Reducing PBGC premiums in 2023 – the significance of the standard/alternative method election

In the weeks ahead we will be reviewing the economics of de-risking, for this purpose defined as reducing defined benefit plan costs – principally the cost of Pension Benefit Guaranty Corporation premiums – by settling liabilities, by paying a participant’s benefit out as a lump sum or transferring it to an annuity carrier. But this year, for many plans, the amount of PBGC premiums the plan will owe will depend more on whether the plan is able to use the standard (spot-rate) method, rather than the alternative (24-month average) method, to value PBGC “unfunded vested benefit” liabilities. This article discusses that latter issue.

Who this is for: This analysis is for sponsors of DB plans that (1) are not fully funded and (2) are not at the PBGC variable-rate premium headcount cap

In what follows, we begin with the bottom line. We then provide background on PBGC variable-rate premium math and the calculation of a plan’s unfunded vested benefits and provide some more detail on our analysis.

Bottom line: PBGC variable-rate premiums (VRPs) are (generally) 5.2% of a plan’s unfunded vested benefits (UVBs). For 2023, sponsors of underfunded DB plans switching from the alternative (24-month average) method to the standard (December 2022 spot rate) method for valuing UVBs will be able to increase their liability valuation rate by around 150 basis points. For a duration 12 plan, that would mean an 18% reduction in the plan’s benefit liability, dramatically decreasing the amount of VRPs it owes.

These are unprecedented numbers – and for affected sponsors the decision appears to be obvious: if you’re a sponsor of an underfunded DB plan on the alternative method, you should, if you can, switch to the standard method before the October 15, 2023 deadline. (There’s no penalty for waiting until that deadline.)

As we’ll discuss further below, however, not all sponsors on the alternative method will be able to switch (although there may be a viable Plan B). And (as we said) this analysis will generally not affect sponsors/plans at the variable-rate premium headcount cap – for those sponsors/plans, the only way to reduce premiums will be to reduce headcount.

Now, let’s unpack this analysis, beginning with some background.

Background

For DB plans that are not (on a market basis) fully funded, much of the sponsor’s DB finance strategy is driven by cost reduction, where the biggest cost is PBGC VRPs. VRPs function as a 5.2% tax on the plan’s underfunding, subject to a headcount cap.

Thus, underfunded plans breakdown into two groups – those that are/are not subject to the headcount cap:

For plans that are not subject to the headcount cap, only a reduction in the plan’s unfunded vested benefits will reduce VRPs. The obvious way to reduce VRPs is to make additional contributions (in this regard, see our article PBGC variable-rate premium vs. borrow-and-fund). Those contributions can generally be made any time before September 15, 2023. Any such contributions would immediately reduce the premium due on October 15 by 5.2%.

But – and this is the point of this article – for 2023 many sponsors may also be able to dramatically reduce UVBs simply by changing the PBGC UVB valuation method.

For plans that are subject to the headcount cap, only a reduction of headcount will reduce VRPs. The math here is very simple: every participant that is taken off the books will save the plan $652 per year in VRPs (this number will be adjusted after 2023 for inflation). Headcount reductions in 2023 will reduce premiums owed beginning in 2024.

The effect of the method used for measurement of UVBs

In determining UVBs, sponsors of underfunded DB plans have a choice. They can use (for a calendar year plan): (1) December spot segment rates (the “standard” method) or (2) the 24-month average segment rates used for plan funding (the “alternative” method). (In all cases, 25-year average interest rate stabilization is disregarded.)

Plans that (already) use the standard method to value liabilities will see an extraordinary decline in UVB liability valuations for 2023. The typical duration 12 plan using spot rates saw a 225 basis point increase in plan valuation rates over the 2022 year. That will translate into a 27% decrease in liability valuations. For plans on the alternative method, however, because of 24-month smoothing, the effect of 2022 interest rate increases/reduction in UVBs will be much less significant.

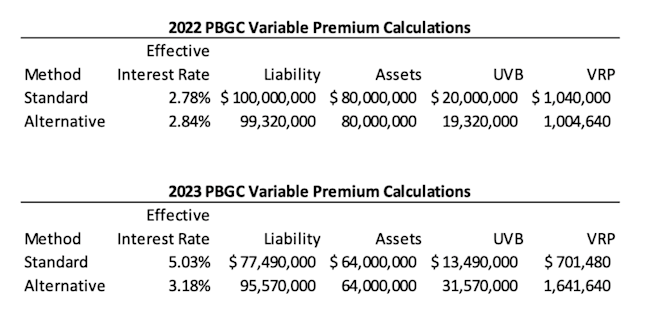

The tables below summarizes the standard and alternative method PBGC calculations for a generic duration 12 plan that was 80% funded in 2022, assuming the plan suffered a 20% asset loss during 2022.

