Markets 2020 – DB finance as of the end of May 2020

As we discussed in our introduction to these issues, the current situation is (to state the obvious) very volatile. In this article we update our analysis of three critical defined benefit finance issues – minimum funding, Pension Benefit Guaranty Corporation premiums, and settlement – in light of interest rate and asset market developments since the end of March 2020.

Minimum funding: The key conclusions in our March 24, 2020, article have not changed. Funding requirements for 2020 for a calendar year plan were locked in as of January 1, 2020. 2020 asset declines may affect minimum funding as early as 2021. Interest rate declines won’t show up in minimum funding numbers until 2023. If they persist.

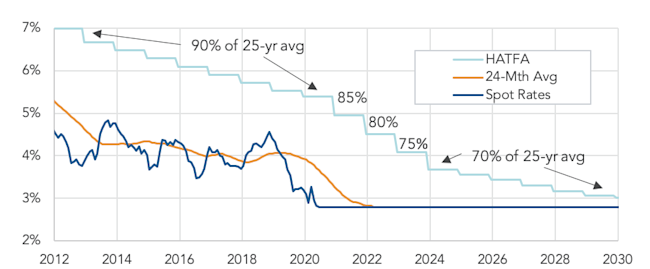

What has changed since our last article? Two things: First, on March 24, we were projecting that that (higher) market interest rates would take sponsors out of the HATFA interest rate stabilization regime beginning as early as 2025 or 2026. If current (end of May 2020), much lower rates persist, however, we’re now projecting that sponsors will have to live with lower HATFA valuation interest rates for the foreseeable future – past 2030. (We note that the proposed HEROES Act would significantly ease HATFA valuation interest rates.)

The chart below projects market and HATFA 25-year average rates based on current conditions.

Chart: Valuation interest rates for ERISA minimum funding

Second, asset performance – which generally has a more immediate effect on plan funding – has generally improved since late March – making near-term asset-driven minimum funding issues less likely for some plans. When we wrote on this issue on March 24, 2020, equities were down 30% on the year. Through May 21, they are only off around 11%. And bonds are up 7%-10% on the year.

As we have discussed, 2020 asset losses will have no effect on 2020 funding. They may, however, increase a plan’s funding shortfall and minimum funding requirements for 2021. That shortfall will generally have to be paid for beginning in 2022, starting with 2022 quarterlies and ending with the September 2022 residual contribution for 2021.

Moreover, sponsors that want or need to stay above 80% funding, e.g., to avoid benefit restrictions, may as a result of asset losses have to make contributions in 2021.

PBGC premiums: Unlike minimum funding, which is subject to HATFA 25-year average interest rate stabilization, PBGC variable-rate premiums are determined based on a liabilities-minus-assets calculation of “unfunded vested benefits” (UVBs) that reflects market interest rates (entirely or based on 24-month average rates at most) and the fair market value of assets. Thus, e.g., 2021 variable-rate premiums will reflect 2020 interest rates and assets.

Interest rate declines – as noted, around 50 basis points since the beginning of the year – and asset declines are going to trigger or increase the payment of variable-rate premiums (often significantly) for many sponsors in 2021.

We estimate that a duration 12 plan, with a 60/40 equity/fixed income portfolio, that (on a fair market value basis) was 100% funded on January 1, 2020, is about 90% funded as of May 21, 2020. For a $100 million dollar plan, this translates to $10 million in unfunded liabilities and a 2021 variable premium of $450,000. That is down from our estimate of $500,000 for the same plan as of March 23, 2020.

Our March 2020 article details these issues and discusses strategies for reducing PBGC premiums.

We also note that for some plans the most significant decision will be whether to elect the Alternative method for calculating UVBs for 2020. We discuss that issue in the sidebar.

* * *

Sidebar: using the Standard vs. the Alternative method to calculate 2020 UVBs

In 2019 we posted an article discussing in detail the issues presented by using either the Standard (generally, December spot interest rates) or Alternative (24-month average rates) method to calculate UVBs (used to determine underfunding for PBGC variable-rate premiums).

We note that using the Alternative method (vs. the Standard method) for calculating UVBs in 2020 will produce a more significant reduction in 2020 premiums than this election has in any previous year. Based on current rates, the Alternative method is also likely to produce a much lower premium for 2021. For sponsors using the Standard method for 2019, who are free to elect the Alternative method for 2020, this is likely to be the most important “lever” they can use to reduce PBGC premiums (literally) in the history of PBGC premium elections.

This election, however, does not have to be made until October of this year, and sponsors will want to reassess the situation in early October before making any final decision.

* * *

Settlement: At the beginning of May we posted an article about the effect of changes in market interest rates on the settlement decision – whether to pay out (as a lump sum or annuity) current DB benefits. Summarizing, the four key datapoints affecting the settlement decision, in the current context, are:

1. Lump sum valuation rates generally are more favorable (currently, around 50 basis points higher) than current market rates.

2. Savings in PBGC premiums may be considerable.

3. Many participants need cash now and may be eligible for favorable tax treatment. And, indeed, late 2019 rates produce higher lump sums than in any previous year.

4. The one wild card facing sponsors is the direction of future interest rates.

Our article provides details on these issues.

* * *

We intend to regularly update these key DB finance datapoints for the duration of the current crisis.