May 2020 Pension Finance Update

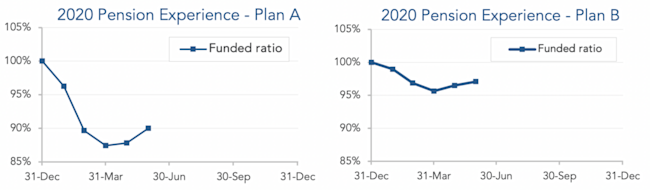

Rebounding stock markets gave pension finance a boost in May. Both model plans we track[1] gained ground last month, with Plan A improving 2% and plan B up almost 1%. For the year, Plan A is down 10% and Plan B is down 3% through the first five months of 2020.

Rebounding stock markets gave pension finance a boost in May. Both model plans we track[1] gained ground last month, with Plan A improving 2% and plan B up almost 1%. For the year, Plan A is down 10% and Plan B is down 3% through the first five months of 2020:

Assets

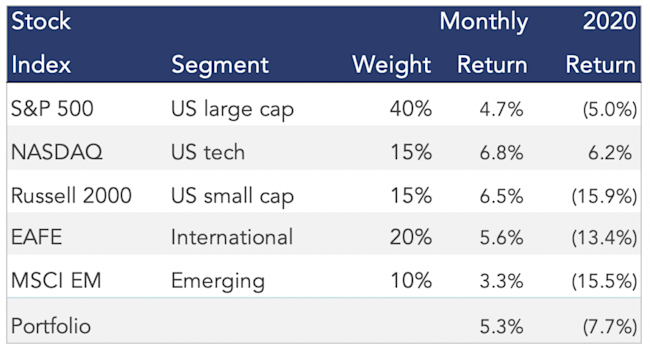

Stocks followed up a strong April with another good month across the board in May. Most indexes are still significantly underwater for the year, but the NASDAQ has managed to post a 6% return through May this year.

Treasury rates rose almost 0.1% last month, but corporate yields fell less than 0.1%, mostly at shorter maturities, as credit spreads continued to “normalize”. As a result, Treasuries were flat to down 1% for the month, while corporate bonds gained close to 1%. A diversified bond portfolio gained less than 1% last month and is now up 8%-9% through the first five months of 2020, with long duration and Treasuries performing best.

Overall, our traditional 60/40 portfolio gained 3% in May but remains down more than 1% for the year, while the conservative 20/80 gained almost 2% last month and is now up more than 4% through the first five months of 2020.

Liabilities

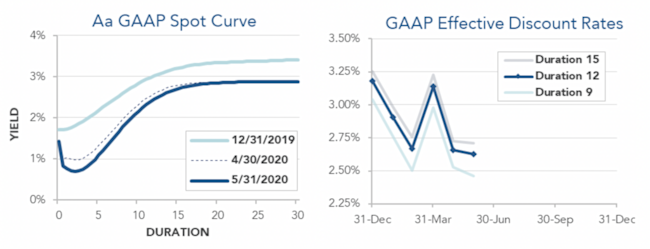

Pension liabilities (for funding, accounting, and de-risking purposes) are driven by market interest rates. The first graph below compares our Aa GAAP spot yield curve at December 31, 2019 and May 31, 2020, and it also shows the movement in the curve last month. The second graph below shows our estimate of movements in effective GAAP discount rates for pension obligations of various duration during 2020:

Corporate bond yields fell less than 0.1% in May, once again marking new all-time lows for pension discount rates. Pension liabilities rose less than 1% during May and are now 8%-11% higher than at the end of 2019, with long duration plans seeing the largest increases.

Summary

No one could have predicted 2020 thus far: the COVID-19 pandemic threw a monkey wrench into the global economy, and now the USA is suffering through a huge eruption of domestic protests and chaos. Yet, since the end of March, stocks have regained a lot of lost ground and pension finances have clawed back some of the first quarter losses. The graphs below show the movement of assets and liabilities during the first five months of 2020:

Looking Ahead

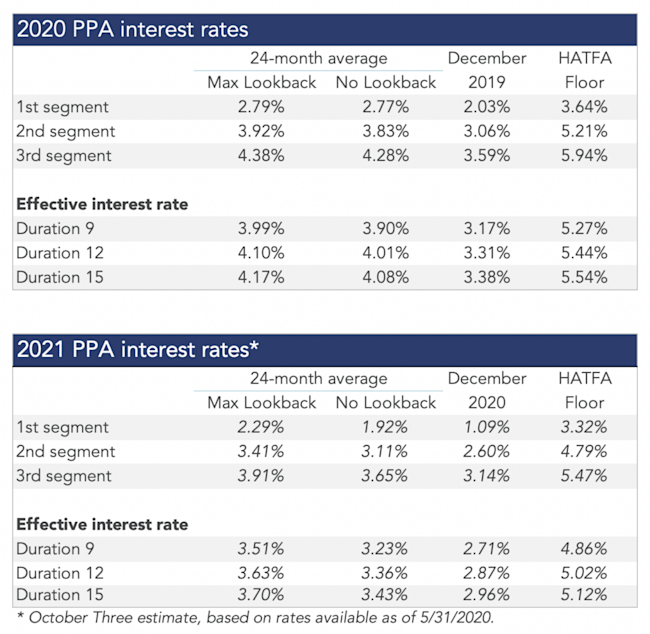

Pension funding relief has reduced required plan funding since 2012, but under current law, this relief will gradually sunset. Given the current level of market interest rates, it is possible that relief reduces the funding burden through 2030, but the rates used to measure liabilities will move significantly lower over the next few years, increasing funding requirements for pension sponsors that have only made required contributions.

2020 experience, if it persists, will not increase required contributions until 2022, compounding higher funding requirements due to the fading of funding relief. There is a reasonable chance we get more relief this year, but at this point it’s too soon to say for certain.

Discount rates moved lower last month. We expect most pension sponsors will use effective discount rates in the 2.4%-2.8% range to measure pension liabilities right now.

The table below summarizes rates that plan sponsors are required to use for IRS funding purposes for 2020, along with estimates for 2021. Pre-relief, both 24-month averages and December ‘spot’ rates, which are still required for some calculations, such as PBGC premiums, are also included.

[1] Plan A is a traditional plan (duration 12 at 5.5%) with a 60/40 asset allocation, while Plan B is a largely retired plan (duration 9 at 5.5%) with a 20/80 allocation with a greater emphasis on corporate and long-duration bonds. We assume overhead expenses of 1% of plan assets per year, and we assume the plans are 100% funded at the beginning of the year and ignore benefit accruals, contributions, and benefit payments in order to isolate the financial performance of plan assets versus liabilities.