May 2019 Pension Finance Update

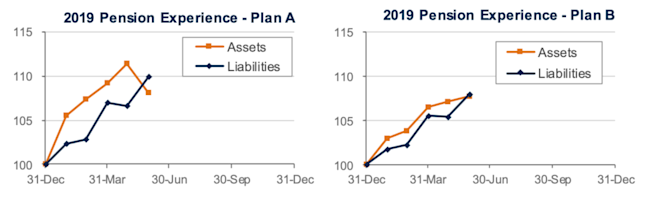

Pension finances got clobbered in May, due to falling stock markets and lower interest rates, giving back gains enjoyed earlier in the year. Both model plans we track[1]lost ground last month: Plan A lost 6% and is now down almost 2% for the year, while Plan B lost close to 2% and is now basically flat through the first five months of 2019.

Pension finances got clobbered in May, due to falling stock markets and lower interest rates, giving back gains enjoyed earlier in the year. Both model plans we track[1]lost ground last month: Plan A lost 6% and is now down almost 2% for the year, while Plan B lost close to 2% and is now basically flat through the first five months of 2019:

Assets

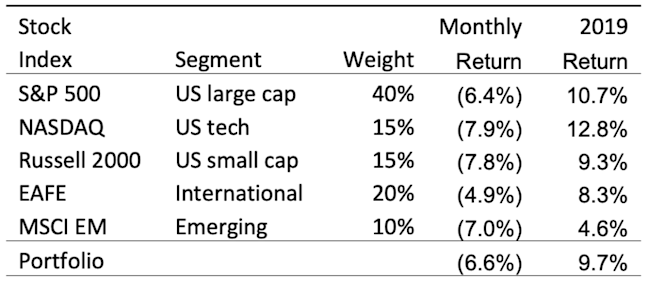

Stocks lost 5%-8% in May but remain up by a decent amount so far in 2019. The table below summarizes returns on various stock indexes included in our model portfolio:

Bonds added more than 2% during May, as Treasury yields plunged more than 0.3% at most maturities while corporate bond yields fell by 0.2%. For the year, bonds have earned 6%-8%, with long duration and corporate bonds performing best.

Overall, our traditional 60/40 portfolio lost 3% in May but is still up 8% for the year, while the conservative 20/80 portfolio gained less than 1% last month and is up almost 8% during 2019.

Liabilities

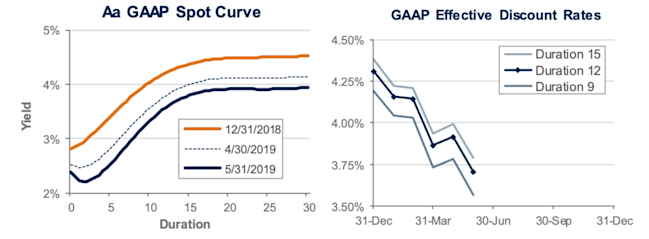

Pension liabilities (for funding, accounting, and de-risking purposes) are driven by market interest rates. The graph on the left compares our Aa GAAP spot yield curve at December 31, 2018, and May 31, 2019, and it also shows the movement in the curve last month. The graph on the right shows our estimate of movements in effective GAAP discount rates for pension obligations of various duration during 2019:

Corporate bond yields fell by 0.2% in May, increasing pension liabilities 2%-3%. For the year, liabilities are now up 7%-11%, with long duration plans seeing the largest increases.

Summary

Interest rates have fallen more than 0.5% this year, pushing pension liabilities higher. Combined with the stock market correction in May, pension sponsors now find themselves treading water or modestly underwater this year. The graphs below show the progress of assets and liabilities for our two model plans through the first five months of 2019:

Looking Ahead

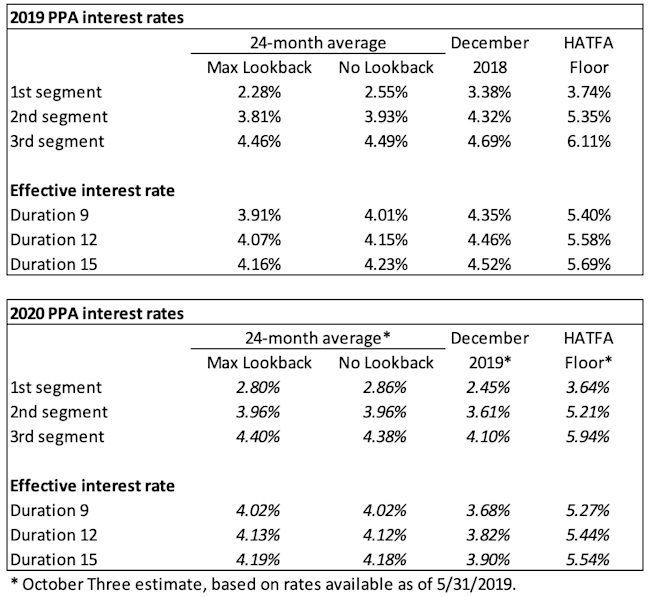

Pension funding relief has reduced required plan funding since 2012, but under current law, this relief will gradually sunset by 2022, increasing funding requirements for pension sponsors that have only made required contributions.

Discount rates fell by 0.20% last month. We expect most pension sponsors will use effective discount rates in the 3.5%-3.9% range to measure pension liabilities right now.

The table below summarizes rates that plan sponsors are required to use for IRS funding purposes for 2019, along with estimates for 2020. Pre-relief, both 24-month averages and December ‘spot’ rates, which are still required for some calculations, such as PBGC premiums, are also included.

[1]Plan A is a traditional plan (duration 12 at 5.5%) with a 60/40 asset allocation, while Plan B is a largely retired plan (duration 9 at 5.5%) with a 20/80 allocation with a greater emphasis on corporate and long-duration bonds. We assume overhead expenses of 1% of plan assets per year, and we assume the plans are 100% funded at the beginning of the year and ignore benefit accruals, contributions, and benefit payments in order to isolate the financial performance of plan assets versus liabilities.