Pension Finance Update – January 2022

What have retirement Plan Sponsors experienced last month from a pension finance perspective, based on two model plans that we track.

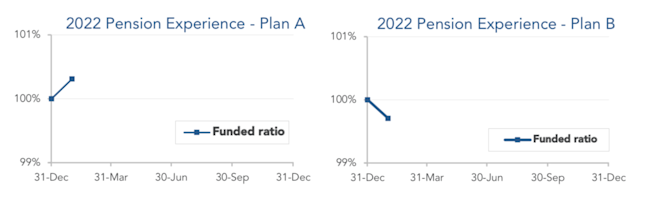

January was a mixed month for pensions, as higher interest rates and lower stock markets pushed pension assets and liabilities down last month. Both model plans we track were close to even on the month, with Plan A improving less than 1% while the more conservative Plan B lost a similar amount:

Assets

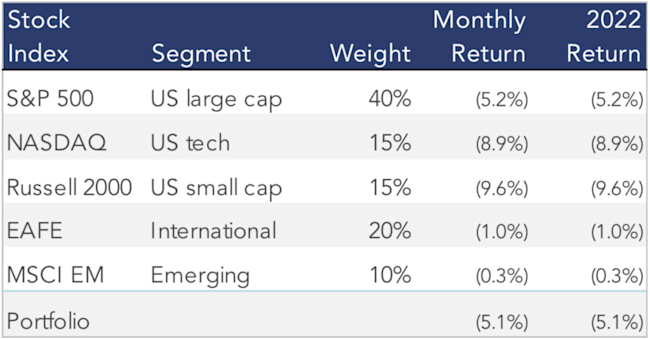

Stock indexes, particularly in the US, fell last month. A diversified stock portfolio lost 5% last month:

Interest rates and credit spreads both jumped last month; Treasury yields increased 0.2% while corporate bond yields rose 0.3% during January. As a result, bonds lost 2%-4% last month, with long duration and corporate bonds performing worst.

Overall, our traditional 60/40 portfolio lost 4% during January, while the conservative 20/80 portfolio lost 3%-4%.

1 Plan A is a traditional plan (duration 12 at 5.5%) with a 60/40 asset allocation, while Plan B is a largely retired plan (duration 9 at 5.5%) with a 20/80 allocation with a greater emphasis on corporate and long- duration bonds. We assume overhead expenses of 1% of plan assets per year, and we assume the plans are 100% funded at the beginning of the year and ignore benefit accruals, contributions, and benefit payments in order to isolate the financial performance of plan assets versus liabilities.

Liabilities

Pension liabilities (for funding, accounting, and de-risking purposes) are driven by market interest rates. The first graph below compares our Aa GAAP spot yield curve at December 31, 2021 and January 31, 2022. The second graph below shows our estimate of movements in effective GAAP discount rates for pension obligations of various duration during January:

Corporate bond yields moved up 0.3% in January. As a result, pension liabilities fell 3%-5% during the month, with long duration plans seeing the largest declines.

Summary

After an outstanding 2021, January saw declines on both the asset and liability side of the balance sheet, producing mixed results. The graphs below show the movement of assets and liabilities during January 2022:

Looking Ahead

Pension funding relief was signed into law during March, and additional relief was provided by November legislation. The new laws substantially relax funding requirements over the next several years, providing welcome breathing room for beleaguered pension sponsors.

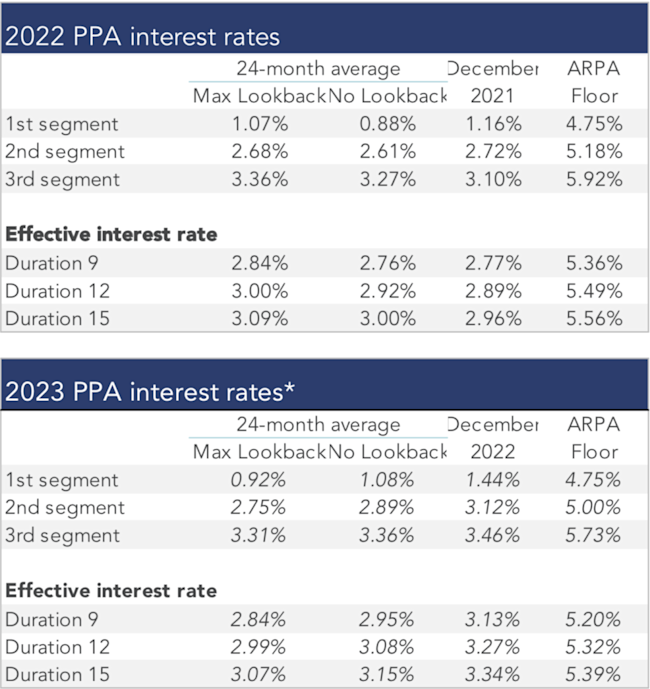

Discount rates moved 0.3% higher last month. We expect most pension sponsors will use effective discount rates in the 2.9%-3.3% range to measure pension liabilities right now.

The table below summarizes rates that plan sponsors are required to use for IRS funding purposes for 2022, along with estimates for 2023. Pre-relief, both 24-month averages and December ‘spot’ rates, which are still required for some calculations, such as PBGC premiums, are also included.

* October Three estimate, based on rates available as of 1/31/2022.

October Three, LLC is a full service actuarial, consulting and technology firm that is a leading force behind the reemergence of defined benefit plans across the country. A primary focus of the consultants at October Three is the design and administration of comprehensive retirement benefits to employees that minimize the financial risks and volatility concerns employers face. Through effective plan design strategies October Three believes successful financial outcomes are achievable for employers and employees alike. A critical element of those strategies is the ReDB® plan design. The ReDefined Benefit Plan® represents an entirely new, design-based approach to retirement and to the management of both the employer’s and the employee’s financial risk, focusing on maximizing financial efficiency and employee value.

For more information:

233 South Wacker Drive, Suite 8350 Chicago, IL 60606-4902 info@octoberthree.comPhone: 312-878-2440

Fax: 866-945-9697

Contact Us