While the difference in 2022 calculations is negligible, the steep increase in interest rates during 2022 produce dramatically different results for 2023.

These numbers simply reflect the (intuitive) effect on DB plan liability valuations of marking to market vs. smoothing in a year in which interest rates increase sharply.

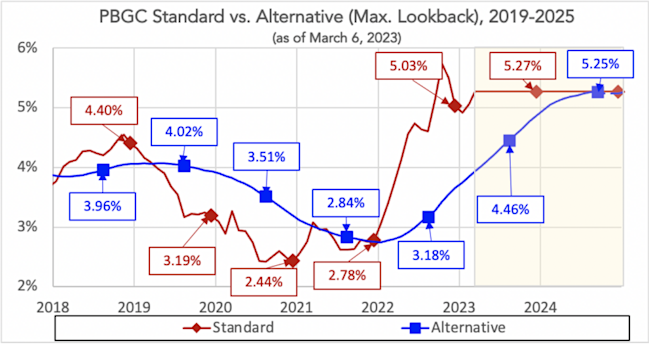

The chart below illustrates how unprecedented the 2023 divergence between standard and alternative method valuations rates is.

All of the foregoing is to say: any plan currently on the alternative method that can switch to the standard method of valuing UVBs ought to strongly consider that strategy. A sponsor’s ability to change methods (standard vs. alternative) is, however, limited. Once a particular method (standard or alternative) is elected, the sponsor can’t switch to the other method for five years.

Switching to the standard method in 2023 will significantly reduce 2023 premiums for many sponsors. Based on current rates, the switch would likely reduce premiums in 2024 as well, but this picture will be clearer by October 15. For years after 2024, the risk is that market interest rates move lower and the standard method produces a higher PBGC liability.

Plan B – for plans currently locked into the alternative method

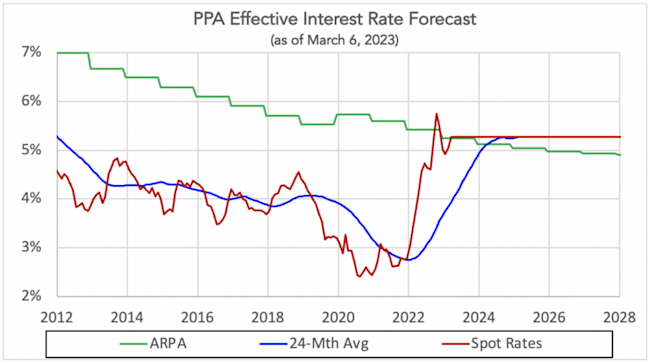

As we noted, plans that elected the alternative method within the last five years (2019 or later) may not elect to return to the standard method for 2023. These plans do, however, have an alternative. A plan/plan sponsor may elect, for 2023, to calculate plan funding (under ERISA’s minimum funding rules) on the basis of a “full yield curve,” in effect marking liabilities to market for minimum funding purposes and using that market rate to value UVBs in calculating its VRP liability. Doing so will produce a result that is (more or less) the same as electing the standard method for valuing UVBs.

Plans that take this approach give up, for ERISA minimum funding, 25-year smoothing of interest rates – the “interest rate relief” that has cushioned many plans from high liability valuations in prior years when valuation interest rates were at historically low levels.

Currently, market interest rates are very close to the 25-year average rates, so the impact of this change on ERISA minimum funding in 2023 will be insignificant for most sponsors.

But once a plan changes its valuation assumption for ERISA minimum funding purposes, it cannot (easily) change it again (e.g., change it back to 25-year averaging) without permission from IRS.

Thus, if, in the future, interest rates decline sharply, a plan/plan sponsor that has elected the full yield curve may not be protected against the consequent sharp increase in liability valuations.

For frozen plans that are well-funded and in a position to immunize or settle pension liabilities, the benefit of retaining smoothing for minimum funding purposes may well be lower than its cost, i.e., the additional premium incurred in 2023 under the alternative method.

* * *

We will continue to follow this issue.