonds and corporates enjoying the best results.

Overall, our traditional 60/40 portfolio was flat during June and finished the first half of 2016 up 2%-3%, while the conservative 20/80 portfolio added 1%-2% last month and has earned 6%-7% so far during 2016.

Liabilities

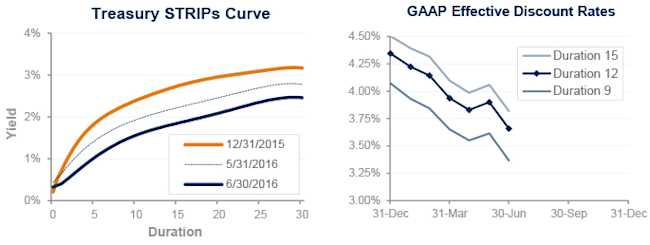

Pension liabilities (for funding, accounting, and de-risking purposes) are now driven by market interest rates. The graph on the left compares Treasury STRIPs yields at December 31, 2015 and June 30, 2016, and also shows the movement in rates last month. The graph on the right shows our estimate of movements in effective GAAP discount rates for pension obligations of various duration during 2016:

Treasury yields fell 0.3% during June and are down more than 0.70% this year. Meanwhile, corporate bond yields fell 0.25% last month and are now down almost 0.70% in 2016.

The move pushed pension liabilities up 4% last month; liabilities are now 12%-16% higher than at the end of 2015, with long duration plans seeing the biggest increases.

Summary

2016 has been a painful year for pension sponsors so far – assets are up a bit, but liabilities have seen double-digit increases, as long-term interest rates reach all-time low levels, in part due to the recent Brexit.

The graphs below show the movement of assets and liabilities for our two model plans this year:

Looking Ahead

The Obama Administration and Congressional leaders passed a budget last fall that includes a third round of pension funding relief since 2012. The upshot is that pension funding requirements over the next several years will not be appreciably affected by current low interest rates (unless these rates persist). Required contributions for the next few years will be lower and more stable than under prior law.

Discount rates fell a full quarter point last month. We expect most pension sponsors will use effective discount rates in the 3.3%-3.9% range to measure pension liabilities right now. These rates are as low as we’ve ever seen.

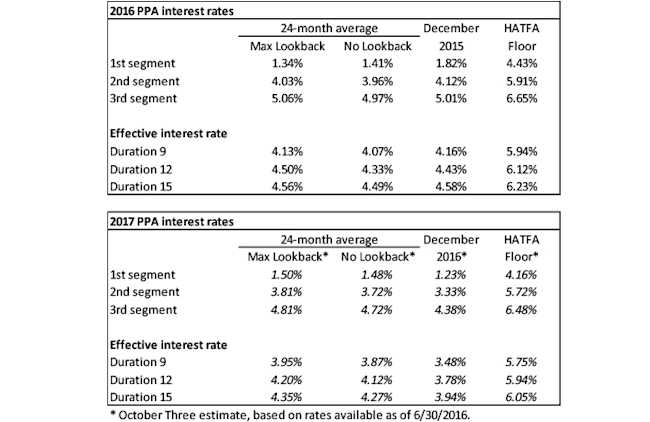

The table below summarizes rates that plan sponsors are required to use for IRS funding purposes for 2016, along with estimates for 2017. Pre-relief, both 24-month averages and December ‘spot’ rates, which are still required for some calculations, such as PBGC premiums, are also included.